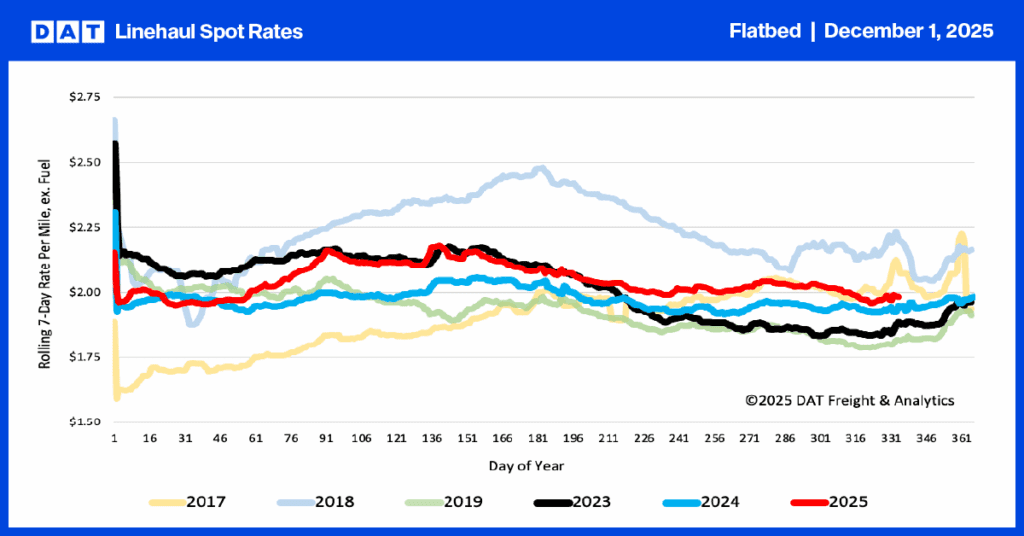

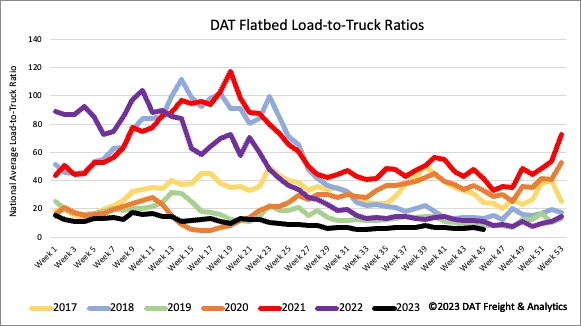

Demand for flatbed carriers continues to be the flattest in the last seven years, as spot market load post volumes continue below 2019 levels, a notoriously poor year for carriers. As we start November, flatbed load post volumes are 41% lower than in 2019 and 66% lower than in 2018, considered by most to be an excellent year for the flatbed sector. Negatively impacting the flatbed market are U.S. homebuilding rates, which dropped 7.2% year-over-year (y/y) in September as higher mortgage rates slowed demand for housing, mainly single-family homes, the most freight-intensive for flatbed carriers.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

A freight recovery in 2023 for flatbed carriers seems off the table, but the chances of a 2024 recovery are increasingly more remote given the “lock-in” effect preventing Americans from selling their homes and adding to the current housing crisis. In the 1980s, University of California at Berkeley economist John Quigley identified the lock-in effect, which he said: “was preventing Americans from selling their homes.” Mortgage rates had spiked from 9% in 1978 to 18% in 1981, leaving millions of households with older and cheaper mortgages, creating a powerful disincentive to moving.

