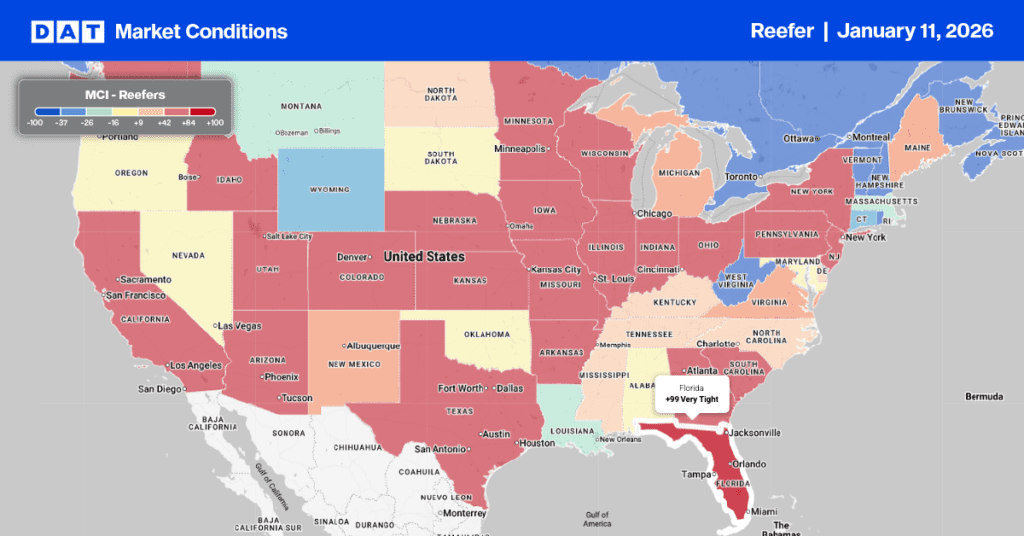

The Florida strawberry season has begun on a positive note, suggesting a reliable flow of reefer freight for truckload carriers as the first quarter of 2026 approaches. Growers are optimistic, reporting excellent fruit quality and higher yields compared to last year. This follows a growing season free of major hurricane issues, which is expected to drive steady volumes through December and potentially lead to a strong peak season in February and March. Kristen Hitchcock, CFO of Parkesdale Farms and a Gem-Pack Berries grower partner, noted that harvesting started earlier this season. She explained, “Hurricane Milton caused significant damage to our fields last year, which impacted overall production. Fortunately, our yields are currently higher than they were in 2024.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Florida’s strawberry season typically runs from November through March, with the heaviest volume concentrated in late winter. The period around Valentine’s Day (February 14th) and the subsequent weeks, culminating in the Florida Strawberry Festival (February 26 to March 8, 2026, in Plant City, FL), is considered the “peak” for promotional volume. This timing is critical for reefer carriers, as the demand for freight in the Lakeland, FL market generally spikes in the week leading up to Valentine’s Day. For context, the USDA reported that peak strawberry volumes this year occurred in the second week of March, with 32 million pounds (754 truckloads) shipped.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted. The rate charts exclude 2021 and 2022, years influenced by the pandemic.

