On top of the crash in the building market creating a gloomy outlook for flatbed carriers in 2023, news of pine trees dying in significant numbers in Oregon further complicates the Pacific Northwest demand outlook. In addition to being the number one state for producing Christmas Trees, Oregon is also a major supplier of lumber for the housing market. According to the Oregon Forest Resources Institute, Oregon is the top producer of softwood lumber, producing more than 16% of the nation’s softwood.

The Oregon Department of Forestry reports that in 2022, Drought-stricken Oregon saw a historic die-off of fir trees that left hillsides once lush with green conifers dotted with patches of red, dead trees. The damage to fir trees was so significant that researchers called the blighted areas “firmageddon” as they flew overhead during aerial surveys that estimated the extent of the die-off. Aerial surveyors from the U.S. Forest Service tallied about 1.1 million acres of Oregon forest with dead firs, the most damage recorded in a single season since surveys began 75 years ago.

This year, the aerial observation program flew over about 69 million acres of Washington and Oregon forest in about 246 hours. According to Glenn Kohler, an entomologist with the Washington State Department of Natural Resources, “We’re just really painting the picture. It’s not hard science. You’re not counting individual trees or inspecting individual trees. The purpose is — what are the major trends and to detect outbreaks.” The scale of damage in Oregon this year was staggering to the researchers and could have longer-term implications for flatbed carriers relying on consistent lumber volumes in 2023.

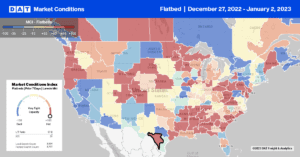

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Flatbed spot rates in Oregon were at their lowest level in seven years at an outbound average of $2.38/mile last week. In the Portland market, however, spot rates jumped increasing by $0.54/mile to an outbound average of $2.88/mile. Loads to Denver were paying $1.97/mile while loads to Ontario, CA, were slightly higher at $2.06/mile.

In the Houston flatbed market, spot rates increased by $0.31/mile w/w to an average of $2.61/mile last week. Loads 1,600 miles northwest to Salt Lake City at $2.69/mile, were the same as the previous year but up by $0.32/mile compared to the November average. Loads from Houston to Lubbock in the Permian Basin oilfield were paying carriers $2.79/mile, which was flat compared to the November average and around $0.20/mile lower than the previous year. Capacity on the high-volume lane from Houston to Ft. Worth continues to loosen as rates dropped to $2.52/mile. That’s the lowest in 12 months and $1.42/mile lower than the peak of $3.94/mile reported last May.

Load-to-Truck Ratio (LTR)

Flatbed load posts decreased by 19% last week to end 2022, just over 70% lower than the previous year. Even though flatbed carrier equipment posts dropped by 38% w/w as carriers took time off over the break, they remained at their highest level in six years. As a result, last week’s load-to-truck (LTR) ratio increased from 10.92 to 14.21, the second-lowest LTR level for flatbeds in the past six years for this time of the year.

Spot Rates

As they’ve done in the prior two years, flatbed linehaul rates increased between Christmas and New Year following last week’s $0.06/mile w/w gain. The national average flatbed rate ended in 2022 at $2.22/mile, just over $0.50/mile lower than the previous year. Last week’s average spot rate was $0.24/mile higher than the same week in pre-pandemic years.