The outlook for flatbed carriers in the housing construction industry continues to worsen. According to the National Association of Home Builders (NAHB), homebuilder sentiment in November dropped for the 12th straight month to the lowest since 2012. Regionally, the sentiment was strongest in the Northeast and weakest in the West, where prices are highest.

Single-family housing starts continue to fall in November, according to data from the U.S. Census Bureau. Construction levels had dropped by 32% since February, when mortgage rates began to rise along with high construction costs, and declining demand is harming housing affordability. Overall, housing starts decreased by 0.5% to a seasonally adjusted annual rate of 1.43 million units in November. Year-to-date, single-family starts are down 9.4%. The multifamily sector, which includes apartment buildings and condos, increased by 4.9% to an annualized 599,000 pace.

According to Jerry Konter, chairman of the National Association of Home Builders (NAHB), “It’s no surprise that single-family starts are running at their lowest level since May 2020, given that builder sentiment has dropped for 12 consecutive months as builders remain fixated on rising building material costs and supply chain bottlenecks, with electrical transformers, in particular, being in short supply.”

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Flatbed spot rates in Oregon, the Pacific Northwest’s largest lumber market, increased by $0.23/mile last week to a state average of $2.61/mile, right around where flatbed rates were in 2018. In the Portland market, load posts increased by 37% w/w with plenty of available capacity resulting in outbound average spot rates plunging by $0.41/mile to $2.47/mile. In the neighboring Medford market, outbound flatbed rates dropped by $0.08/mile to $2.58/mile, while on the 1,300-mile haul to Denver, rates were by $0.10/mile to $2.14/mile. Loads south to Los Angeles also increased by $0.12/mile to $2.53/mile last week, while capacity for loads to Phoenix loosened. Spot rates on that 1,000-mile lane decreased to $2.22/mile, which is $1.26/mile lower y/y.

Outbound Texas rates start in 2023 at the second-highest rate in seven years at an average of $2.22/mile, which is $0.42/mile lower than in 2022. At $2.38/mile for outbound loads in Houston last week, spot rates decreased by almost $0.30/mile the previous week to $2.38/mile even though there was a spike in load posts (up 41% w/w). Even though the volume of loads moving on the high-volume Houston to Ft. Worth lane decreased by 4% w/w, capacity tightened for the first time since May increasing by $0.06/mile to $2.84/mile. That’s still $0.37/mile lower than the previous year.

Load-to-Truck Ratio (LTR)

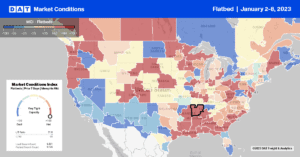

Flatbed load posts started in 2023 at about a quarter of volumes last year, reflecting how much demand has cooled in many markets. Major truckload markets, including steel production, ended 2022 down by 9.4% y/y, while in the single-family home housing market, volumes are just over 30% lower y/y. Builders started almost 400,000 fewer homes last November compared to the previous year. Flatbed carrier equipment posts remained at their highest level in seven years resulting in last week’s load-to-truck (LTR) ratio increasing from 14.21 to 15.36.

Spot Rates

Flatbed linehaul rates begin in 2023 at $2.15/mile, which is $0.54/mile lower than the previous year but within $0.02/mile of 2018 levels. This is a crucial comparison, given the 2018 rate rally was primarily driven by flatbed and a robust industrial economy. The national average flatbed rate is $0.23/mile higher than in pre-pandemic years for Week 1 of the shipping year.