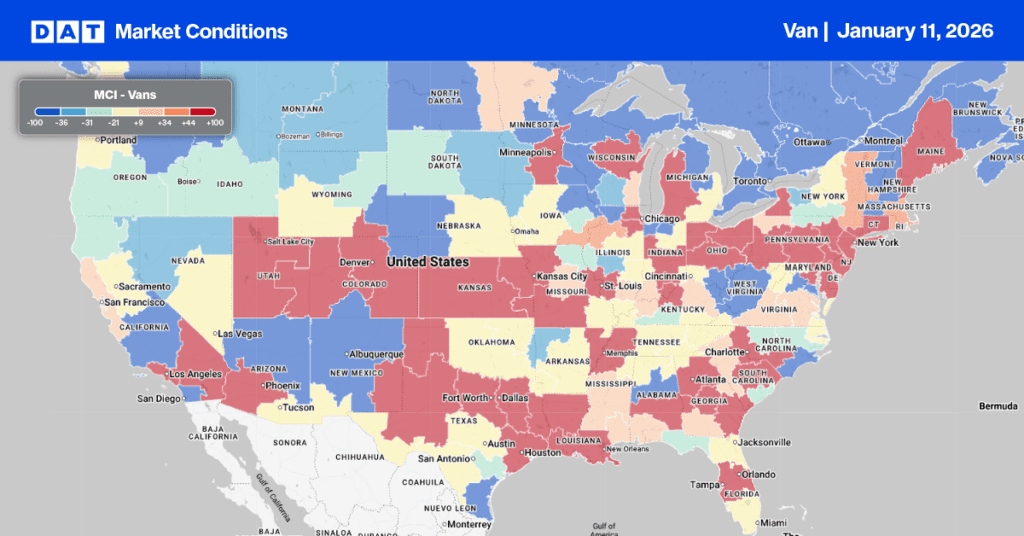

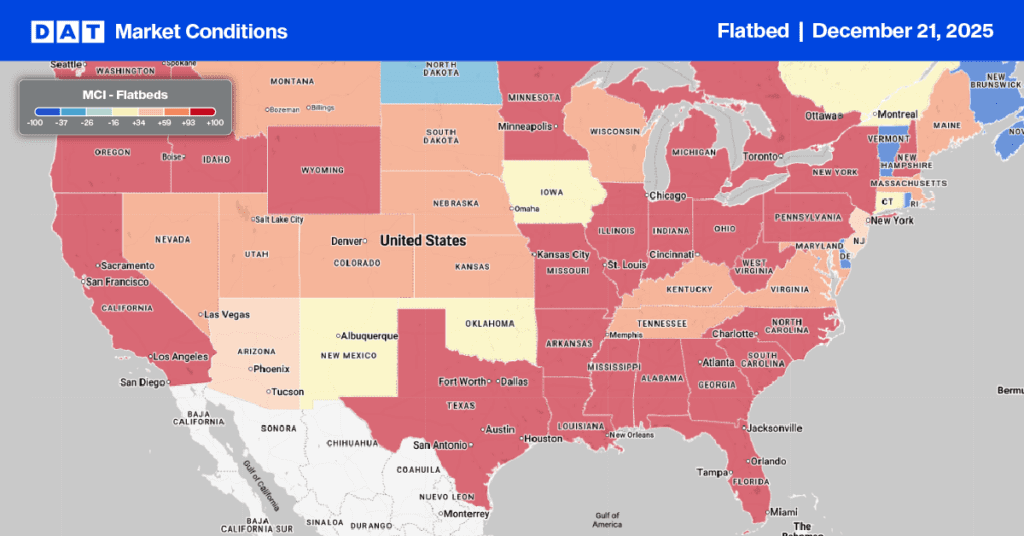

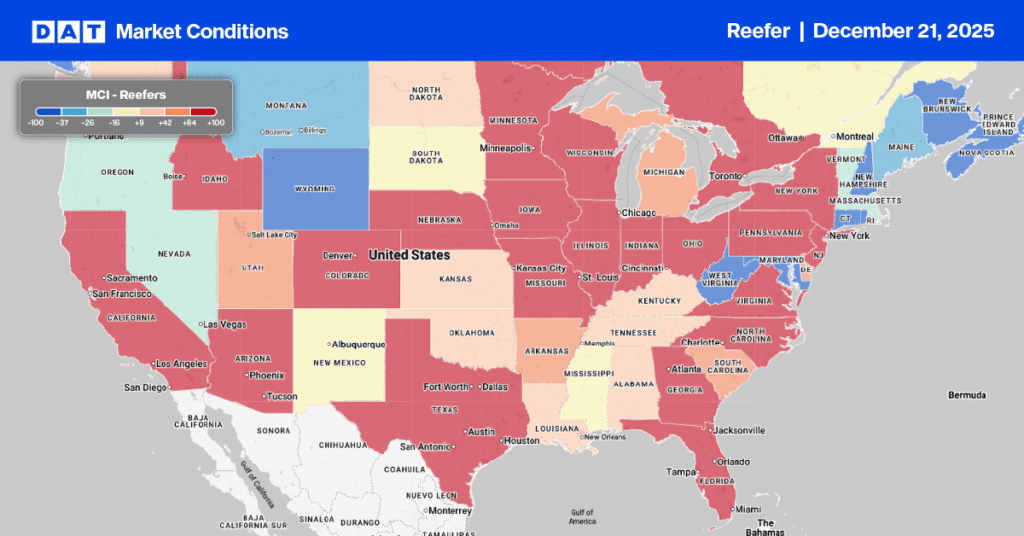

The January 7 USDA Weekly Truckrate Report shows the post-holiday freight market shifting quickly, with capacity tightening most visibly at key Mexican import gateways. After a relatively calm early winter, the New Year surge is now firmly in place. Texas crossings through Laredo, Pharr, and McAllen remain the backbone for Mexican produce imports such as avocados, limes, and tomatoes, but competition for trucks has intensified. Availability is now short to slightly short, and spot rates are trending modestly higher compared to late December as carriers become more selective, particularly on longer-haul lanes to the east coast. Nationally, there’s a slight shortage of trucks being reported and at a level (4) last seen this time three years ago.

The pressure is even more pronounced in Nogales, Arizona, which has become the focal point for winter vegetable shipments. As Nogales competes directly with Yuma and the Imperial Valley for refrigerated capacity, long-haul lanes to the Northeast are experiencing outright shortages. Spot rates out of Nogales are already up 5–8% week over week, driven by strong demand for squash, cucumbers, and eggplant. While the capacity crunch is not yet widespread across the country, history suggests these border constraints often ripple inland, tightening markets and pushing rates higher before contract pricing has time to adjust.

Nationally, reefer load post volumes for all trailer temperature zones and commodities, increased 22% year over year and was 60% higher than the 10-year average for Week 2 (excluding the pandemic-influenced years of 2021 and 2022). The reefer load-to-truck ratio increased by 17% to 19.74.

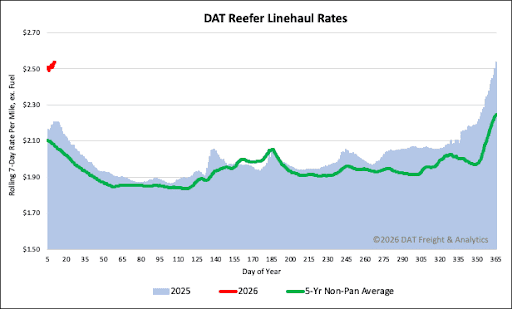

After a six-week surge where linehaul rates climbed by $0.45 per mile, the temperature-controlled reefer spot market saw a cooling trend last week. The national 7-day rolling average spot rate dropped by $0.04 per mile, settling at a national average of $2.53 per mile. This rate remains $0.33 per mile (15%) higher than the same period last year. It is also substantially elevated when compared to historical data, exceeding the 5-year average (excluding pandemic-influenced years) by $0.45 per mile, or 18%.