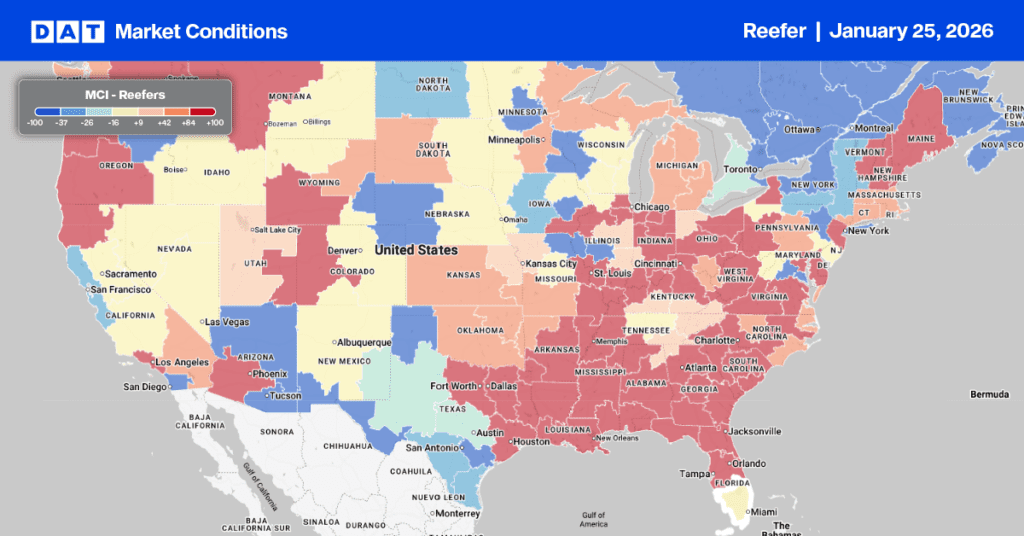

The annual surge of refrigerated (reefer) truckload demand is underway in the Philadelphia region, driven by the start of the South American produce import season. As a premier East Coast gateway, the Port of Philadelphia (PhilaPort) is now seeing consistent arrivals of high-value perishables like Peruvian blueberries and the initial shipments of Chilean grapes. This influx creates an immediate and intense logistical challenge: perishable cargo must move quickly out of the cold chain storage at the port, causing a sudden, localized spike in the need for temperature-controlled trailers. Outbound reefer truckload volumes are already 16% higher than last year, while spot rates are 4% higher, averaging $2.25 per mile.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

For carriers and logistics providers, this means peak operational opportunity as shippers compete fiercely for available trucks to maintain the cold chain integrity of these imports. While peak volumes are still building toward the December/January window with the arrival of more Chilean citrus and stone fruit, shippers must secure their dedicated reefer capacity now to avoid being sidelined by rising costs. In essence, the arrival of fresh fruit from the Southern Hemisphere acts as a reliable, seasonal shock to the Eastern reefer market, demanding proactive planning from everyone involved in the cold supply chain.

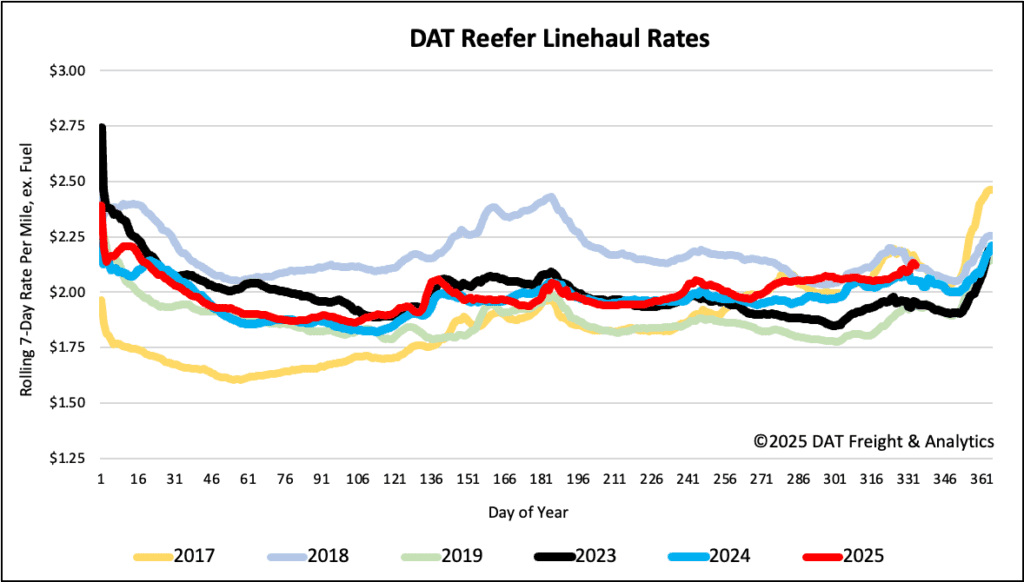

Reefer national spot rates

The national 7-day rolling average rate settled at $2.13 per mile last week, marking a $0.05 per mile increase. This is approximately $0.07/mile, or 3%, higher than reefer spot rates recorded during the same period last year.