The agricultural industry relies heavily on the flatbed industry for the movement of tractors. Although volumes are tracking slightly higher than the 5-year average, we don’t expect to see peak volume until March next year. According to the Association of Equipment Manufacturers (AEM), U.S. total farm tractor sales decreased 12.8% y/y in September and are down 14.3% YTD. The self-propelled combine harvester category grew 6.6% y/y and is up 3.4% YTD. The 100+ horsepower 2WD tractor segment continues to grow and is up 9.6% y/y and 11.6% YTD. Mid-range tractors between 40 and 100 horsepower were down -10.2% y/y and -12.4% YTD. The sub-40hp tractor segment had the most considerable losses and was down -16.3% y/y and -17.56% YTD.

According to the latest data from PIERS, the Tractor and Agricultural Machinery TEUs are up 1% y/y for September, lapping a 40% import increase in 2021. YTD tonnage is up 21% through September; however, Q3 2022 tonnage was down 13% compared with Q2, signaling a slight decrease on the horizon. In September, we saw Agricultural machinery and tractors shift back to the West coast ports with y/y comps up 13%, while the East coast was down 19% y/y. The East coast still receives most of the imports with 58% of the volume YTD, and Savannah processes 34% of that volume for the east coast. The west coast receives 28% of the import volume, with Los Angeles handling 44% of the tonnage. The Gulf coast receives 10% of the total volume, with Houston handling nearly all of the volume at 95%.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

In Baltimore, MD, which typically handles the majority of the U.S. East coast market’s share of Ro/Ro cargo during peak season in March each year, outbound flatbed rates were flat m/m averaging $2.87/mile last week following a 35% w/w drop in load posts. For flatbed carriers, Baltimore is ideally positioned for shipments to the Midwest’s central farm and construction equipment manufacturers for combines, tractors, hay balers, and importing excavators and backhoes. We expect volumes to start trending up over the winter ahead of next year’s start to planting season in Spring.

Looking at roll-on/roll-off (RoRo) specific imports, Savannah (24%), Houston (17%), and Norfolk (14%) are the most important ports for RoRo cargo so far this year. Import volumes in Norfolk were up 73% y/y in September and 104% from 2019 levels. Loads moved are up 78% YTD in Norfolk and 74% YTD in nearby Richmond, VA. The overall outbound flatbed in Norfolk at $2.77/mile has remained flat throughout October, while in Richmond, flatbed capacity is very tight following last week’s $0.73/mile increase to $3.73/mile. In Greensboro, VA, the largest flatbed spot market in the region, capacity tightened last week following a 138% w/w jump in load post, which pushed up linehaul rates by $0.14/mile to $2.89/mile.

On the West Coast in Los Angeles, load posts increased for the third week following last week’s 17% w/w gain. Los Angeles outbound spot rates increased by $0.19/mile to $2.19/mile, and on the high-volume flatbed lane 372 miles east to Phoenix, rates increased by $0.04/mile to an average of $3.01/mile last week. In one of the largest flatbed markets in the country, capacity tightened the previous week in Jackson, MS, following a $0.25/mile increase to $2.81/mile. In nearby Memphis, capacity tightened for the first time in a month following last week’s $0.07/mile increase in linehaul rates to an average of $2.76/mile.

Load-to-Truck Ratio (LTR)

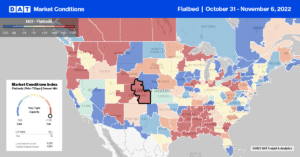

The flatbed spot market continues to track very closely with 2018 volumes, while capacity, measured by carriers posting their equipment in search of loads, mirrors 2019 levels when the market was oversupplied with equipment. Load posts dropped another 4% last week and are now down 24% from the previous month. Even though equipment posts were flat throughout October, they increased by 2% last week and remained at the highest level observed in the previous six years. As a result, last week’s load-to-truck (LTR) ratio decreased by 5% to 10.79.

Spot Rates

As demand weakens in the flatbed sector, an oversupplied market continues to suppress linehaul spot rates. After dropping $0.58/mile since the start of June, spot rates were relatively flat last week and remained at $2.07/mile. Compared to the previous year, linehaul rates are 21% lower and 6% lower than in 2018.