The overall economy grew for the 21st consecutive month in February, according to the Institute for Supply Management (ISM). The latest Manufacturing ISM report registered 58.6%, an increase of 1% sequentially, and being a diffusion index, any reading above 50 represents a growing economy.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment,” according to the ISM Chairman. “The COVID-19 omicron variant remained impacted in February; however, there were signs of relief, with recovery expected in March. A higher-than-normal quit rate and early retirements continued.”

“All of the six biggest manufacturing industries — Transportation Equipment; Machinery; Computer & Electronic Products; Food, Beverage & Tobacco Products; Chemical Products; and Petroleum & Coal Products, in that order — registered moderate-to-strong growth in February,” says Fiore.

The forward-looking New Orders Index registered 61.7% in February, an increase of 3.8% compared to 57.9% in January and the 21st consecutive month of growth. Notable survey responses include, “Demand for steel products has increased to historic levels, driven by the automotive and energy industries.” [Fabricated Metal Products] and “Demand for transportation equipment remains strong. Supply of transportation services continues to be a major issue for the supply chain.” [Transportation Equipment].

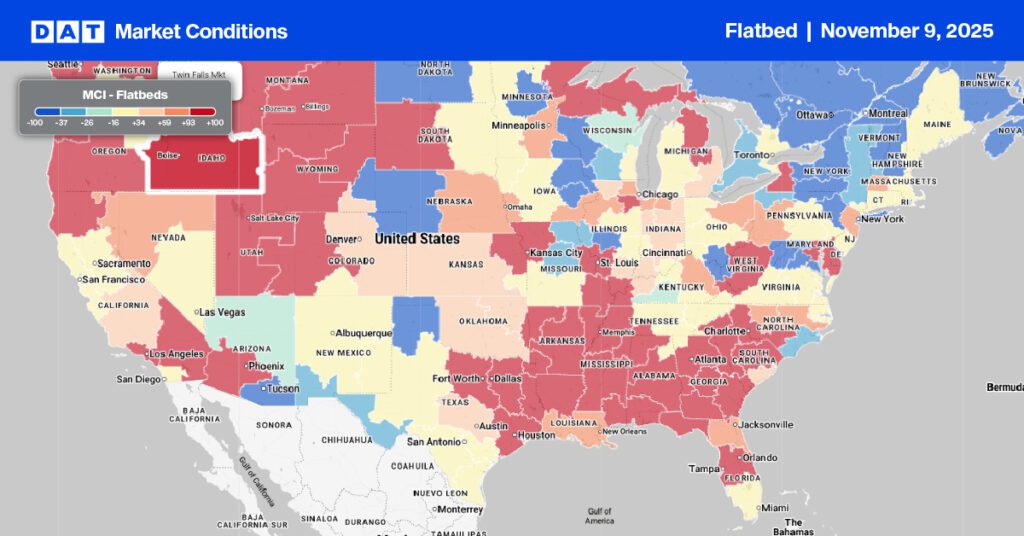

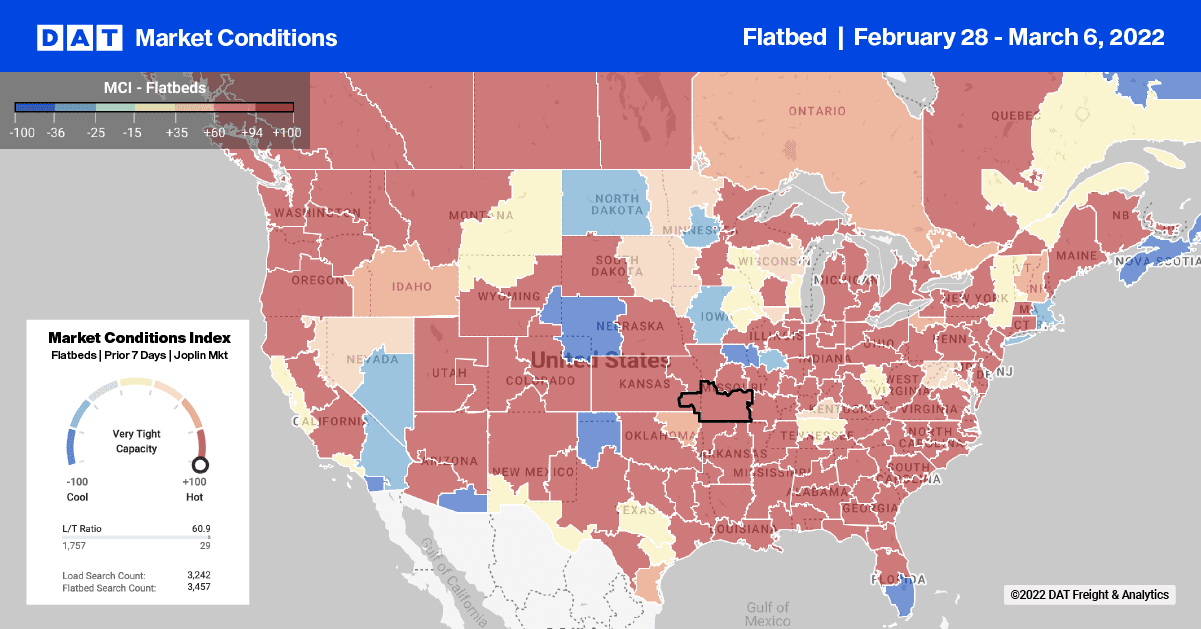

Similar to the dry van and reefer sectors, flatbed capacity was tight in Lakeland, FLlorida, last week. Spot rates jumped by $0.18/mile to an average of $2.24/mile excl. FSC. Loads moved between Lakeland and Miami were up by 10% w/w with capacity flat as rates held steady around $600/load excl. FSC. In DAT’s largest flatbed market, spot rates in Houston increased by $0.09/mile last week to an average of $2.85/mile excl. FSC and as high as $3.29/mile