As we head into planting season, combine harvester sales in the U.S. and Canada continue to grow while tractor sales are tracking closely with their 5-year average, according to the latest data from the Association of Equipment Manufacturers (AEM). This is good news for flatbed and specialized carriers looking to gauge service demand this season. Professor Jason Miller at Michigan State University states, “In the general freight trucking, long-distance, truckload market, we are witnessing the most rapid correction of prices the sector has ever seen. The rate correction is far less pronounced on the specialized freight side of things”.

The AEM report total 2WD farm tractor sales (more suited to flatbed trailers) were down 13% y/y and almost 16% in March. In the drop-deck and specialized trailer category, 4WD farm tractor sales are nearly double the same period the previous year and up 51% YTD. U.S. self-propelled combine harvester sales were up 47% y/y and just over double YTD, whereas in Canada, combine harvesters continue their growth streak, up 198.5 percent year-to-date.

On the machinery import front, import volumes of Tractors, Agricultural Machinery, and Lawn and Garden Equipment were down 13% y/y, according to data from IHS Markit/PEIRS. The port of Baltimore continues to hold the number one spot for machinery imports handling 17% of the total tonnage in March. Import volume was up 26% y/y in March. In Savannah, the number two port for machinery imports (12.5%), March volumes were down 29% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

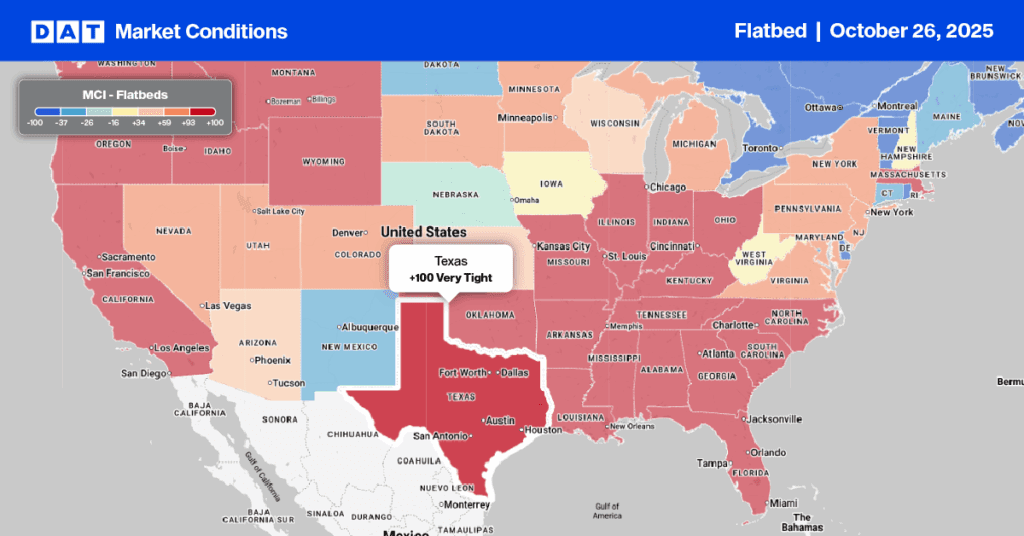

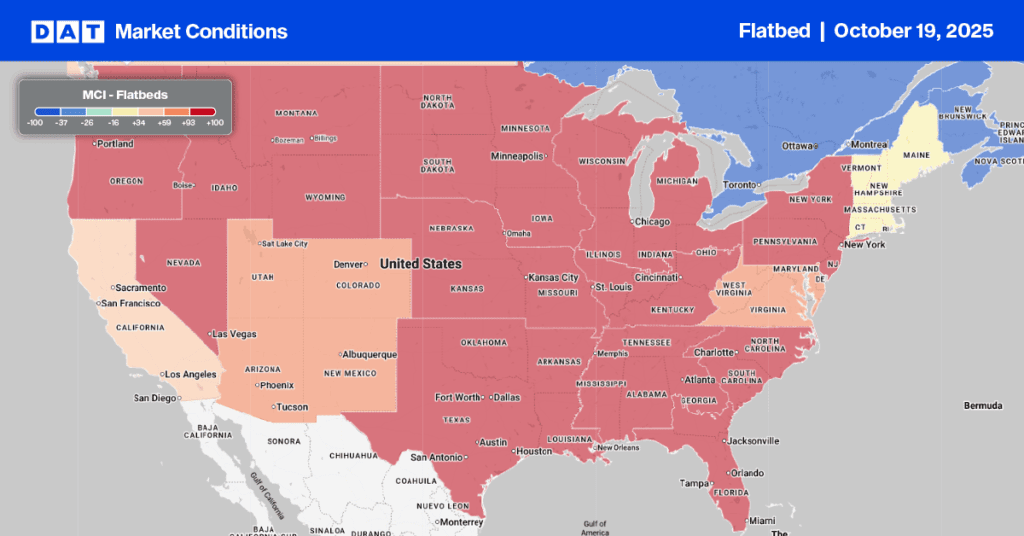

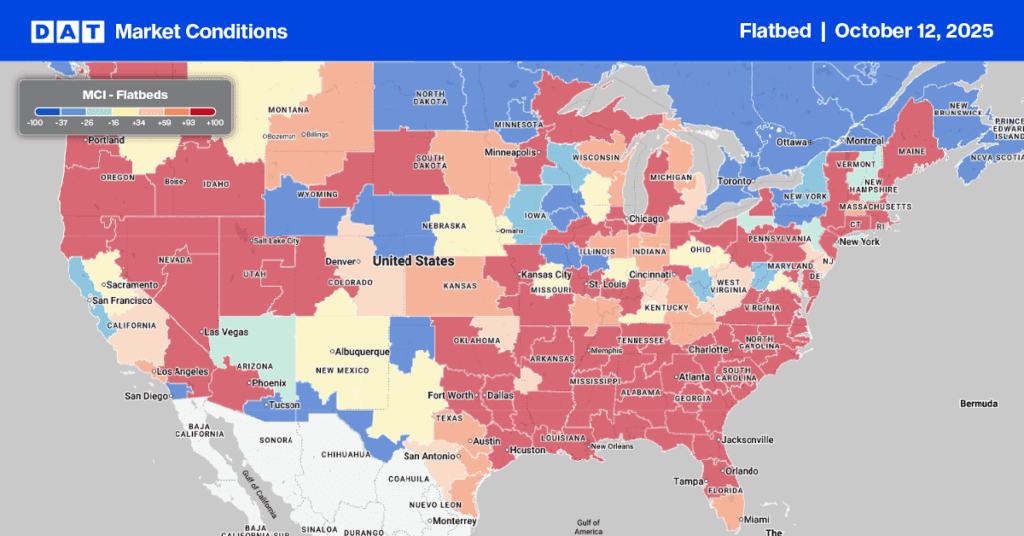

