The school year may have just ended, but shoppers are already getting ready for the start of school in the Fall. According to the June National Retail Federation (NRF) report, 25% of back-to-school and back-to-college shoppers are already placing orders compared to 17% five years ago. Also, 68% plan to take advantage of major retailer sales events such as Independence Day (July 4), Amazon Prime Days (July 11-12), and Labor Day (September 4). According to the NRF, 80% expect to see higher prices when they shop for back-to-school and back-to-college this year, even with concerns about the state of the U.S. economy. The June NRF survey reported 83% of shoppers expect clothing and accessories to be higher this year, followed by school supplies (79%) and shows (69%).

A large percentage of back-to-school and back-to-college supplies come from overseas; ocean cargo is expected to peak in August, according to a recent report from the NRF and Global Port Tracker. At just over 2.2 million TEU (twenty-foot equivalent units), June import volumes were up 2% month-over-month (m/m) but still trailing June 2022 by 17%, according to IHS Markit/PIERS. Compared to June TEU import volume as far back as 2015, last month’s volume was 7% or 152,000, which could suggest next month may, in fact, be the peak for this year.

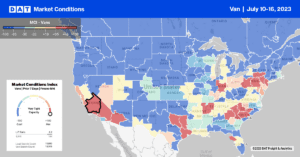

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Containerized import volumes increased by 17% last month in the Port of Los Angeles, and as it always does, a considerable amount of that volume finds its way onto the spot market for warehouse market moves. On the Los Angeles to Stockton lane, loads moved were up 7% m/m following last week’s 23% increase. Available capacity tightened slightly, with spot rates increasing $0.03 to $2.76/mile, the highest since last September but still $0.64/mile lower than the previous year. Another warehouse market connected to the transPacific trade lanes is Los Angeles to Phoenix, where loads moved increased by 25% last week, pushing up spot rates by $0.18/mile to $2.97/mile.

At $1.95/mile, state-average spot rates in Indiana are identical to 2019 following last week’s penny-per-mile increase. In the Indianapolis market, spot rates averaged $1.86/mile, with regional loads to Detroit paying carriers $2.21/mile and $2.65/mile for short-haul loads to Chicago. After increasing the prior month, outbound spot rates in Chicago and Joliet dropped by $0.01/mile to a combined average of $2.02/mile. Illinois state average rates are just $0.05/mile higher than in 2019. After dropping for the prior three weeks, outbound linehaul rates in the McAllen market in the Rio Grande Valley increased by a penny per mile to $1.73/mile.

Load-to-Truck Ratio (LTR)

Spot market load posts bounced back in the first full shipping week since the July 4 break following last week’s 26% week-over-week (w/w) increase. Volumes are starting the second half of the shipping year 35% lower than 2022 and 6% higher than 2019. Last week’s Operation Safe Driver Week didn’t keep as many drivers at home as Roadcheck Week did in May. Carrier equipment posts bounced back to around the same level as before July 4, resulting in the dry van load-to-truck ratio (LTR) increasing slightly from 2.56 to 2.66.

Linehaul Spot Rates

After being flat the prior week, the dry van linehaul market lost some energy, registering a $0.03/mile decrease. At $1.69/mile, the national average is $0.27/mile lower than in 2022, but within a penny per mile of the three-month average spot rate.