More than 148 million consumers were estimated to have shopped in-store and online last Saturday. This number is slightly lower than last year when 150 million consumers were expected to shop. However, it was an increase from the 147 million expected shoppers in 2019.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

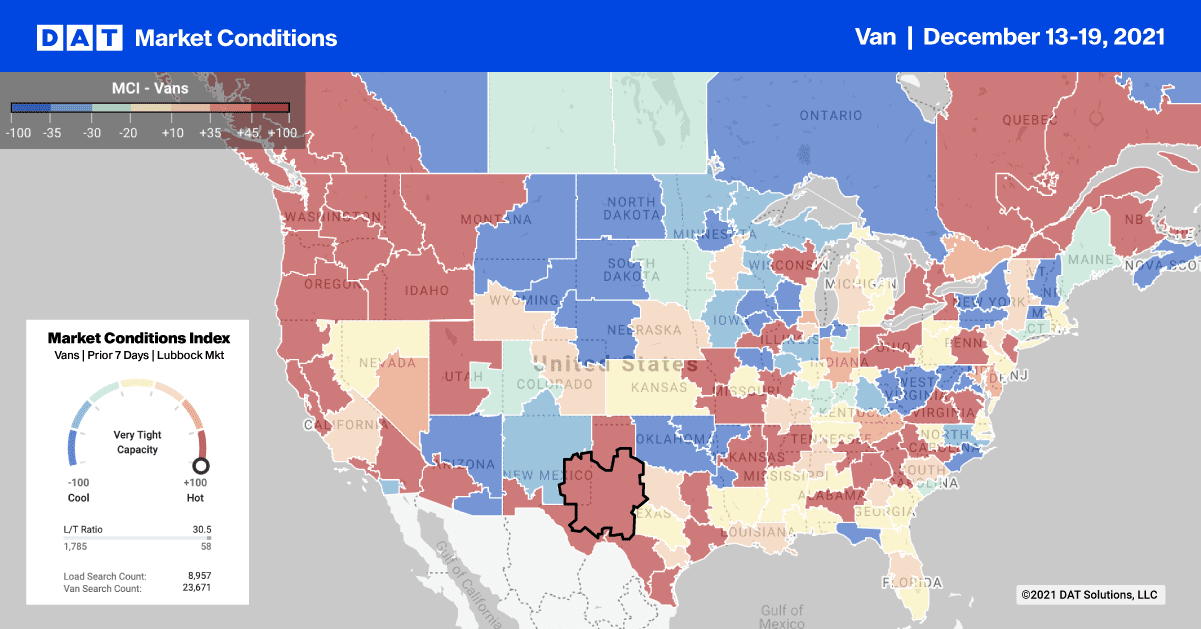

What does this mean for overall dry van demand as we round out 2021 with declining truckload volumes this week?

Find loads and trucks on the largest load board network in North America.

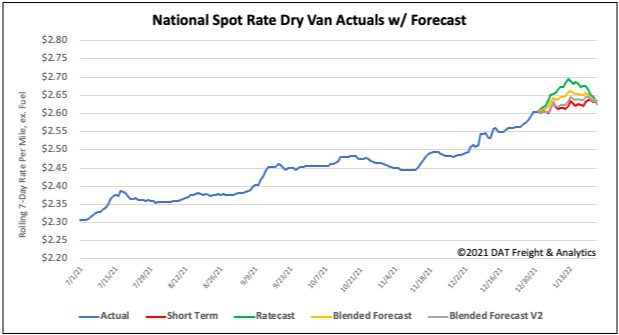

Note: All rates exclude fuel unless otherwise noted.

In the latest DAT iQ Signal Report, Professor Chris Caplice noted:

“The claim that the pandemic drove the country to e-commerce is almost a cliché. It is true that the percent of retail revenue flowing through e-commerce jumped from 11.4% in Q1 of 2020 to 37% in Q2. However, what is not being reported as much is that this percentage has been falling over the subsequent 5 quarters. In fact, it is now at the level (13%) that it would have been if the pre-pandemic growth rate of 0.2% per quarter had continued. In other words, we have regressed to the mean. Total retail sales increased a whopping 1.7% in October. While some of this was due to higher prices, the majority was spent on advanced buying – cannibalizing the demand we usually see closer to Christmas.”

This in part explains why DAT is seeing lower weekly truckload volumes as more freight moves in the final-mile sector this week after being initially hauled longer distances to a staging warehouse some weeks and even months prior.

Last week’s closure of major trucking route I-80 in the Sierra Nevada Region halted truckers for up to three days. However, the impact on freight markets will last much longer. Spot rates through the snow-affected region were up around $0.05/mile last week to an average of $2.65/mile.

On the busy Stockton to Denver lane on Donner Pass, dry van spot rates hit a new 12-month high at $4.01/mile. High winds and truckers protesting the record-high 110-year sentence of a fellow truck driver following a 2019 accident impacted both rates and volumes in the Denver market last week. Outbound capacity tightened and average rates shifted up $0.06/mile to $1.68/mile.

Loads moved to major destination cities including Phoenix, Los Angeles, and Stockton dropped 22% last week following three weeks of gains prior.

On the East Coast in the port city of Charleston, S.C., truckload capacity tightened last week with spot rates jumping $0.10/mile to an average of $2.67/mile after dropping steadily since the end of November. Import container volumes in Charleston increased by 20% in November due to more vessel calls looking to avoid recent delays further south in the Port of Savannah.

As a result, the port has been deluged with containers. And with no on-dock rail service to shift containers, the ongoing shortage of dray carriers is restricting the movement of containers.

Spot rates

Spot rates in the dry van sector last week remained flat last week for the third week in a row. The national average spot rate ended the week where it started at $2.60/mile. Dry van spot rates are still 16% or $0.40/mile higher than this time last year.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models