The September 2025 Logistics Managers’ Index (LMI) came in at 57.4, down 1.9 points from August’s 59.3, marking the slowest logistics expansion since March. The main drag was Transportation Utilization, which dropped 4.7 points to 50.0, signaling no growth at all — unusually weak for September, a month that typically sees strong freight demand (the 8-year average for this metric is 65.1).

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The ongoing “freight inversion” persists, with Transportation Prices (54.2) slightly trailing Transportation Capacity (55.1), indicating a minor oversupply. While prices are still growing, this is the slowest expansion since April 2024, which marked the end of the last freight recession. Historically, negative freight inversions have signaled a potential slowdown in the transportation market. However, as the chart illustrates, the September inversion is slight, at a 0.9-point difference. This follows the previous month’s 1.9-point difference, which was also considered relatively mild, yet still within negative freight inversion territory.

Professor Zach Rogers cautioned, “In the past, anytime we have seen three consecutive months of either a positive or negative inversion it has signaled a significant shift in the transportation market. This is not a prediction of a freight recession, but that would change if these dynamics remain on their current trajectory.”

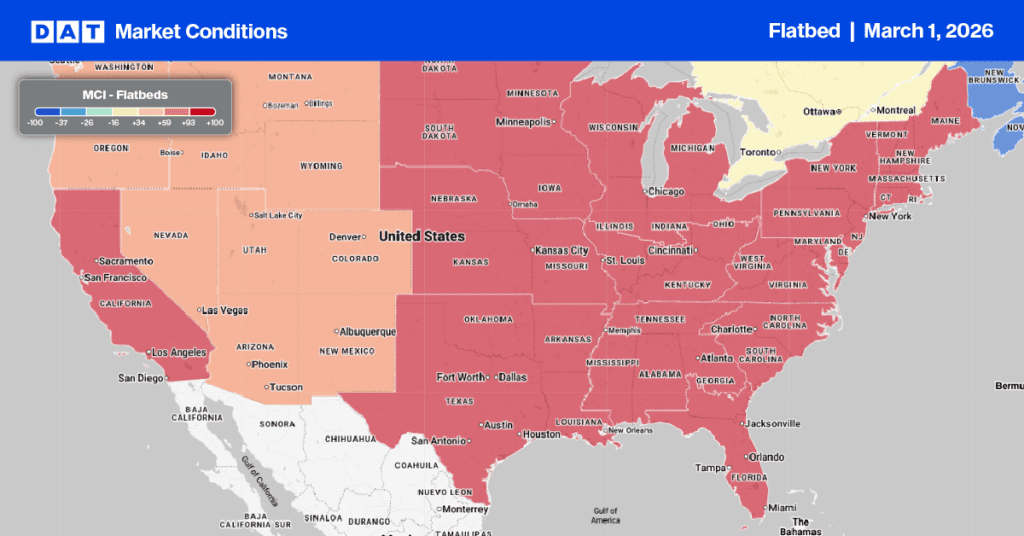

Flatbed Market Watch

Last week, the flatbed load-to-truck ratio decreased to 27.16, as flatbed load posts decreased by 6% while equipment posts remained unchanged. Brokers reported significant capacity constraints in the Southeast, particularly in Birmingham, Montgomery and Jackson flatbed markets where loads posted surged by 23% last week. Spot rates for regional outbound loads rose by $0.06 per mile, paying carriers an average of $2.69 per mile This region ships a mix of heavy industrial freight including heavy steel, machinery, building materials, and concrete.

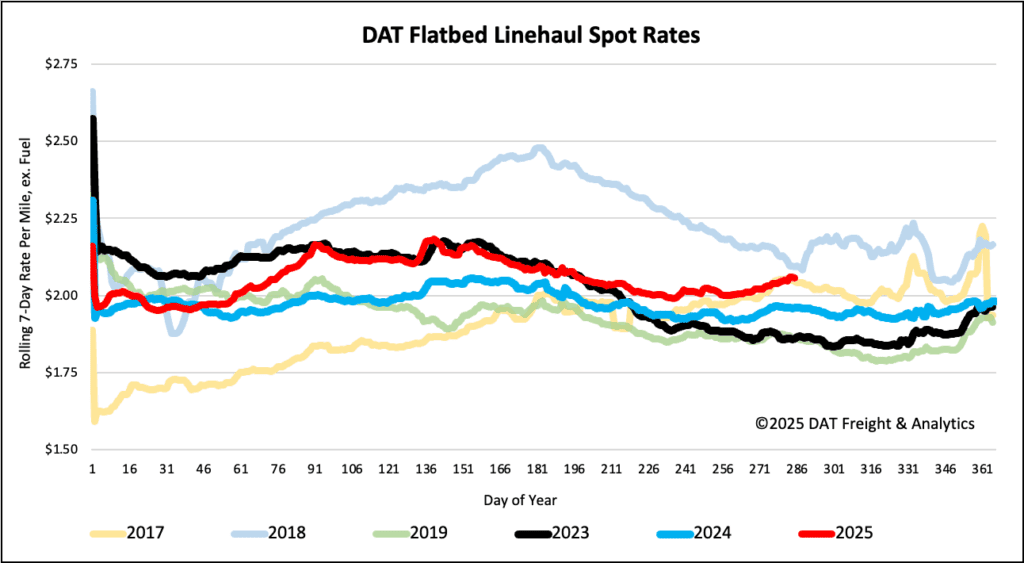

National flatbed spot rates

Flatbed rates experienced a modest increase last week, rising by a penny to just over $2.07 per mile. This current rate is $0.10 higher than last year and $0.20higher than in 2023. Notably, the 2025 spot rate continues to track closely with 2017, a year marked by a strong industrial economy for flatbed carriers.