Produce volumes continue to taper off after the seasonal peak, which occurs just before the July 4 weekend. According to the latest Truckrate report from the USDA, weekly truckload volumes of domestic produce have declined by 25% since the holiday following last week’s 7% week-over-week decrease.

On the imported produce front, truckload volumes have dropped by 20% since July 4 after decreasing by 4% last week. To put those numbers into perspective, carriers hauled just under 14,000 fewer loads of produce last week compared to the 61,000 loads of produce hauled in the week leading up to Independence Day.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

The USDA reports there was a shortage of trucks across several markets:

- Potatoes in San Luis Valley in Colorado

- Cantaloupes and watermelons in Delaware and Maryland

- Watermelons in southern Missouri, southwest Indiana and southern Illinois

- Sweet potatoes in eastern North Carolina

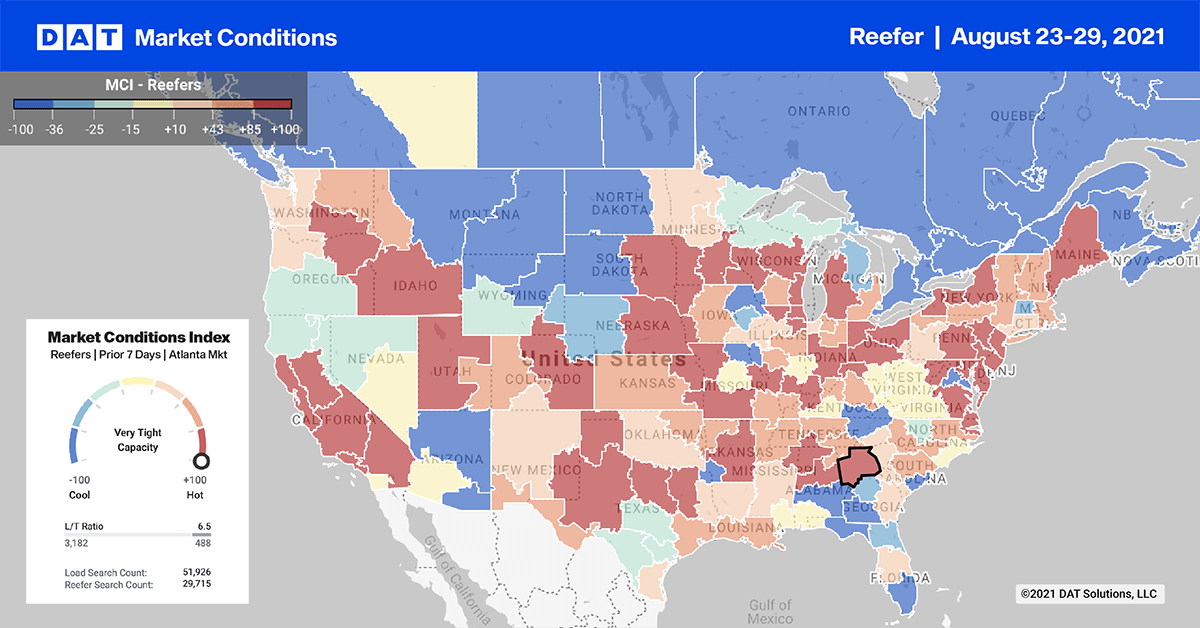

Truckload capacity is still tight in southern Missouri in the Cape Girardeau freight market where reefer rates increased for the fourth week in a row to an average of $4.55/mile. That’s an increase of $1.10/mile since the start of August. Loads from Cape Girardeau to Chicago were averaging $4.57/mile last week. On the 458-mile run to Atlanta, reefer spot rates averaged much higher at $5.07/mile.

Hurricane Ida drove New Orlean inbound volumes and rates

With perishables being in greatest demand during a major hurricane event, inbound reefer volumes into the New Orleans market increased by 18% last week. Temperature-controlled shippers were also busy moving freight out of the way, pushing up outbound volumes by 25% last week. But with lots of inbound capacity available, outbound spot rates dropped $0.37/mile to an average of $2.30/mile.

As expected, capacity was tight on some inbound lanes including Dallas to New Orleans, which increased by $0.34/mile to $3.82/mile. Loads from nearby Fort Worth were up $0.11/mile to an average of $3.46/mile. From the large warehouse market in Phoenix, loads were paying $3.04/mile representing an increase of $0.37/mile last week.

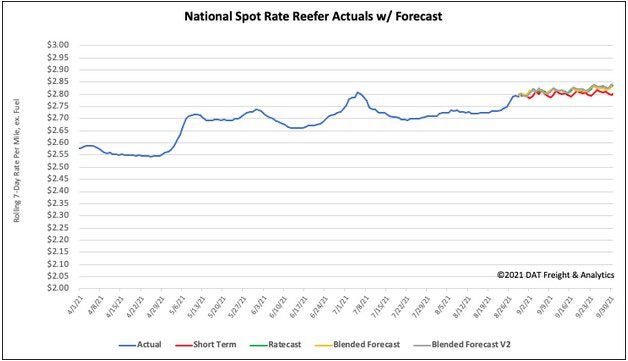

Spot rates

Following the lead from the dry van sector, reefer spot rates also increased by just over $0.02/mile last week to an average of $2.79/mile. Spot rates are still $0.56/mile higher than this time last year.

Of our Top 70 reefer lanes (for loads moved), spot rates:

- Increased on 29 lanes (compared to 23 the week prior)

- Remained neutral on 29 lanes (compared to 23)

- Decreased on 19 lanes (same as prior week)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models