The blueprint for effective supply chain management (SCM) has evolved. It’s not just about saving money anymore. While financial considerations and budget optimization will always be facets of SCM planning, customer-centric value creation is the supply chain’s new top business driver.

Historically, organizations only viewed the supply chain as a cost center. Traditional SCM approaches were designed to move goods through the last mile at the cheapest price possible even if it meant enduring delays along the way. However, e-commerce proliferation coupled with an increasingly on-demand marketplace swung consumer loyalty toward immediacy and reliability — rendering traditional SCM ineffective.

The pandemic’s inventory shortages exacerbated that trend. More than 70% of U.S. shoppers purchased products from new brands during COVID-19. With buyers more willing to sacrifice loyalty for availability, revenue declined for sellers with supply chain challenges. Companies with low on-shelf availability or in-stock rates of between 72% and 85% lost 0.7 percentage points of share of wallet in 2022, according to the Wall Street Journal. Gartner’s Supply Chain Excerpt: 2022 Q4 Business Quarterly reinforced a similar notion: “The supply chain is often first in line for cost-cutting when budgets are tightened. But executive leaders weighing these cuts must recognize that declines in supply chain performance negatively impact customer loyalty by nearly three times as much as price hikes.”

This new reality is leading more organizations to adopt “value chain” mindsets where SCM moves beyond cost efficiency toward customer centricity and resilience. A value chain approach transforms the supply chain from a siloed, single-functioning system to a network that delivers value — not just products — through the last mile. The overarching value equation is meeting evolving buyer expectations with seamless fulfillment processes and flexible delivery capabilities that mirror product availability with buyer demand. Customers are most loyal to the brands they can rely on. All it takes is the right delay at the wrong time to lose their loyalty for good.

In turn, resilience during unexpected disruptions and rapid demand swings is imperative to value chain execution. Optimizing supply chains with advanced technologies and freight market intelligence data promotes an agile distribution network able to withstand that volatility. By integrating supply chain digitalization tools at scale, shippers can leverage real-time data for real-life value that drives revenue growth.

Overcome supply chain disruptions

Disruptions are inevitable in fragile regional supply chains. Severe weather, deteriorating infrastructure, geopolitical tensions, and supply shortages cause bottlenecks. Companies that avoid delays during periods of noticeable disruption are better positioned to build consumer trust that separates them from industry competitors. Just think back to the height of the pandemic, when out-of-stocks associated with consumer panic buying accounted for nearly $3 billion in lost sales across 10 CPG categories. The shippers who got their products to shelves stood out above the rest after inventory levels returned to normal.

Digitalization allows shippers to overcome disruption with data-driven decision making. IoT traceability data coupled with freight market intelligence from Benchmark Analytics iQ shows every part of their distribution network. In the wake of disruption, it shines a light on emerging areas of risk (vulnerable shipments) that could escalate into value reduction (delays or out-of-stocks) on high-priority lanes. With data as their guide, supply chain leaders can proactively work with their carrier partners to re-route shipments and implement effective contingency plans. This amplified collaboration creates a strength-in-numbers effect for better risk mitigation and resilience.

Navigate demand swings with DAT

Value chains are designed around demand-driven shipping and buyer personalization. For example, if 65% of a shipper’s customer base prefers direct-to-consumer (D2C) distribution, their transportation network must be optimized for just-in-time delivery on tight turnarounds. Flexible fulfillment processes that are personalized to unique buyer preferences promote value-centric customer experiences.

It’s important to leverage accurate forecasting metrics that indicate how consumer purchasing patterns impact demand and market capacity levels. It’s impossible to align availability and demand — the basis of a value chain mindset — without access to reliable supply chain data. That could mean holiday season point of purchase data from a retail partner or seasonal on-shelf inventory analytics from a grocer. Regardless of the source, sharing timely insights via integrated supply chain networks that promote cross-functional collaboration is paramount to demand-driven shipping.

