North American commercial vehicle demand continued to soften in July, with Class 5–8 truck orders totaling 26,200 units, a 10% decline year-over-year, according to ACT Research. Class 8 truck orders, crucial for for-hire truckload carriers, remained soft at 13,300 units, a nearly 2% year-over-year decrease, hovering near replacement levels as fleets prioritize cost control over expansion. Despite some margin gains for public TL fleets in Q2, net income has fallen for the 11th consecutive quarter, driven by weak freight demand, high equipment costs, and economic uncertainty. Medium-duty (Classes 5–7) orders were hit harder, falling 17% year-over-year to 13,000 units, as this segment is more susceptible to slowing growth in service-related industries.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Owner-operators and small fleets face difficulties justifying new equipment purchases due to elevated truck prices, softening freight markets (especially in housing and manufacturing), and concerns about inflation and tariffs. Seasonally adjusted numbers show a slight increase for Class 8 (17,700 units) and a 15% month-over-month increase for medium-duty. Nevertheless, Class 8 backlogs are anticipated to decrease by over 8,600 units in July, reaching approximately 81,800, further reinforcing the trend of fleets pausing expansion plans and focusing on managing costs amid current market headwinds.

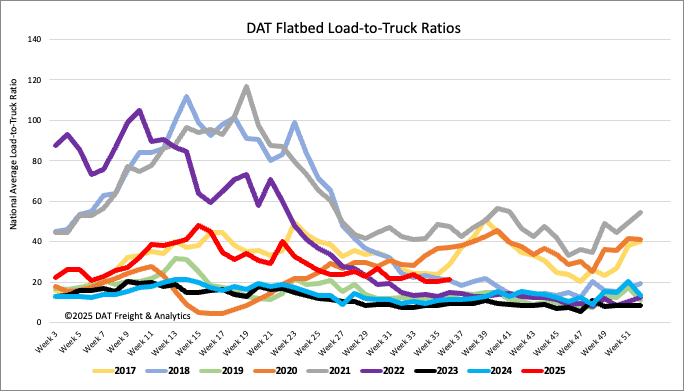

Load-to-Truck Ratio

Flatbed load post volumes held steady last week for the third consecutive week, while still showing a 37% increase compared to the previous year. Concurrently, a minor reduction in carrier equipment posts resulted in the load-to-truck ratio climbing to 21.05.

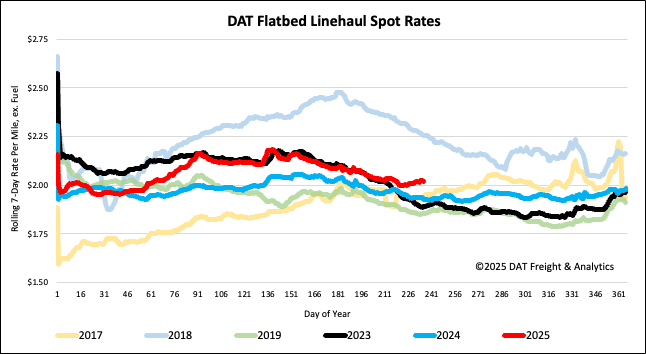

Spot rates

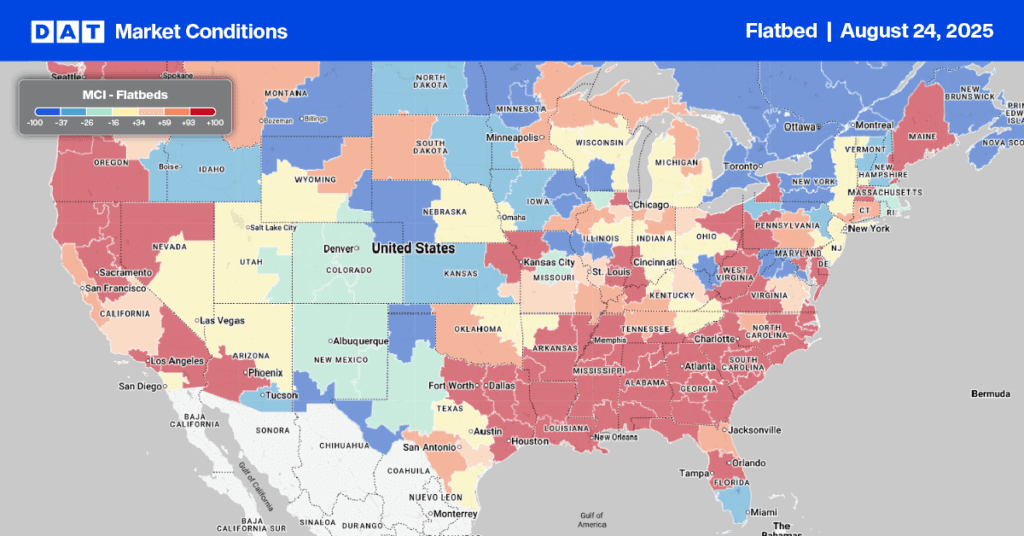

The national average flatbed spot rate, excluding fuel, has held steady at just over $2.03 per mile for the past three weeks. This represents a $0.09 per mile increase from the same week in 2024 and a $0.13 per mile increase from 2023. Specifically, in Houston, spot rates for outbound Texas loads rose by $0.03 per mile to $2.32. Carriers transporting loads from Houston to Dallas earned an average of $2.78 per mile, an $0.08 increase from the previous week.

Lane rates from Houston to Lubbock in the Permian Basin oil and gas field decreased by $0.06 to $2.45 per mile, year over year, amidst a 35% reduction in load volume. This decline in volume is directly tied to a decrease in drilling activity. The total number of U.S. oil and gas drilling rigs fell by one to 538, marking the 15th decline in 17 weeks. Baker Hughes reports that the overall rig count is down 47 rigs, an 8% decrease from this time last year.