Peak machinery shipping season seems to be behind us following the start of crop planting season and two consecutive months of lower import and domestic sales volumes. According to June’s import volume of machinery through the Port of Baltimore, June volumes are down 10% this month but still up a healthy 142% compared to June 2020.

The number one import category in the number one port for roll-on/roll-off (RoRo) machinery is construction equipment. This category accounted for 48% of volume in June followed by agricultural tractors at 19% and trucks at 16%. All three reported higher annual comparisons. While construction equipment reported a 20% decrease this month, tractor and truck import volumes were up 6% and 17% respectively.

The higher June volumes in the agriculture sector should be reflected in next month’s farm tractor retail sales volume. Retail sales volume are up 16.7% year-to-date and still around 7% above the five-year average.

For flatbed and specialized carriers, they typically see declining machinery volumes from now until October. But since volumes are much higher this year, they hauled more than double the number of truckloads of construction and agricultural machinery in June this year compared to June last year.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Flatbed rates on the 284-mile run from Memphis to St. Louis took off last week. This lane increased by $0.50/mile to reach $4.36/mile. Capacity is also tightening in the opposite direction where spot rates climbed to $3.79/mile last week, which is a 12-month high and $1.40/mile higher than at the start of 2021. For carriers working that lane in both directions, rates for the 568-mile round-trip are averaging $4.07/mile this week.

In DAT’s number one flatbed market in Houston, spot rates to Bismarck, ND, surged last week increasing by $0.52/mile to reach an average of $3.25/mile. On the number one flatbed lane from Houston to Lubbock, TX, in the Permian Basin, flatbed rates dropped slightly last week. Rates decreased by $0.04/mile to an average of $3.31/mile.

Spot rates

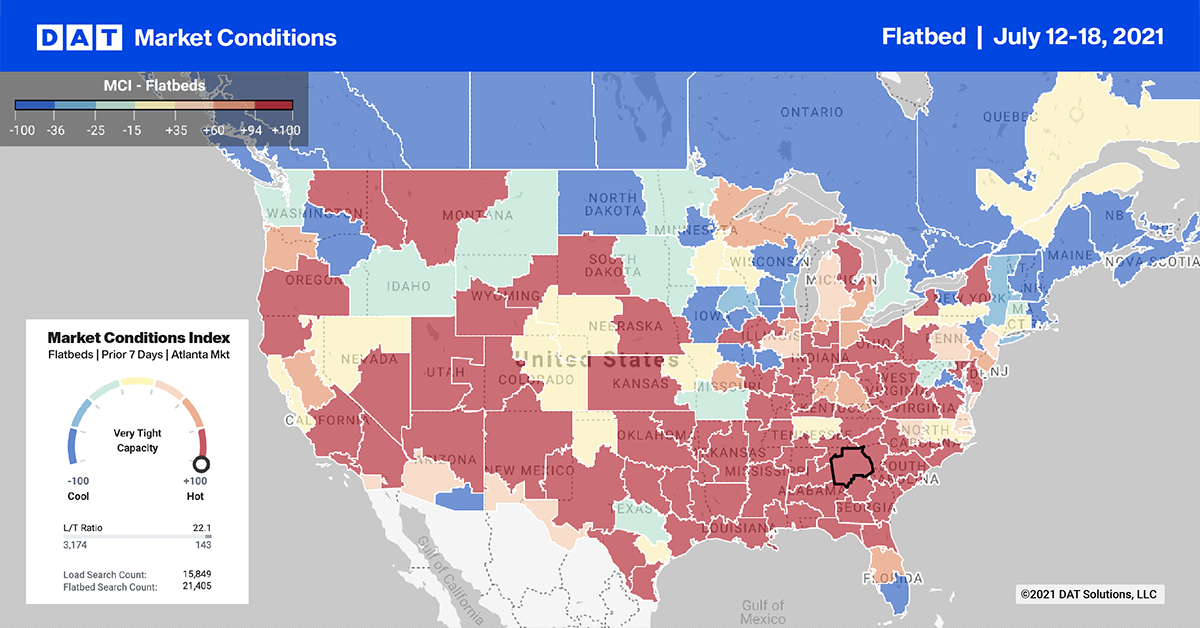

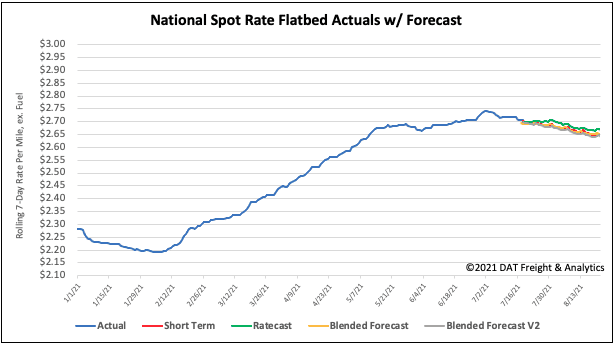

After dropping by $0.02/mile the week prior, flatbed spot rates dropped another $0.03/mile last week to an average of $2.70/mile. Even though the flatbed market appears to be tracking 2018 when that flatbed rate rally turned the corner in July and headed south, flatbed rates are still $0.77/mile higher than the same week last year and $0.24/mile higher than the same time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models