Avocados From Mexico are looking to make a touchdown on February 12, 2023. The Super Bowl is the biggest occasion of the year for Avocados from Mexico, with peak-shipping season coinciding with the NFL end-of-season event in Phoenix, AZ. Over the course of a year, U.S. truckload carriers will move around 95,000 truckloads of avocados, with 97% crossing the southern border in Texas. The commercial zone crossing in Laredo accounts for 55% of the volume, followed by 42% in Pharr, TX.

According to the USDA, import volumes are currently tracking around 8% higher than last year. Avocados From Mexico, a non-profit marketing organization representing avocados from Mexico, starts its Super Bowl programming shortly. This year the company is teaming up with football legend Deion Sanders and his fiancée — TV and film producer Tracey Edmonds — “to drive retailer and shopper excitement,” said Stephanie Bazan, vice president of shopper and trade marketing for Avocados From Mexico. In seven years, the Avocados From Mexico brand has almost doubled the volume of Mexican avocados imported to the U.S. to meet the growing demand. Today, 8 in 10 avocados in the U.S. come from Mexico.

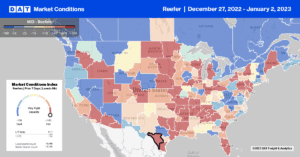

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Boosted by the highest imported volumes of fruit and vegetables in three years, Texas reefer carriers had one of their best weeks in years following last week’s $0.45/mile increase to a state average of $2.79/mile for all outbound loads. That’s the second-highest in seven years and just $0.32/mile lower than the previous year. In Laredo, the largest commercial zone for trucks entering the U.S. from Mexico, reefer spot rates jumped, increasing by $0.76/mile to an average of $3.17/mile. Excluding fuel, loads 1,200 miles east to Atlanta were paying carriers $3.36/mile last week, which was $0.09/mile higher than the previous year.

Available capacity was very tight on the Laredo to Chicago lane, where spot rates spiked, increasing by $1.18/mile to $3.12/mile, just over $0.40/mile higher than the previous year. Outbound Chicago reefer spot rates ended 2022 at $3.05/mile, up just over $0.30/mile w/w. Regional loads from Chicago to Pittsburgh averaged $4.49/mile last week, up just over $1.00/mile compared to the November average but $0.67/mile lower than the previous year. Chicago to Columbus, OH, was paying carriers $4.53/mile while longer haul loads to Atlanta averaged $3.74/mile, up $0.50/mile compared to the November average.

Load to Truck Ratio (LTR)

Similar to the previous year, which also ended with a short work week, reefer load posts surged last week, increasing by 44% w/w. Even though volumes were 48% lower compared to the previous year, they were at their second-highest level in six years and even 9% higher than in 2020 at the peak of online shopping. Carrier equipment posts remained at their highest level in six years, more than double the number of carriers posting their equipment during the prior oversupplied market in 2019. As a result of higher volumes and a decrease in equipment posts, last week’s reefer load-to-truck (LTR) almost doubled, increasing from 6.63 to 12.87.

Spot Rates

Last week’s national average reefer linehaul rate, at $2.51/mile, represents a week-over-week change more than double the same week the previous year. Even though reefer spot rates surged last week, increasing by $0.16/mile, they ended 2022 down $0.72/mile y/y and just $0.10/mile lower than in 2020.