excl. FSC on the number lane for loads moved between Houston and Ft. Worth. This is a relatively balanced freight lane with loads moved in both directions flat w/w, but spot rates did drop by $0.08/mile on the southbound leg following last week’s $0.04/mile increase in the opposite direction.

On the West Coast in Los Angeles, flatbed capacity was highly tight for loads to Phoenix; spot rates increased by $0.02/mile to $3.89/mile excl. FSC following a 12% w/w increase in loads moved. Following a week of torrential rain in the Pacific Northwest, spot rates in Medford, OR, jumped by $0.56/mile to an outbound average of $3.81/mile excl. FSC. The increase was even more pronounced on the high-volume lane between Medford and Stockton, CA, where rates jumped $0.68/mile to an average of $4.32/mile excl. FSC. In contrast, capacity eased on the second-highest volume lane 600-miles east to Twin Falls, IDdaho, where spot rates dropped by $0.13/mile to an average of $3.49/mile excl. FSC.

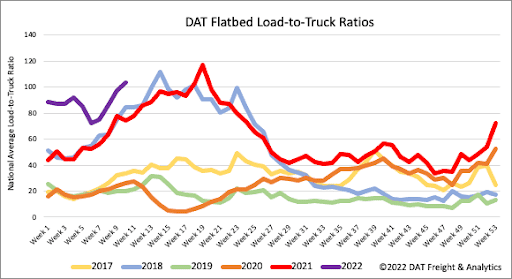

It’s no surprise flatbed load post volumes continue to increase as we enter Spring and the seasonal surge in building and construction activity. The flatbed market continues to track closely with 2018 and 2021 freight markets as the load-to-truck (LTR) moves past to the 100 loads per truck mark, a level only observed for just two weeks in each of those prior years. Carrier equipment posts have decreased for the last four weeks, resulting in the previous week’s flatbed LTR increasing 6% w/w 103.47.

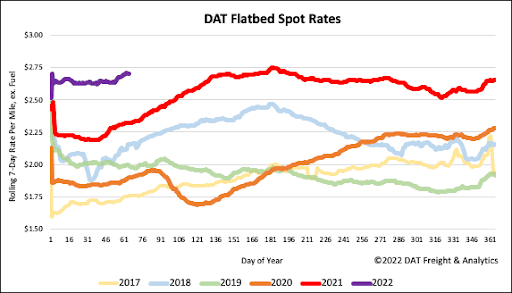

Flatbed spot rates increased another $0.02/mile last week to a national average of $2.70/mile excl. FSC. That’s now just $0.04/mile below the record-high $2.75/mile excl. FSC was set in June last year. Flatbed spot rates are now $0.39/mile higher than the previous period last year and $0.55/mile higher than the same week in 2018.