Every February, as the football world turns its attention to the Super Bowl, the truckload market gets its own kind of kickoff. Avocado imports from Mexico surge weeks before the big game, driven by the nation’s insatiable appetite for guacamole at Super Bowl parties. Spot rates for reefers climb as fleets scramble to cover lanes from McAllen, Nogales, and Laredo to Los Angeles, Dallas, Houston, Atlanta, and even as far north as Chicago, all while drivers juggle tight delivery windows to keep avocados fresh for peak consumption.

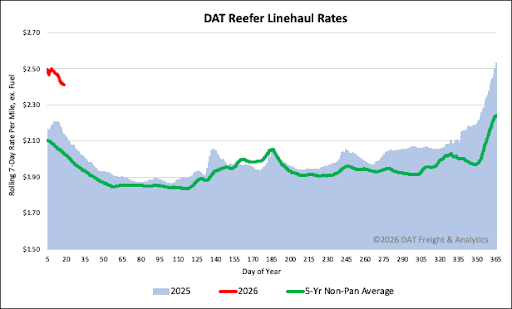

For carriers, the Super Bowl avocado rush is a predictable, yet intense, seasonal pattern. In the three weeks leading up to kickoff, demand outpaces normal produce volumes, tightening capacity in key lanes and boosting rates on short-haul and regional runs out of import hubs. This year is different though. Spot rates for reefer carriers are already at record highs driven by recent English Language Proficiency (ELP) testing and foreign-domiciled commercial driver’s license (CDL) restrictions on commercial truck drivers, impacting refrigerated carriers from California.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

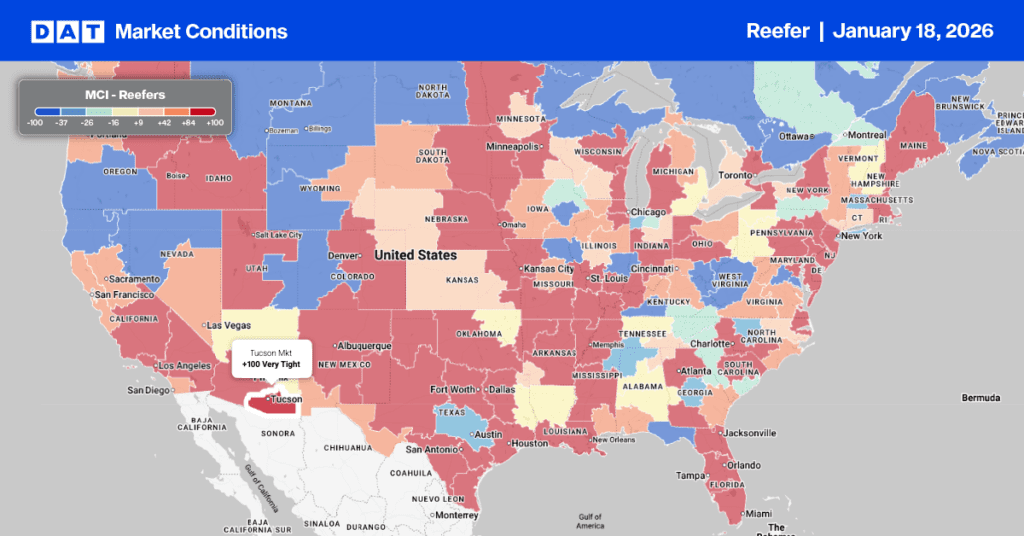

Reefer carriers transporting produce for the Super Bowl are likely to see the best spot rates in a decade, perhaps ever, as reefer capacity tightens. This is especially true for freight lanes along the southern border, the origin of roughly 88–90% of all avocados imported into the U.S. from Mexico each year.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted. The rate charts exclude 2021 and 2022, years influenced by the pandemic.

After the volume surge the previous week (a post-holiday catch-up), national reefer load post volumes saw a cooling trend last week. This volume includes all trailer temperature zones and commodities. Nationally, reefer volumes dropped 37% week over week. However, this level was nearly identical to the same week last year and was 23% higher than the 10-year average for Week 3 (excluding the pandemic-influenced years of 2021 and 2022). Consequently, the reefer load-to-truck ratio fell by 27%, settling at 13.69.

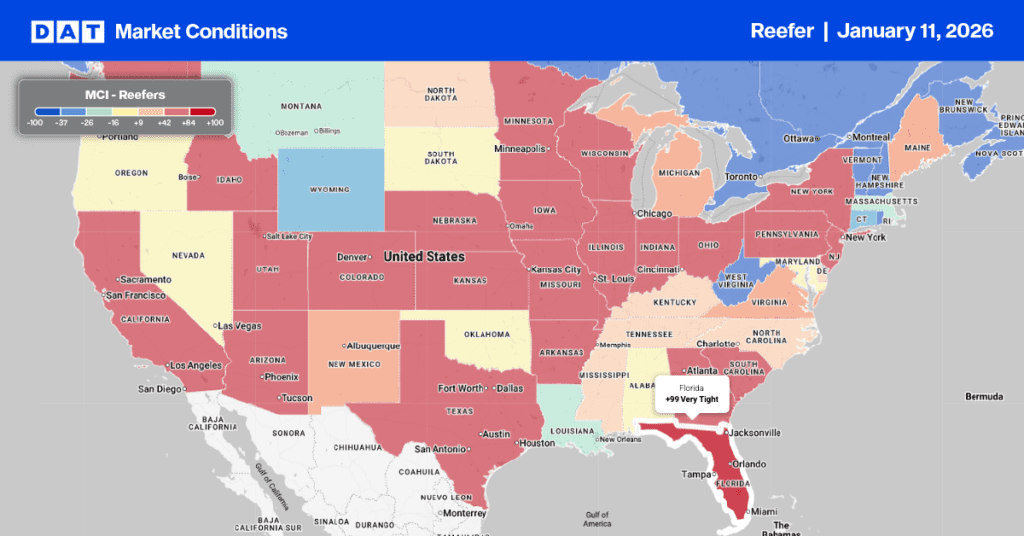

Despite the early stage of the 2026 produce season, the USDA reports an unusual scarcity of trucks across most California produce regions, with the southern Imperial Valley’s Winter Salad Bowl being the sole exception. Truck shortages were also slightly noted in Nogales for winter vegetables. Meanwhile, in Florida, produce volumes saw a 9% week-over-week increase. Tomatoes still dominate the truckload volume, but early season strawberries are now entering the market.

Additionally, the reefer market is showing initial signs of tightening. In Miami, load post volumes rose by 2% last week, reversing a five-week decline, even though the Valentine’s Day floral import surge is still two weeks away.