Flatbed carriers are moving around 37,000 fewer truckloads of steel compared to the start of June last year, based on data from the American Iron and Steel Institute (AISI). Excluding 2020, when global demand crashed, year-to-date steel production tonnage is the lowest since 2018. The AISI reports steel output in the U.S. in the week ending June 3, 2023, fell by 0.2% compared with the same time frame in 2022. Year-to-date production through June 3, 2023, was 37,246,000 net tons, down 3.3% from the 38,350,000 net tons during the same period last year.

Steel tonnage in the two major steel-producing regions increased in the week ending June 3. In the Great Lakes region, production was up 0.5% or 3,000 tons w/w, while in the Southern region, production was up 3.2% or 24,000 tons w/w. The Midwest region reported lower volume, down 4.5% or -10,000 tons w/w, while the smaller Western region reported 5.1% or 3,000 tons higher volume. State-level data to the end of April shows Indiana was ranked first in tonnage but was down 2.2% m/m but up at 4.4% y/y. Ohio was ranked second in tonnage, down 3.5% m/m and 4.3% y/y. Texas moved to third in tonnage, up 12.1% m/m and down 11.8% y/y.

April Steel imports were down 9.4% m/m and 11.7% over the 12 months from May 2022 to April 2023. In April, the most significant suppliers were Canada (594,000 NT, down 10% vs. March), Mexico (345,000 NT, down 21%), Brazil (213,000 NT, down 53%), South Korea (168,000 NT, down 10%) and Japan (130,000 NT, up 11%).

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

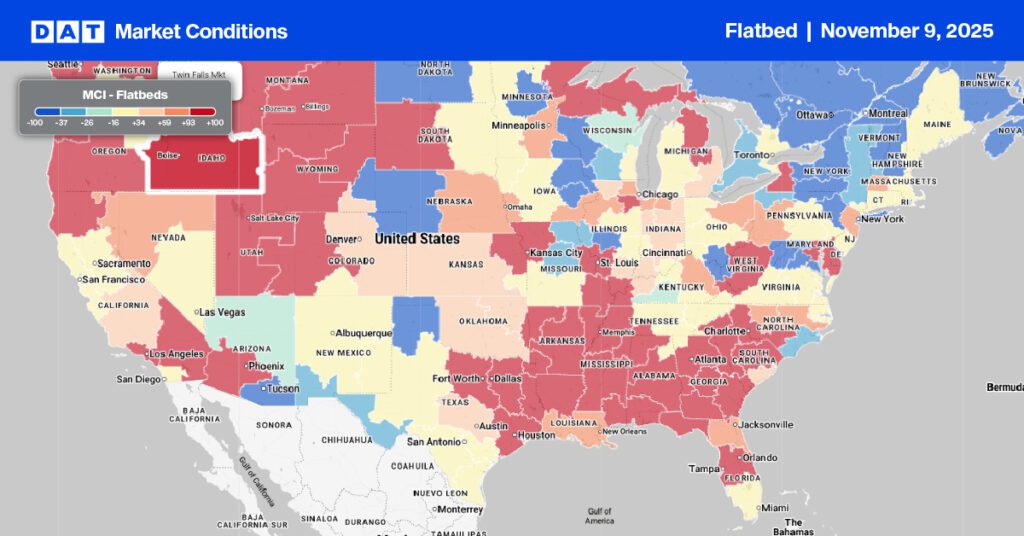

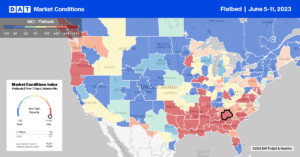

Flatbed capacity was much tighter last week in the Pacific Northwest, where regional rates at $2.53/mile were $0.016/mile higher w/w. In Portland, flatbed rates were up $0.22/mile w/w to $2.89, with next door in Medford; flatbed linehaul rates increased by $0.32/mile w/w to $3.27/mile. Regional loads from Medford to Stockton paid $3.73/mile, the highest since last July and $0.33/mile lower than the previous year. At $3.17/mile, Oregon’s outbound average flatbed rates are the highest in eight years.

In the Southeast, capacity tightened slightly in Birmingham, where rates increased by a penny per mile to $2.66/mile for outbound loads. In contrast, in the largest flatbed in the region in Montgomery, rates dropped to $2.80/mile following the prior week’s spike in linehaul rates. Outbound loads in Miami averaged $2.10/mile last week, up $0.24/mile w/w, with loads to Jacksonville averaging $1.73/mile, down $0.07/mile compared to the May average but ending the week closer to the 12-month average for this lane. In the Southwest, outbound rates in Houston continued to cool, dropping by $0.03/mile to $2.38/mile, with rates on our number two spot market lane between Hoston and Ft. Worth flat at $2.96/mile. Linehaul rates averaged $2.62/mile last week on the number lane west to El Paso, the lowest in 12 months and just over $1.00/mile lower than the previous year.

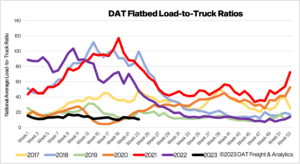

Load-to-Truck Ratio (LTR)

Flatbed spot market volumes increased last week and are now 10% higher m/m following last week’s 9% w/w increase. However, they are also at the lowest level in seven years and 26% lower than in 2019. Carrier equipment posts surged by 28% w/w and at the highest level in seven years, resulting in last week’s flatbed load-to-truck (LTR) ratio decreasing from 12.54 to 10.66.

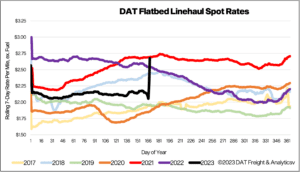

Spot Rates

After three weeks of solid gains, flatbed linehaul rates plunged last week, reverting to the long-term yearly average of around $2.16/mile. Linehaul rates dropped by almost $0.03/mile last week and, compared to the previous year, are $0.43/mile lower but remain $0.12/mile higher than the pre-pandemic average for this time of the year.