Flatbed carriers looking for market direction received good news last week following the new single-family homebuilding rebounded in September. According to the U.S. Census Bureau, single-family housing starts, which account for most homebuilding, increased 3.2% to a seasonally adjusted annual rate of 963,000 units last month. In contrast, single-family building permits, a leading indicator of housing starts, declined 1.8% m/m, pouring cold water on the surprising September result. The housing market has been boosted by demand for new construction amid an acute housing shortage despite the highest mortgage rates in nearly 23 years.

According to Alicia Huey, chairman of the National Association of Home Builders (NAHB), “The uptick in single-family production was somewhat unexpected as our latest builder surveys indicate that starts are likely to weaken in the months ahead due to recent higher mortgage rates that were near 7.6% in mid-October.”

Regionally, the densely populated South has the highest volume of single-family starts at 593,000, up 2.8% m/m and 16% y/y. The Western region was second in volume with 202,000 single-family starts, up 5.2% m/m and 4.7% y/y. The Midwest region had 121,000 single-family starts, up 14.2% m/m but down 1.6% y/y. The volume of starts plunged by 19% m/m in the smaller Northeast region.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

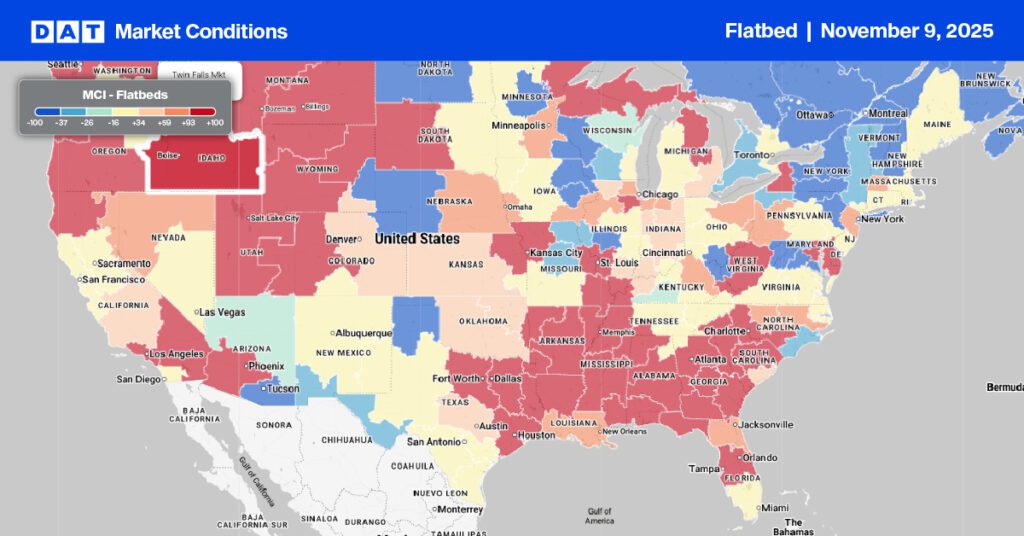

Flatbed capacity tightened in California last week following last week’s $0.03/mile increase to $2.06/mile for outbound loads. In the larger Fresno flatbed market, load posts increased 18% w/w, pushing up spot rates by $0.03/mile to $2.08/mile. Solid gains were reported in San Diego, where spot rates jumped by $0.13/mile to an average outbound rate of $2.24/mile. Regional loads east to Phoenix paid carriers $2.97/mile, $0.05/mile higher than last year.

In the Finger Lakes region in Upstate New York, flatbed capacity was very tight following a 66% w/w increase in load posts. Outbound spot rates surged, increasing by $0.75/mile to a regional average of $3.22/mile after dropping for three weeks. In Houston’s most significant spot market for flatbeds in the country, load posts increased by 6% w/w, with spot rates increasing by $0.08/mile to $2.03/mile.

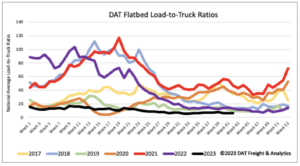

Load-to-Truck Ratio (LTR)

The volume of Reefer load posts (LP) remained flat for the second week and was 55% lower than last year. Carrier equipment posts (EP) were also flat and slightly below the average weekly LP volume for 2023, resulting in last week’s reefer load-to-truck ratio (LTR) remaining primarily flat at 2.78.

Spot Rates

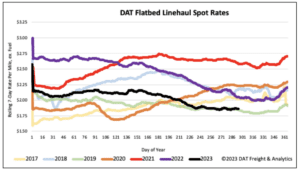

Flatbed linehaul rates were flat for the third week at a national average of $1.88/mile, which is $0.18/mile lower than last year and just $0.01/mile higher than 2019. Compared to the pre-pandemic average for Week 41, last week’s national average was $0.08/mile lower and $0.32/mile lower than in 2018.