Despite being the off-peak season for imported Mexican produce along the southern border, the McAllen market has recently seen capacity shortages on its West Coast long-haul lanes. McAllen is a significant gateway for Mexican tomatoes, limes, mangoes, and avocados entering the U.S., accounting for approximately 75% of the total imported truckload produce volume passing through the Pharr commercial zone.Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Spot reefer rates for outbound loads from McAllen are currently 1% higher than last year. However, rates for loads traveling 1,600 miles west to Los Angeles have seen a significant year-over-year increase of almost 70%. For loads heading to Chicago, carriers are receiving 6% more than last year, while rates for loads to Brooklyn, NY, are more than 17% higher compared to 2024. Truckload capacity in this region is expected to be impacted by ongoing immigration enforcement activity for the foreseeable future.

Reefer Market Watch

Despite reefer load post volumes plunging by 18% last week, truckload capacity tightened in what can be described as “Roadcheck Week” effect. With reports of immigration attorneys advising carrier clients and drivers to avoid being on the roads even if they have valid work permits for fear of being arrested during the current crackdown on supposed illegal drivers. ]

Immigration and Customs Enforcement (ICE) enforcement continues to impact southern border freight markets. Whilst not a large reefer truckload market, the Nogales commercial zone crossing from Mexico into the Tucson freight market saw a 95% increase in reefer load posts last week, mostly for loads to New York and California. Load posts increased by 9% week over week in neighboring El Paso and by a similar amount in McAllen where the majority of produce is imported from Mexico each week. Truckload carriers are currently getting around $1,000 more per load for produce from McAllen to Los Angeles than they were a year ago.

Reefer national spot rates

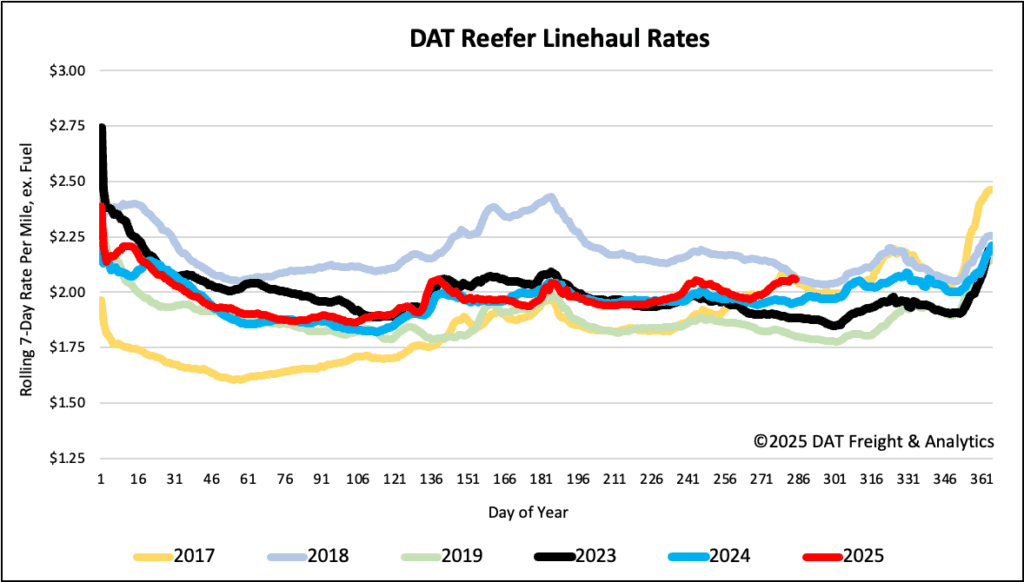

Last week, the national 7-day rolling average for reefer carriers saw an increase of just under $0.02, reaching $2.07 per mile. This figure continues to outpace previous years, now standing $0.10 higher than last year and $0.18 above 2023.