The National Restaurant Association’s Restaurant Performance Index (RPI) registered a moderate decline in September, reflecting the continuation of challenging business conditions for the restaurant industry. The RPI – a monthly composite index that tracks the health of the U.S. restaurant industry – stood at 99.4 in September, down 0.4% from August and the lowest reading since March.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

September’s decline in the RPI was largely due to dampened current situation indicators. Although restaurant operators posted a modest net increase in same-store sales in September, they reported negative customer traffic for the 8th consecutive month. Restaurant operators’ outlook for business conditions remains mixed, with just 34% expecting higher sales in six months.

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, customer traffic, labor and capital expenditures), stood at 99.2 in September – down 0.7% from a level of 99.8 in August. September represented the third straight month in contraction territory and the lowest reading since March.

The Expectations Index, which measures restaurant operators’ six-month outlook for four industry indicators (same-store sales, staffing, business conditions and capital expenditures) , stood at 99.7, which represented the third consecutive month below 100. Restaurant operators are cautiously optimistic about sales in the months ahead, but remain generally pessimistic about the direction of the economy.

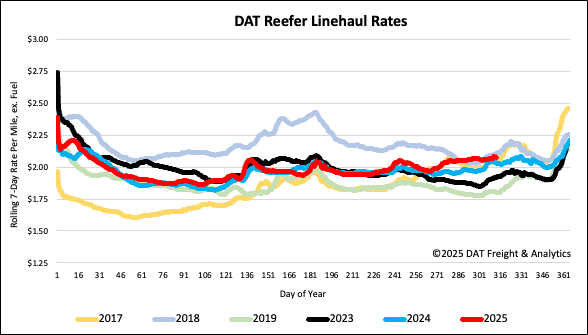

Reefer Market Conditions

Last week, the temperature-controlled market experienced uncharacteristic weakness three weeks out from Thanksgiving, despite a national increase of less than 1% in load post volumes. This softness was particularly evident in the Top 10 markets, which account for 23% of national volume, where load post volumes sharply declined by 15%. Atlanta and Chicago saw a 12% drop in volumes. Dallas recorded the most significant week-over-week decrease in reefer volume among the Top 10, plummeting by almost 27%.

Reefer National Spot rates

The national 7-day rolling average reefer spot rate clawed back some of the prior week’s losses, increasing by a penny per mile to $2.09 last week. Compared to last year, this week’s average is 2% or $0.04 per mile higher, but is 3% or $0.07 per mile higher than the Week 45 average over the last decade.