According to Wells Fargo’s Chief Agricultural Economist Michael Swanson, Midwest and Southwest reefer volumes in the frozen food category are being impacted by the “smallest beef herd in decades” due to prolonged drought in essential cattle-ranching states like Texas and Kansas. Drought conditions have regularly occurred in many beef-producing areas, but a prolonged drought in recent years has impacted farmers in Oklahoma and Texas in particular. Drought conditions decrease forage production (grass and legumes), resulting in diminished feed available for cattle and the need to spend more on supplements.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Additionally, farmers have been hit with higher input costs, including feed, labor, and transportation, resulting in cattle ranchers reducing their breeding herd to the lowest cattle inventory in nine years, according to Brian Earnest, lead economist for animal protein at farm credit association Cobank. For reefer carriers, this has meant higher volumes of frozen beef this year as ranchers liquidate costly breeding stock. However, with supplies expected to tighten due to a lower national herd count, 2024 frozen freight volumes are expected to be subdued. Ernest noted, “Demand for beef will likely outstrip supply for several years. This means that prices will bump up around record-type levels for cattle at least over the next 18 months. Retail beef prices are currently hovering around record levels of about $8 per pound, according to data from the United States Department of Agriculture (USDA).

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

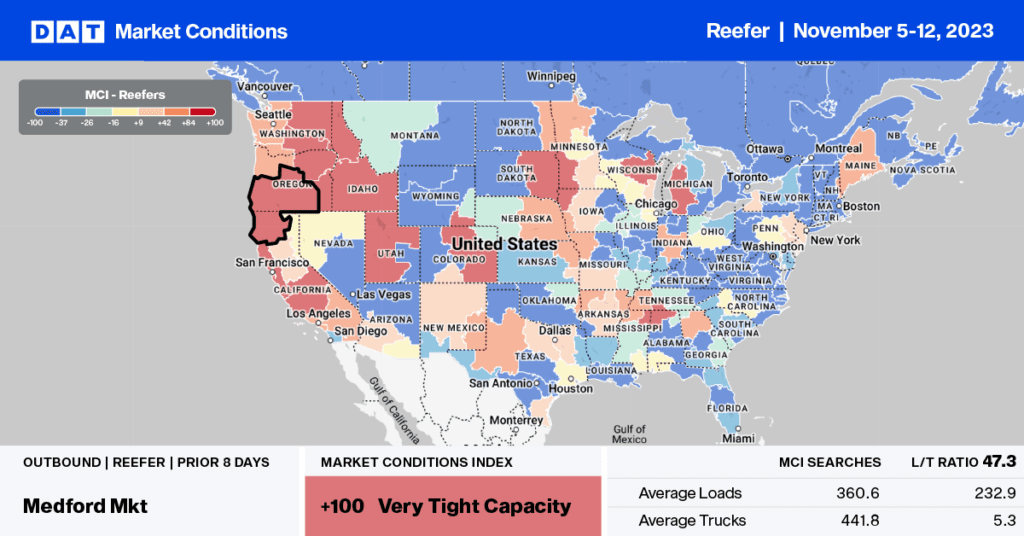

Last week, the PNW was the hottest region, boosted by Fall produce and Christmas tree shipping season. Regionally, carriers were paid an average of $2.31/mile for outbound loads, an increase of $0.16/mile w/w and the highest rate for this time of the year except for 2020 and 2021. Solid gains were reported in the Pendleton, OR, market, where reefer rates averaged $2.08/mile and $2.11/mile on the long-haul lane to Allentown, PA.

In California, reefer rates increased by $0.03/mile w/w to $2.25/mile, boosted by gains in the larger Fresno produce market, where rates increased by $0.10/mile to $2.30/mile for outbound loads. In Texas, reefer linehaul rates were flat at $1.79/mile, while in Florida, spot rates jumped by $0.07/mile to $1.21/mile, just $0.03/mile higher than in 2019 (when outbound rates were the lowest in seven years). In Minnesota, spot rates increased by $0.09/mile to $2.41/mile, while next door in Wisconsin, carriers were paid an average of $2.57/mile, up $0.01/mile w/w.

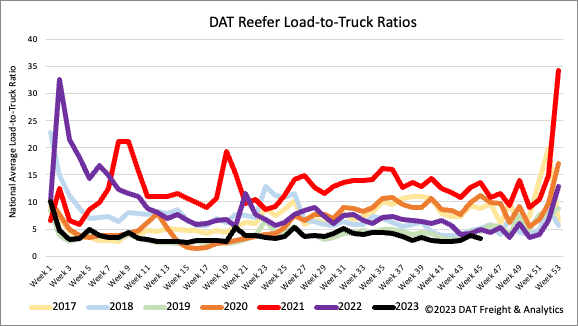

Load to Truck Ratio (LTR)

Reefer load post (LP) volume typically increases by 7% w/w at this time of the year, boosted by Christmas tree, Fall produce, fresh turkey, and pork shipments ahead of Thanksgiving. Going against the seasonal trend, reefer LP volume dropped by 13% w/w, the lowest volume recorded in seven years for Week 45. Carrier equipment posts (EP) were up 4% w/w, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing by 18% to 3.17, the lowest reefer LTR in seven years.

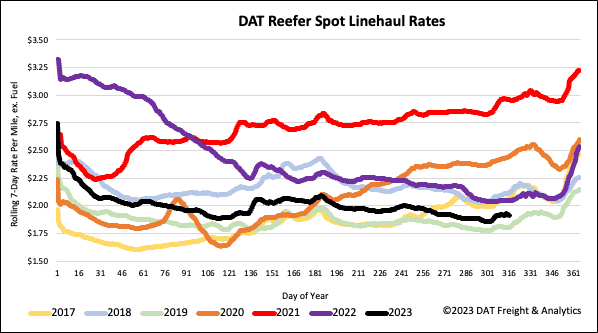

Spot rates

Reefer spot rates increased by almost $0.03/mile last week, building on the prior week’s $0.05/mile gain. At $1.95/mile, reefer linehaul rates have increased by $0.08/mile in the last two weeks, although compared to last year, reefer linehaul spot market rates are $0.14/mile lower and around $0.11/mile higher than in 2019.