At $2.31/mile, Texas flatbed linehaul rates are almost identical to 2018, and even though volumes increased by 17% last week in Houston, the largest flatbed market in the nation, rates dropped by a penny-per-mile for the third week. Loads moving between Houston and Ft. Worth were up 1% w/w pushing up spot rates to $2.96/mile, the highest since last October and $0.15/mile higher than the previous month. Loads west to El Paso at $2.56/mile were the lowest in 12 months and $0.87/mile lower than the last year.

In Little Rock, volumes were up 34% w/w pushing up spot rates by $0.06/mile to $2.54/mile. Loads to Dallas at $2.99/mile were the highest since last August but almost $1.00/mile lower than the previous year. In St Louis, volumes were up 34% w/w, with spot rates up $0.04/mile to $2.25/mile. In Reno, NV, volumes increased by 24% w/w, with outbound spot rates up $0.16/mile to $2.23/mile. Reno to Phoenix loads paid $1.96/mile, $0.24/mile higher than the previous month.

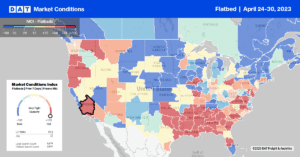

Load-to-Truck Ratio (LTR)

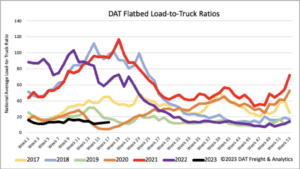

Even though flatbed volumes increased by 9% last week, they were just over 2% lower than at the end of March and 9% lower than in 2019. Carrier equipment posts were up 5% last week but also at the highest level in seven years resulting in last week’s flatbed load-to-truck (LTR) ratio increasing from 12.56 to 13.0.

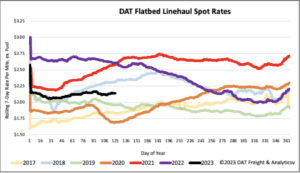

Spot Rates

At a national average of $2.16/mile, flatbed rates excluding fuel, have been around this level for most of the year. Linehaul rates are just under $0.50/mile lower than last year and $0.18/mile lower than in 2018 and $0.18/mile higher than in 2019.