The Georgia peach season has suffered a setback this year. After a warmer winter followed by several days of freezing temperatures in March, Georgia peach farmers “fear a brutal, one-two punch may have wiped out much of their crop.” At the start of March, Georgia’s oldest operating peach packinghouse Dickey’s Farms, reported peach trees were blooming, boosting hopes of a bumper crop this season.

According to the latest USDA Georgia crop report, “Georgia temperatures fluctuated wildly from several days of freezing temperatures to warmer days above 80 degrees. The late freeze damaged many fruit trees across the state. Peaches were noted to have sustained significant damage in northern Georgia since most varieties were in full bloom during the freeze events. Abundant rainfall in some areas delayed farmers from prepping fields for spring planting. Farmers say it could be weeks before the full extent of the damage is known, with early estimates indicating 60% or more of the state’s peach crop may have been destroyed, according to Dario Chavez, an associate professor and peach specialist based at the University of Georgia’s Griffin campus. For reefer carriers, crop losses in Georgia and neighboring South Carolina could mean more peaches from California to offset the losses.

Despite the gloomy news, the Georgia Peach Festival, which typically welcomes the start of the peach season, returns June 2-3 in Fort Valley, GA. The 37th Georgia Peach Festival will be a shared event between Fort Valley and Byron and home of the World’s Largest Peach Cobbler.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

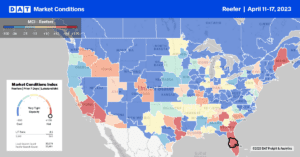

As produce season warms in Florida, Miami and Lakeland markets occupied the top two spots last week, accounting for 11% of load posts. Florida reefer rates increased for the fourth week and, at $1.78/mile, are within $0.07/mile of 2018 levels. In Miami, spot market volumes decreased slightly while available capacity tightened following a $0.20/mile jump in rates to $1.73/mile, up $0.37/mile in the last two weeks. In Lakeland, volumes increased by 2% w/w, increasing spot rates by $0.13/mile to $1.56/mile.

There was a significant volume of load posts on the Lakeland to Detroit lane, where linehaul rates at $1.39/mile have increased by $0.17/mile since February but remain $0.56/mile lower than the previous year. Atlanta loads were paying $1.89/mile, while loads to Hunts Point, NY, at $2.25/mile, were the highest since last June and $0.41/mile higher than the March average.

In Fresno, spot rates increased by $0.06/mile to $1.66/mile following a 38% w/w increase in volume, while in neighboring Stockton, reefer spot rates increased by the same amount to $1.77/mile for outbound loads. California state-level rates at $2.02/mile are identical to 2019.

Load to Truck Ratio (LTR)

Reefer spot market load posts are around half what they were a year ago following last week’s 2% decrease. In contrast to dry van, where Week 15 volumes are higher than the pre-pandemic average, reefer load posts are 18% lower. Reefer carrier equipment posts were flat last week and have moved very little in the previous month. As a result, the reefer load-to-truck (LTR) decreased slightly from 2.61 to 2.54, identical to LTR observed in 2019.

Spot Rates

Reefer linehaul rates recorded the most significant weekly decrease since the start of February following last week’s $0.05/mile decline, identical to the weekly reduction in the previous year. At $1.93/mile, the national average reefer linehaul rate excluding fuel is just $0.04/mile above 2019.