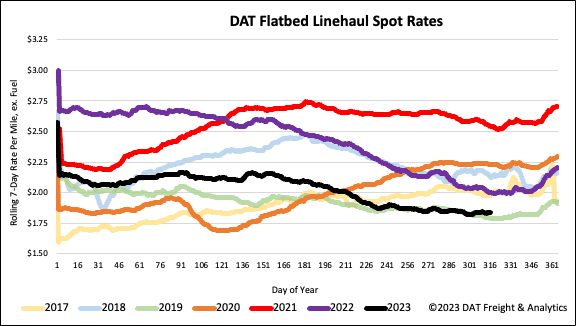

Fast-forward 40 years, and we have an almost identical situation fueled by the pandemic-influenced surge in stimulus payments, low borrowing costs, and the work-from-anywhere job market. This created a boom in homebuilding unseen in decades. In turn, flatbed demand and linehaul freight rates (excluding the fuel surcharge) hit record highs, peaking at $2.73/mile in June 2021, $0.88/mile or 47% higher than the average linehaul rate in October.

The lock-in effect has slowed the sale of existing homes and threatens to prevent younger owners from moving to larger homes and expanding their families. On the other end, empty nesters will put off downsizing, leaving the single-family market in a deep freeze. How long it takes to thaw is anyone’s guess, but it will be around while interest rates remain high.

