The Commercial Vehicle Safety Alliance’s (CVSA) International Roadcheck is scheduled for May 13-15. International Roadcheck is a three-day, high-visibility, high-volume commercial motor vehicle, and driver inspection and regulatory compliance enforcement initiative in Canada, Mexico, and the United States.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

To verify regulatory compliance, law enforcement personnel will inspect commercial motor vehicles and drivers at weigh/inspection stations, temporary sites, and mobile patrols. Data from the 72 hours of International Roadcheck will be collected, and the results will be released this summer.

Each year, International Roadcheck places special emphasis on a driver violation category and a vehicle violation category. During International Roadcheck, inspectors check the driver’s documents, license or commercial driver’s license, “ghost drivers” (claiming a co-driver when there is no co- driver present), medical examiner’s certificate and skill performance certificate (if applicable), record of duty status, Drug and Alcohol Clearinghouse status (in the U.S.), seat belt usage, and alcohol and/or drug impairment. If an inspector identifies driver out-of-service violations, they place the driver out of service, restricting that driver from operating their vehicle.

For the vehicle portion of Roadcheck Week, inspectors ensure the vehicle’s brake systems, cargo securement, coupling devices, driveline/driveshaft components, driver’s seat, fuel and exhaust systems, frames, lighting devices, steering mechanisms, suspensions, tires, wheels, rims, hubs, and windshield wipers are compliant with applicable regulations.

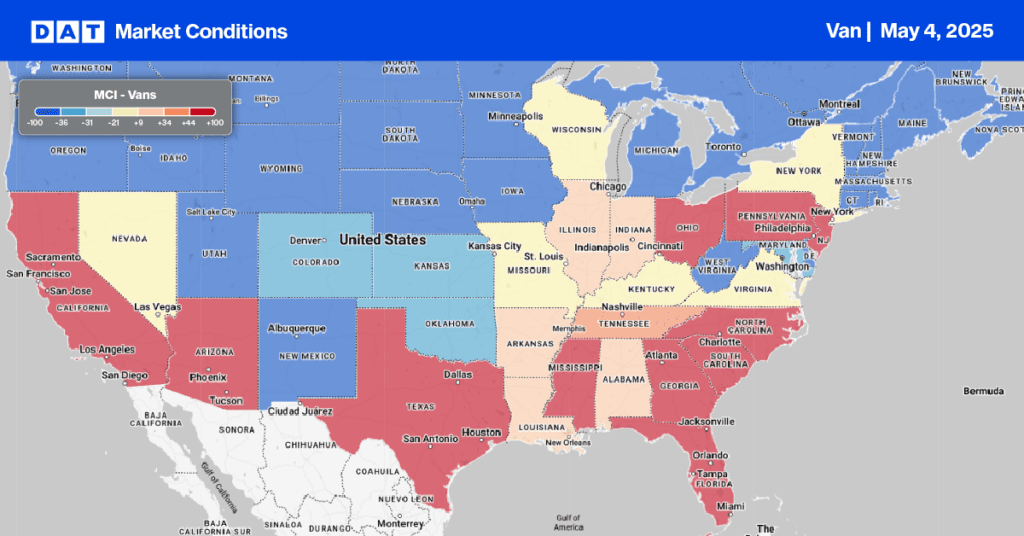

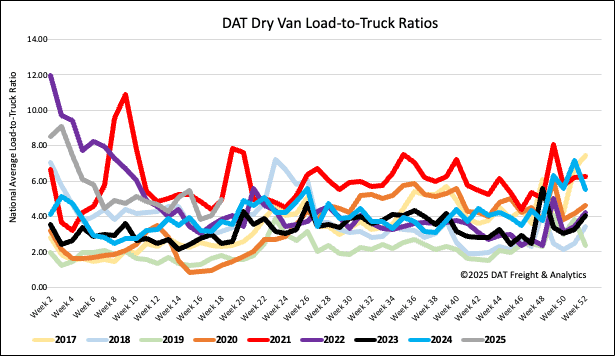

Load-to-Truck Ratio

Dry van load post volumes were mostly flat last week and almost identical to last year. As a result, last week’s dry van load-to-truck ratio (LTR) was up slightly to 4.80, the second-highest in nine years for Week 18 (surpassed only by 2021 at 4.93).

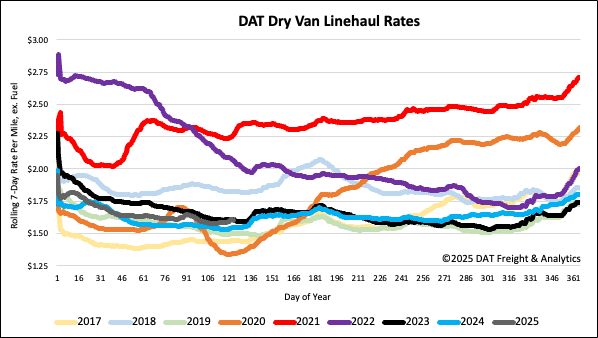

Linehaul spot rates

Dry van linehaul rates increased by another penny-per-mile to just under $1.62/mile last week on a 12% higher month-end load volume (loads moved). At $1.62/mile, linehaul rates remained $0.06/mile higher than last year and $0.03/mile lower than the 90-day trailing average.

On DAT’s Top 50 lanes, ranked by the volume of loads moved, carriers were paid an average of $1.90/mile, up a penny-per-mile and $0.28/mile higher than the national 7-day rolling average spot rate.

In our Midwest Region bellwether states (n=13), which account for 45% of loads moved nationally last week and have the highest correlation to the national average, outbound spot rates were down a penny-per-mile on a 13% higher volume of outbound loads moved at month-end. Inbound loads moved were up by 11% w/w. Carriers were paid an average of $1.78/mile, $0.16/mile higher than the national 7-day rolling average.