On our northern border where around 8% of imported produce volumes cross, Detroit accounted for 35% of truckload volume in August. It’s followed by Champlain, NY (12%) and Houlton, ME (11%) where the majority of potatoes from Prince Edward Island enter the U.S.

Around this time of the year, Canada’s produce import market transitions from mostly potatoes making up most of the monthly volume to other vegetables. The leading produce for August include:

- Cucumbers at 21%

- Tomatoes at 11%

- Bell peppers at 11%

The Ambassador Bridge that connects Detroit, MI to Windsor, ON will see around 57% of the cucumbers and bell peppers crossing into the U.S. About 8% will cross the U.S.-Canadian border in Buffalo, NY.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Outbound cross-border lanes were up 24% and were the best performing based on load posting volumes in July. Compared to the same time last year, cross-border lane volumes were 49% higher. July’s strong outbound performance helped reduce the overall monthly decline as inbound load movement fell at a larger pace.

Continuing from last month’s standout performance, Quebec, Canada once again demonstrated significant outbound freight activity with 66% more cross-border loads leaving the province. This resulted in the top five outbound market lanes to be composed of only lanes originating from Quebec.

Both the Atlantic and Ontario provinces saw strong gains of 23% and 21% more outbound loads, respectively. However, Western Canada fell just slightly with a minor three% dip from June numbers.

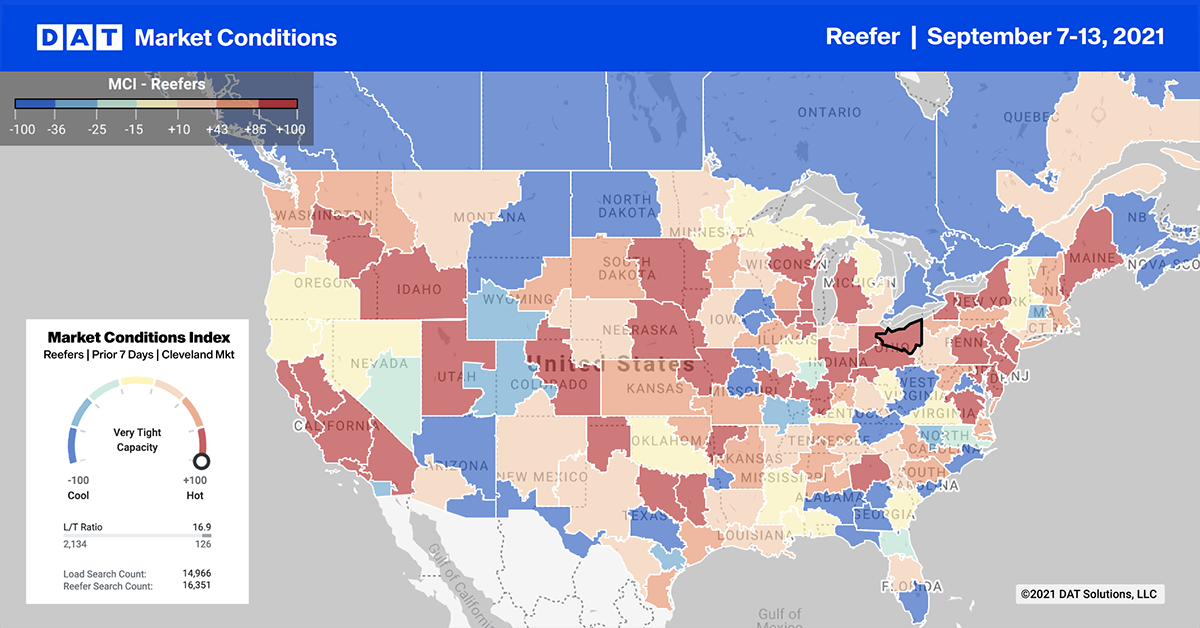

Average reefer rates in the Philadelphia port market are approaching the $3.00/mile mark ending last week at $2.97/mile after increasing $0.19/mile over the last four weeks:

- The Philadelphia to Atlanta lane increased by $1.38/mile to an average of $3.63/mile last week

- The 1,500-mile haul to Dallas increased by $0.76/mile since June to an average of $2.49/mile last week

Out west, reefer spot rates on the 270-mile haul from Los Angeles to Las Vegas have broken through the $6.00/mile mark, averaging $6.17/mile last week. This is the equivalent of $3.08/mile for carriers deadheading back to Los Angeles.

Spot rates

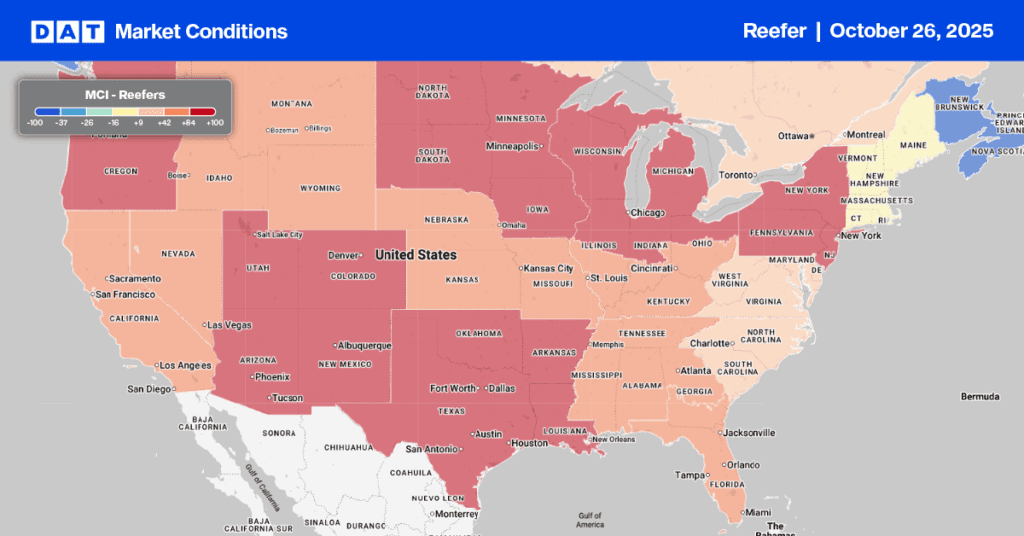

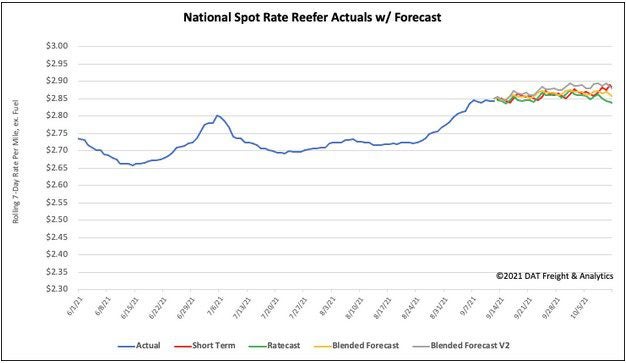

Following the lead from the dry van sector, reefer spot rates also increased by just over $0.03/mile last week to an average of $2.84/mile. Spot rates are still $0.48/mile higher than this time last year.

Of our Top 70 lanes (for loads moved), spot rates:

- Increased on 37 lanes (compared to 29 the week prior)

- Remained neutral on 22 lanes (compared to 23)

- Decreased on 11 lanes (compared to 19)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models