Manufacturing accounts for around 60% of truckload demand, making the most recent data good news for flatbed carriers. Data published by the U.S. Census Bureau reported that new orders for manufactured goods – Factory Orders – increased $6.7 billion, or 1.2%, to $586.1 billion in August. This follows the 2.1% decrease recorded in July and came in better than the market expectation for an increase of 0.3%.

“New orders for manufactured durable goods in August, up five of the last six months, increased $0.4 billion or 0.1% to $284.7 billion, down from the previously published 0.2 percent increase,” the report read.

Orders for computers and electronic products gained 0.3%. Electrical equipment, appliances, and components orders jumped 1.0%. Machinery orders gained 0.6%. Civilian aircraft orders fell 15.9%, while motor vehicle orders rose 0.3%. Shipments of manufactured goods soared 1.3%. Manufactured goods inventory rose 0.3%, while unfilled orders increased 0.4%.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

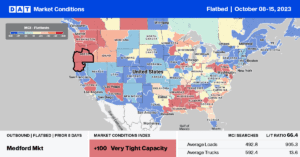

Flatbed capacity tightened in Portland last week following a $0.06/mile increase to an outbound average of $2.40/mile. Portland to Denver loads at $2.36/mile were a new 12-month high, around $0.35/mile higher than last year. Regional loads to Stockton paid carriers $2.51/mile, $0.07/mile higher than last month. Outbound loads in Arizona at $1.51/mile have increased by almost $0.20/mile in the last month, with solid gains reported in the Phoenix market, where loads averaged $1.68/mile last week, up $0.15/mile w/w.

At $1.96/mile, outbound loads in Dallas were up by $0.04/mile last week, and in neighboring Fort Worth, loads paid carriers an average of $2.02/mile, up $0.11/mile w/w. In the Atlanta flatbed market, spot rates averaged $2.22/mile last week, up $0.01/mile w/w. State-level Georgia flatbed rates are considerably lower at $2.08/mile and $0.20/mile lower than in 2019.

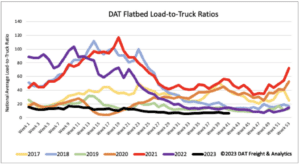

Load-to-Truck Ratio (LTR)

Flatbed load post (LP) volume remained flat last week after plunging at the start of the month. Volumes are around 37% lower than in 2019 and half what they were this time last year. Carrier equipment posts decreased by 2% w/w, resulting in last week’s flatbed load-to-truck ratio (LTR) remaining at 6.63.

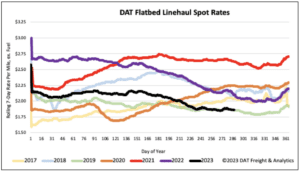

Spot Rates

Flatbed linehaul rates were flat last week at a national average of $1.88/mile, which is $0.24/mile lower than last year and identical to 2019. Compared to the pre-pandemic average for Week 41, last week’s national average was $0.06/mile lower.