Even though September’s container’s import total came in at just over 2.4m TEU (twenty-foot equivalent units), the nation’s major container ports is expected to fall below the 2 million TEU mark for the remainder of the year, according to the Global Port Tracker report released today by the National Retail Federation and Hackett Associates.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“This year’s peak season has come and gone, largely due to retailers frontloading imports ahead of reciprocal tariffs taking effect,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “New sectoral tariffs continue to be announced, but most retailers are well-stocked for the holiday season and doing as much as they can to shield their customers from the costs of tariffs for as long as they can.”

A significant drop in monthly imports is expected, with October forecasting 1.97 million TEU (down 12.3% year-over-year) and November predicting 1.75 million TEU (down 19.2%). December is projected to be the slowest month since March 2023, with an estimated 1.72 million TEU, marking a 19.4% year-over-year decrease. This follows a September where imports fell 10.3% month-over-month and 9.2% year-over-year, with imports from China, a nation subject to ongoing trade tensions, experiencing an even steeper decline of 12% and 19% respectively.

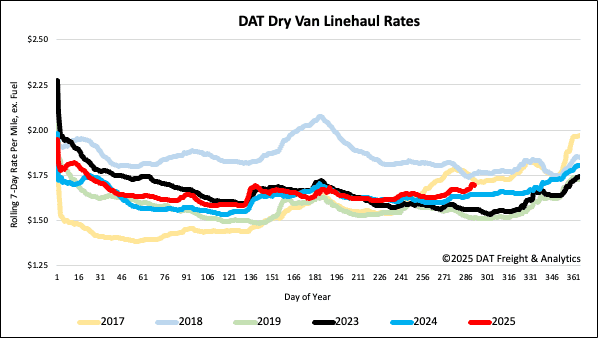

National dry van linehaul spot rates

Dry van linehaul spot rates remained unchanged for the second week, averaging $1.70 per mile, $0.05 or 3% higher than the same time last year and $0.13 higher than in 2023.

The average rate for DAT’s top 50 lanes by load volume remained unchanged last week, averaging $2.00 per mile and $0.30 higher than the national 7-day rolling average spot rate.

In the 13 key Midwest states, which represent 46% of national load volume and often indicate future national trends, spot rates remained unchanged at $1.93 per mile, which was $0.23 above the national 7-day rolling average.

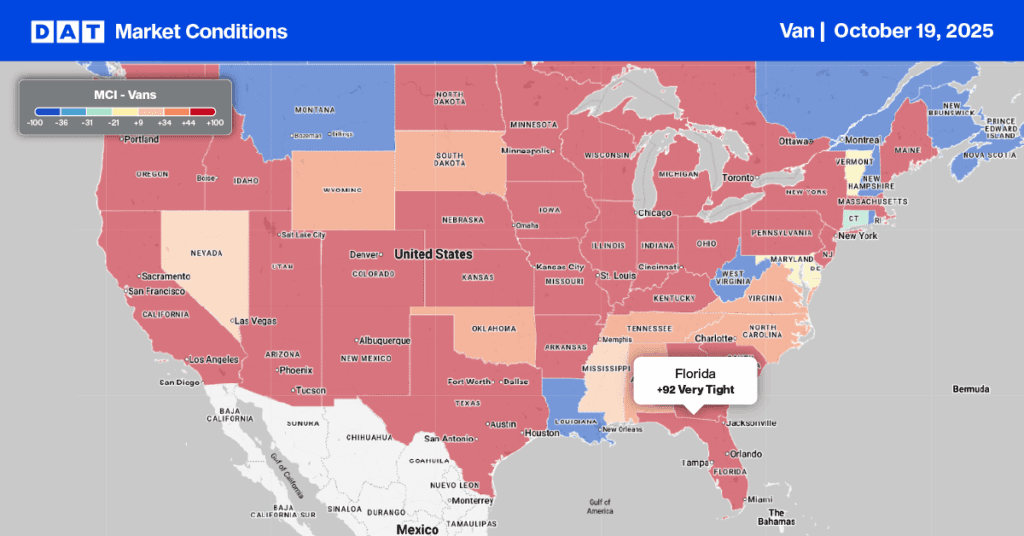

Dry Van market watch

Last week, the dry van load-to-truck ratio decreased to 5.96, as load posts decreased by 7% while equipment posts decreased by a similar amount. Despite the national decrease in volume, freight brokers faced ongoing capacity challenges in southern Florida last week; load posts in Miami jumped 10% last week and are now up just over 23% in the last month. Outbound spot rates were up $0.03 per mile to $0.77 per mile last week.