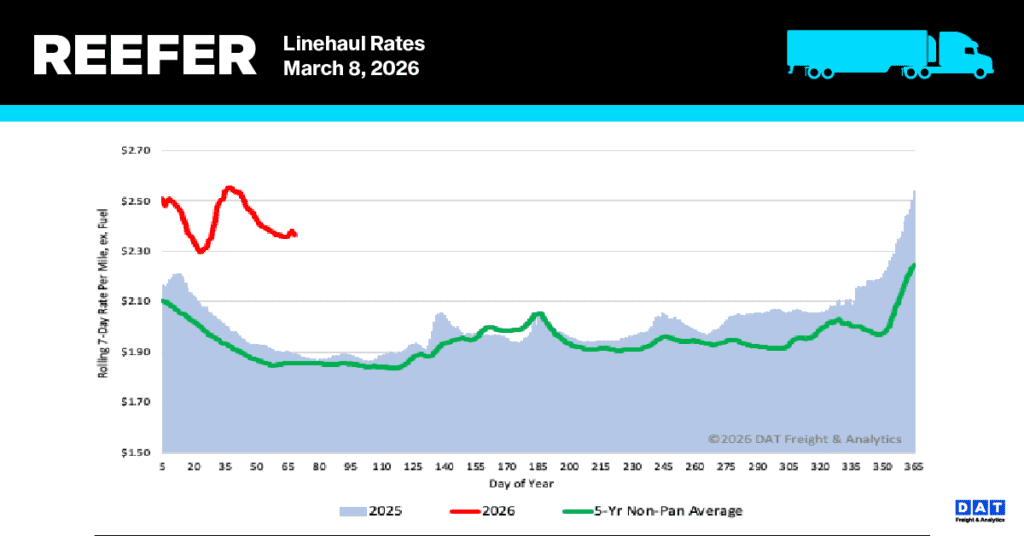

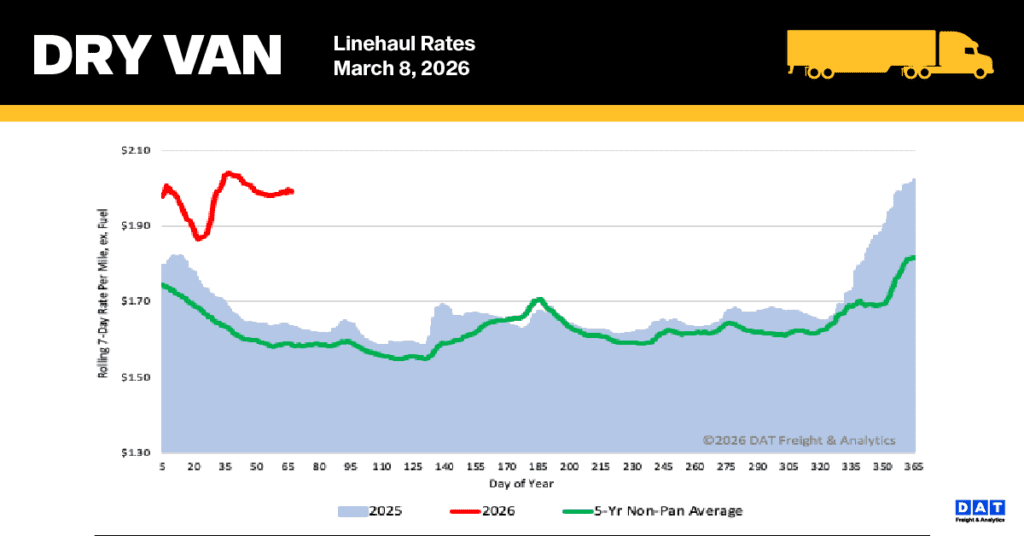

Enter digital transformation. AI-powered prescriptive analytics solutions enable scenario planning by generating actionable insights that reveal anomalies and trends. Combining those insights with real-time data from DAT iQ RateView Analytics Solutions allows shippers to prioritize the right products, lanes, and distribution modes for navigating demand swings without overspending. With DAT iQ Network Analytics Solutions, shippers can leverage the iQ platform’s Market Conditions Index (MCI) to access the latest data on freight market capacity and demand, giving shippers the information they need to lock in the best rates.