National average rates dropped again last week, but all equipment types could be getting ready for a rebound. Why? Load availability is up in the largest van freight markets, accompanied by a big increase in reefer freight movements compared to the previous week. Flatbed is also gaining strength, especially in the Southeast and South Central regions.

The national average reefer rate slipped 2¢ last week, but there were at least three signs that things could change soon:

1. Reefer freight volume was way up last week in most major markets. Green Bay was the only major reefer market that didn’t have an uptick in loads last week.

2. Domestic produce markets in California and Southern Georgia picked up steam. Atlanta continued to improve, and the lane to Dallas climbed 15¢ to $1.78/mile last week. There was even a surge in freight out of Florida last Friday.

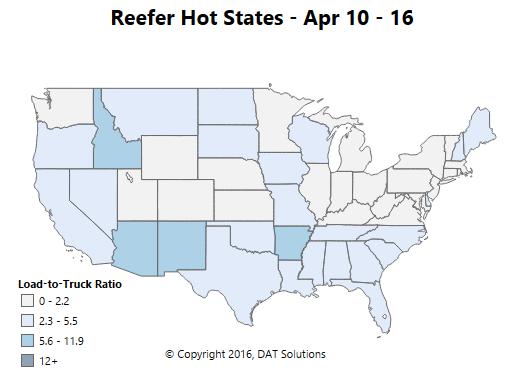

3. Mexican produce continued to boost demand in Nogales, AZ. The average rate for reefer loads was $2.02/mile from Nogales, AZ to Dallas, which was up 13¢ compared to the previous week. Nogales, near Tucson, has been the top market for reefer load availability in the past two weeks, with 10.6 loads per truck. Another Mexican border crossing in McAllen, TX offered loads to Dallas for $2.42 per mile, up 27¢ last week.

National average rates were up 5¢ per mile for flatbeds so far in April, thanks to big increases on the highest-volume lanes. Freight is strong, and rates are holding up well in the Southeast, including lanes originating in Atlanta, Roanoke and Savannah. Memphis outbound rates improved by 14¢ per mile to an outbound average of $2.46. The lane from Memphis to Dallas added 8¢ in just the last week to $2.29 per mile (up 22¢ for the month). This is a good way into Texas, where you can usually find a load out of Dallas, Fort Worth, and especially Houston. One Southeast regional lane to avoid: Raleigh to Baltimore. That rate is back down to $2.31/mile, after a two-week surge, and you don’t want to be stuck looking for a load out of Baltimore anyway.

Van rates continued to fall, but load availability increased in the six biggest van markets, with a lot more outbound freight leaving Atlanta and Stockton, CA, in particular. Improved rates usually follow increased demand. Unfortunately, not much to say for Northeast rates. The West Coast is gaining traction: Imports are up, and those loads tend to arrive on the West Coast, then move inland to the Northeast, so you get a lot of extra trucks competing for westbound loads. The lane from Denver to Stockton plunged 20¢ to only $0.87/mile. Stockton has good volume right now, but this isn’t the best way to get there, even if you’re stuck in Denver. Take a TriHaul instead. (See below.)

There are lots of van loads available in Stockton, and the rates are pretty good — $1.79/mile from Stockton to Denver. Rates out of Denver are trending up, but they’re still under a dollar per mile on the lane from Denver back to Stockton. If you’re stuck in Denver, look for a load to Los Angeles instead. That rate is only slightly better, at $1.04 per mile, but then you get a very nice rate from L.A. back to Stockton at $2.22 per mile. That 338-mile leg adds almost $650 in total revenue to your roundtrip. That’s a roundtrip rate of $1.55 per mile, for all loaded miles, which is better than this week’s national average.

Hot Market Maps can be found in DAT Power, and rates for 65,000 lanes are updated daily in DAT RateView.