Van freight trends have been muted for nearly all of 2019 – we haven’t seen many sharp spikes or large drops. Overall, it’s been a steady decline, interrupted by higher rates in June and the first half of July. Fuel prices fell last week, which offset the drop in revenue somewhat for motor carriers.

Van markets have also been hurt by weakness in the flatbed and refrigerated segments. Flatbed demand has declined with less oil well drilling, while reefer freight has been affected by disappointing produce harvests. Combined, these are dragging down spot market van rate levels, despite an ongoing influx of freight from rail intermodal and contract freight segments. Trade disruptions have also hurt summer freight levels, so the current delay in tariffs may help revive markets in upcoming weeks.

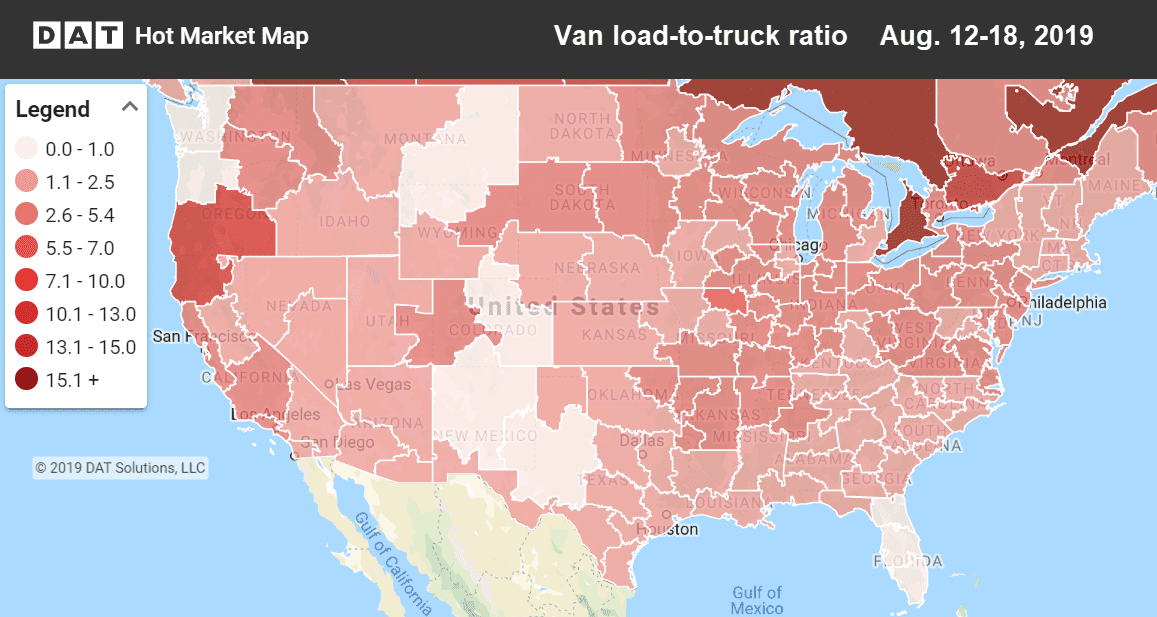

Hot Market Maps show the number of available trucks vs. available loads and are available in the DAT Power load board and DAT RateView.

Rising

Buffalo held onto last week’s increase and rates there are higher than they were in July, a sign of strong Canadian exports to the US. Chicago outbound rates rose modestly last week and they are trending up overall for the month, as well. On the West Coast, increases were rare last week, but Seattle rates have moved up 5% during August so far.

- Buffalo to Columbus, OH rose 12¢ to $1.95/mi

- Buffalo to Charlotte climbed 10¢ to $1.96/mi

- Seattle to Eugene, OR up 18¢ to $2.50/mi

Falling

Columbus rates slipped, a rare reversal for the Midwest, where activity and rates have been trending up. Although Los Angeles outbound rates slipped, volumes turned positive last week, so rates could recover before the end of the month.

- Houston to New Orleans continues to slow, losing 14¢ to $2.23/mi

- Stockton, CA, to Denver fell12¢ to $2.04/mi

- Stockton to Seattle dropped 12¢ to $2.51/mi

- Seattle to Spokane, WA, slipped 12¢ to $2.94/mi (better return volumes to Seattle)