The November 2025 ISM Manufacturing PMI fell to 48.2%, marking a 0.5-point drop from October’s level and signaling another month of contraction for U.S. manufacturing activity. This reading was weaker than economists had anticipated and reflects persistent challenges in demand and hiring conditions throughout the sector. “U.S. manufacturing activity contracted at a faster rate, with pullbacks in supplier deliveries, new orders and employment,” said Susan Spence, chair of the ISM.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The new orders index fell for a third straight month. Decreases in new orders and order backlogs—two of the four demand indicators—more than offset gains posted by the indexes charting new export orders and customer inventories, Spence said. The survey findings underscore that while U.S. manufacturing faces ongoing headwinds, the broader economy remains in expansion, supported by pockets of industry strength and resilient production output. “Business conditions remain soft as a result of higher costs from tariffs, the government shutdown and increased global uncertainty,” said one respondent from the sector.

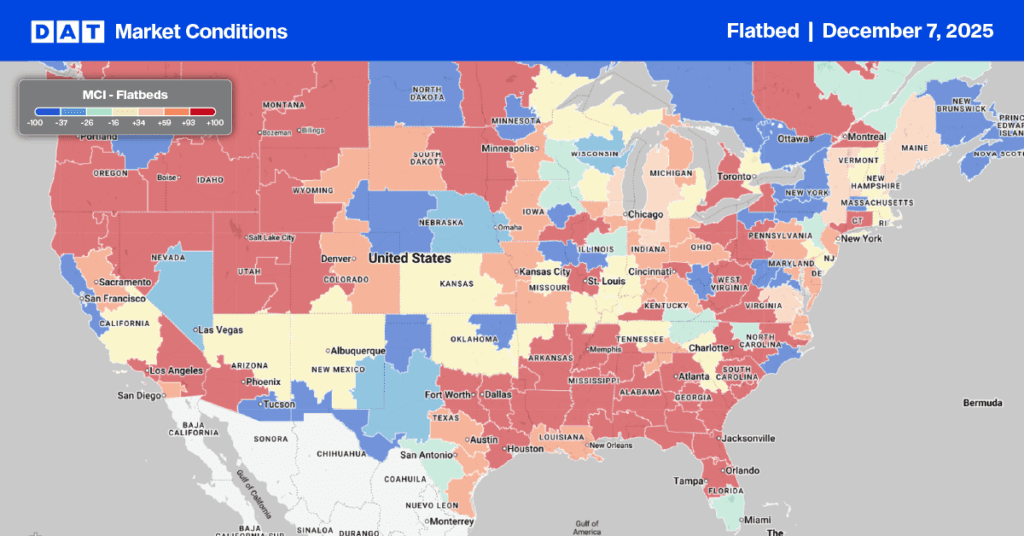

Flatbed Market Conditions

Flatbed load post volumes almost tripled during the post-Thanksgiving catch up week, driving the load-to-truck ratio up to 29.14.

National flatbed spot rates

After holding steady for three weeks, the national average flatbed spot rate increased by $0.04 to $2.05 per mile last week. This rate is currently just 5%, or $0.09 per mile, above the rate recorded at the same time last year.