The annual reports have all rolled in from publicly traded transportation companies, and it’s obvious that 2018 was a record-setting year in many ways.

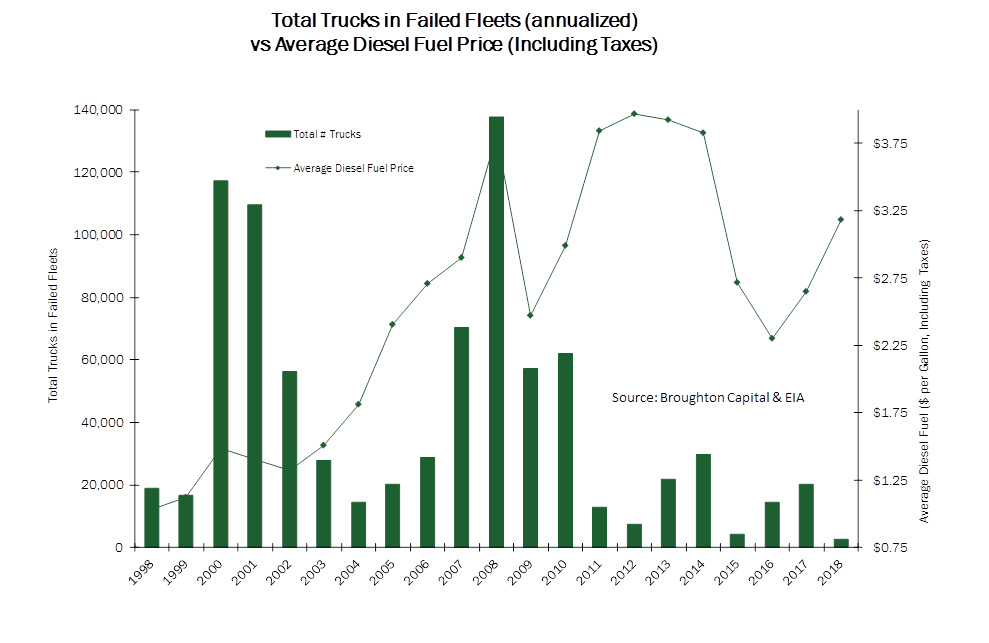

Trucking companies of all sizes enjoyed unparalleled financial success in 2018, with the largest increases in total revenues and operating profits. Freight rates rose faster and higher than ever before — or at least since deregulation in the 1980s — as demand grew and ELDs throttled capacity. Last year also set a record for the lowest number of trucking company failures and the lowest number of trucks removed from service as a result.

Get weekly updates on national freight trends. Sign up for the DAT Trendlines newsletter.

2017 failures led to 2018 capacity shortfall

More trucking companies tend to fail when fuel prices are high. Then in 2016 and 2017, fuel costs fell but a freight recession made it harder for truckers to succeed. Trucking company failures increased and 20,000 trucks were removed from the market in 2017 alone. That set the stage for a capacity shortfall in 2018 that was intensified by the new ELD mandate. Capacity pressures mounted and demand increased, giving trucking companies an edge in contract negotiations. Spot rates rocketed up, and contract rates followed, on a steady volume of freight that led to the lowest-ever failure rate for trucking companies. Choose any metric, and they were all the lowest ever: Compared to any previous year, 2018 had only 310 failed trucking companies, with a combined total of only 2,805 trucks, with an average of only 9 trucks per fleet.

In 2018, trucking companies experienced the lowest failure rate in 20 years, despite an increase in fuel prices.

ELDs constrain capacity, especially for flatbed fleets

On the capacity side, the ELD mandate led to a loss of capacity in varying degrees, depending on the equipment type. Over time, most of that capacity was recovered as truckers adapted to the new rules and devices. Dry van carriers added trailers, to boost the percentage of freight that could ‘drop and hook‘ to save time. Reefer carriers also added trailers, monitored loading and unloading times, and increased customer penalties for detention. Flatbed fleets added more trucks and also worked to improve loading and unloading times. It took flatbedders longer to recover capacity after installing ELDs because those drivers are more likely to run out of hours due to their involvement with loading and unloading. All modes used the rate increases to fund significant driver pay increases and were able to grow the size of the nation’s fleet.

Use DAT RateView to benchmark and forecast your transportation pricing or spending.

Economic growth adds to demand

The economy kicked into high gear in 2018, in both the consumer and industrial sectors. A hot job market and rising 401(k) values enabled consumers to spend more freely, on homes and cars as well as non-durable goods and services. Oil prices rose back above the marginal cost of production for fracking, and together with the new tax cuts, the increased oilfield activity boosted industrial expansion. All those factors contributed to a freight boom that strained the economic infrastructure, including freight transportation in all modes. The only potential downside of all that growth was a fear of significant inflation for the first time in decades, as well as the trade impact of the strong U.S. dollar.

Trucking companies reinvested record profits

Higher freight volume, coupled with sharp rate increases, yielded top-line and bottom-line growth at trucking companies of all sizes. The nine largest publicly traded trucking companies collectively saw an 18% increase in total revenues and a 41% increase in their total operating profits. The industry has already begun to invest those profits in new equipment and drivers. The risk is that trucking is a cyclical industry, and these improvements will eventually generate enough capacity to damage the carriers’ pricing power. This is already happening in the spot market, to a certain degree, as is evident in off-season pricing reductions.

So, in honor of 2018, I adapted this song, with apologies to Ol’ Blue Eyes (I won’t sing it out loud because then I’d REALLY owe Sinatra an apology.)

“When it was 2018

It was a very good year

It was a very good year for trucks on the road

And large rate increases

ELDs made more loads seen

And got us paid a few more pieces

When it was 2018”

Donald Broughton, Principal and Managing Partner of Broughton Capital, is a financial analyst with decades of experience in the transportation industry. Contact him at donald@broughtoncapital.com.