The latest data for new equipment orders from ACT Research for November indicate carriers continue to have a bullish outlook for 2023. Preliminary new Class 8 truck net orders continue at robust levels, with November’s 33,000 orders down 22% m/m but up 245% y/y against easy comparisons to last year when order books remained closed. November’s volume is equivalent to an annual rate of 391,000, while over the past 12 months, 292,000 Class 8 orders have been booked.

Tim Crawford at ACT Research says that “the strength in orders reflects OEMs having opened their order boards for 2023 more broadly, ongoing pent-up demand, with tailwinds from strong carrier profitability and elevated fleet age proving resilient. ACT Research expects a freight and eventual economic recession (mild to medium in magnitude) even though OEMs, at this point, have clear visibility to a strong 1H’23 (barring any unforeseen cataclysmic events).

Trailing equipment also reported substantial numbers in October, with net U.S. trailer orders of 47,860 units, up 83% m/m and 171% above the year-ago October level. Compared to the record-high trailer order in the third quarter of 2018, October’s volume is just 11% lower. According to Jennifer McNealy, Director–CV Market Research & Publications at ACT Research, “Discussions across the past month indicate trailer OEM business conditions, including 2023 demand, component supply chain, and labor, are on-par with September, although swinging toward the ‘better’ side of the pendulum.”

McNealy added, “demand overall remains healthy, cancellations are low, although we expect some cancel-rebooking activity to occur in Q4, and October’s backlog-to-build ratio saw an uptick in tandem with the increase in orders. October orders were mixed, with some trailer categories up triple digits from September, others down double digits, and a few virtually unchanged.”

Note: These numbers are preliminary and subject to revision. Preliminary net order numbers are typically accurate to within +/- 5%. ACT Research aims to release actual final net orders mid-month.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

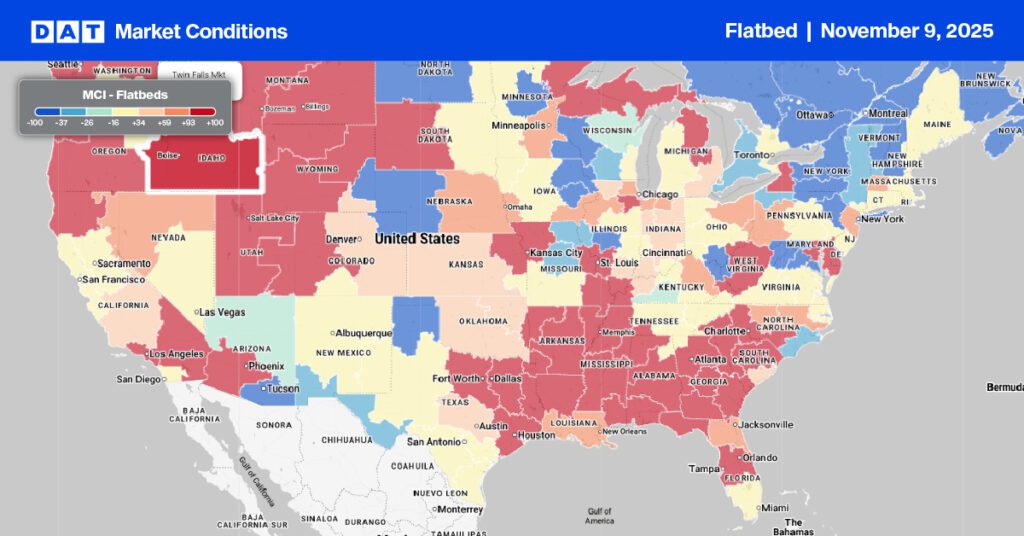

Load posts in Portland, OR, surged last week, increasing by 31%, with most loads destined for Oklahoma City (OKC) and Ontario, CA. Brokers found plenty of capacity on the OKC lane at $1.21/mile, while the opposite was the case on the 1,000-mile Ontario lane. At $2.11/mile, rates were $0.08/mile high y/y and around $0.15/mile higher than the November average. In the Upper Midwest, where Winter Storm Diaz had an impact mid-week, flatbed capacity tightened considerably as spot rates spiked, increasing by $0.36/mile to $2.54/mile.

In Minneapolis, the largest regional flatbed spot market, load posts jumped by 21% w/w. Loads south to Omaha increased by $0.21/mile above the November average to $2.24/mile last week, while outbound Omaha spot rates also surged, rising by $0.22/mile to $1.94/mile. In the Shreveport flatbed market, hardest hit by tornados last week, load posts increased by 27% w/w driving up spot rates by $0.43/mile to $3.01/mile. Loads from Shreveport to Houston, 250 miles to the west, increased to $725/load last week, around $20/load higher than the previous year.

Load-to-Truck Ratio (LTR)

Flatbed load posts were almost four times lower last week than last year, even though weekly volumes increased by 10% w/w. Load posts are also at the lowest level in six years. Flatbed carrier equipment posts remained at their highest level in six years and compared to the average over the last five years, last week’s equipment posts volumes were 60% higher. As a result, last week’s load-to-truck (LTR) ratio increased from 7.83 to 9.52, the lowest LTR level for flatbeds in the past six years for this time of the year.

Spot Rates

Flatbed linehaul rates increased to a national average of $2.07/mile following last week’s $0.03/mile gain. Compared to the previous year, last week’s average spot rate is 20% or $0.52/mile lower and $0.03/mile lower than this time in 2018. For context, last week’s national average is still $0.20/mile higher than in 2019.