Market watch

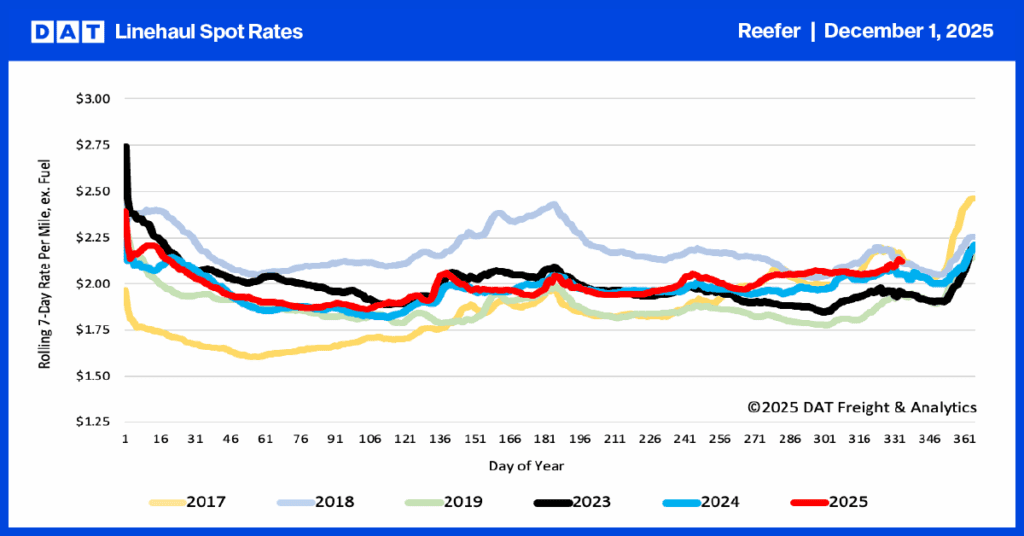

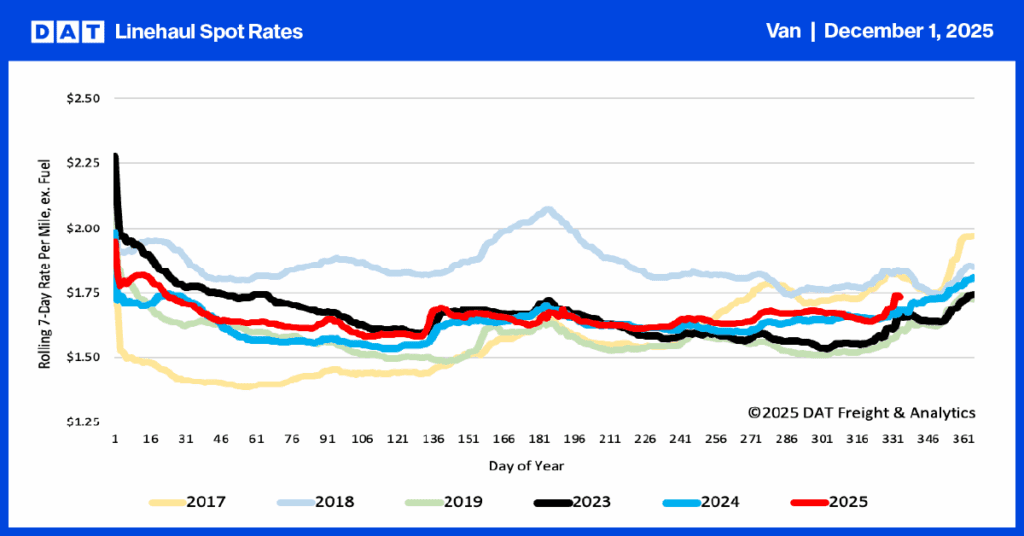

All rates cited below exclude fuel surcharges unless otherwise noted.

Flatbed linehaul rates spiked in Washington, the top state for Christmas tree production, increasing by $0.20/mile to an average of $2.48/mile. At that level, spot rates have increased by $0.35/mile in the last month. Seattle to Stockton loads paid carriers $2.48/mile last week, the highest since February and almost $0.50/mile higher than last year.

In Nevada, spot rates jumped by $0.18/mile to an average of $2.39/mile, while in Wisconsin, spot rates increased by $0.30/mile to $2.32/mile after dropping for the previous four weeks. Michigan outbound loads paid carriers an average of $2.38/mile last week, an increase of $0.09/mile, but lower by the same amount compared to 2019.

Load-to-Truck Ratio (LTR)

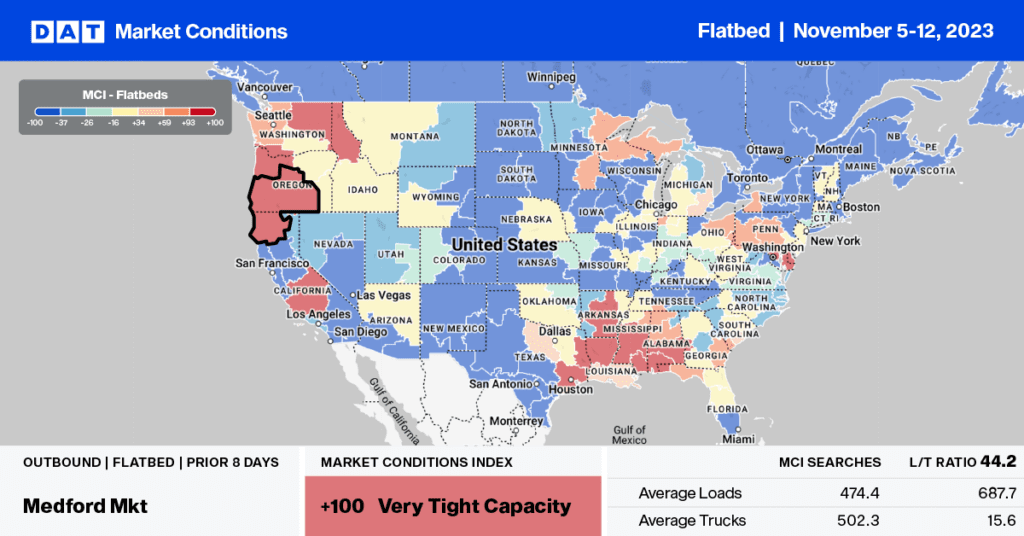

After being relatively flat since July 4, the volume of flatbed load posts (LP) dropped by 15% last week, the lowest LP volume record in seven years for Week 45 – 36% lower than even in 2019. Carrier equipment posts (EP) increased 8% w/w, resulting in last week’s flatbed load-to-truck ratio (LTR) decreasing by 23% w/w to 4.95, the lowest LTR in seven years.

Spot rates

Flatbed linehaul rates lost more ground following last week’s $0.02/mile w/w decrease. At $1.87/mile, flatbed linehaul rates are $0.16/mile lower than last year and only $0.05/mile higher than in 2019. Compared to the pre-pandemic average for Week 45, last week’s national average was $0.06/mile lower and $0.29/mile lower than in 2018.