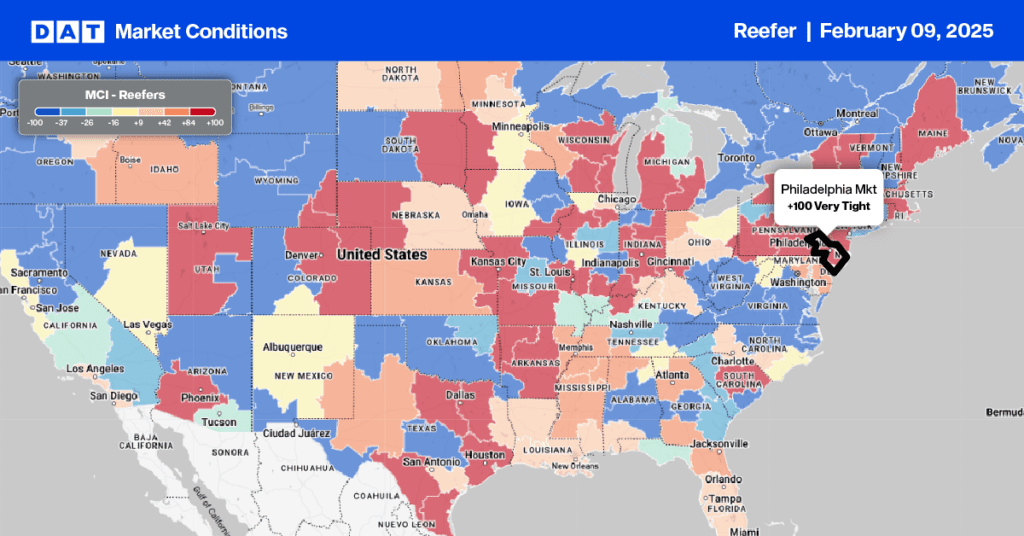

Peruvian grape exports to the United States during the winter in the northern hemisphere are on the rise. Four break bulk cargo ships from Peru’s Port of Paracas will arrive in Philadelphia this season at the less congested Port of Gloucester in New Jersey, carrying an estimated 17,300 pallets and 376 containers of grapes. That’s roughly the equivalent of 900 full truckloads!

Find reefer loads and trucks on the largest on-demand freight marketplace in North America.

The first vessel arrived on Jan. 16, marking a historic milestone for the country’s agricultural exports. The efforts of SENASA of Peru and the U.S. Department of Agriculture accomplished this breakthrough, offering the Peruvian industry a new alternative to shipping fruit in containers. According to Tony Calvillo, vice president of International Business Development at Dayka & Hackett, in an interview with Freshfruitportal, “This had never been done from Peru; we worked for a long time with SENASA, PROVID (the table grape association), the shipping companies, and the ports to achieve this operation in break bulk ships.”

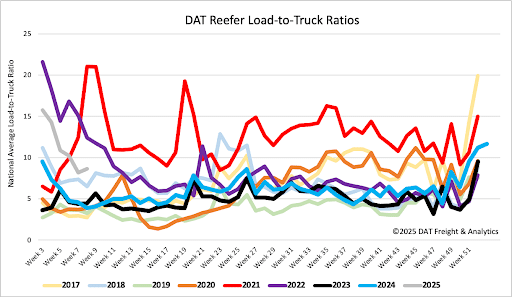

Reefer load posts are 9% higher than last year and 22% higher than the Week 6 average going back to 2016 (excluding 2020, 2021, and 2022). Last week’s reefer load-to-truck ratio (LTR) ended at 8.64.

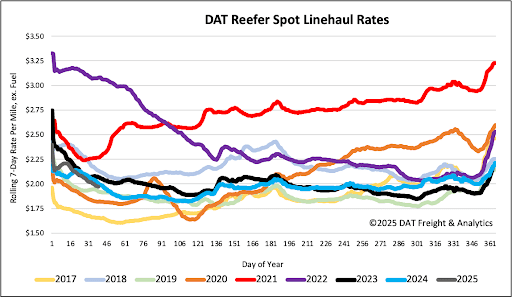

Reefer spot rates have dropped $0.22/mile or 10% in the last month following last week’s $0.04/mile decrease – the third week of decreases in this range. The national average of $1.99/mile (excluding fuel) is lower than last year by $0.03/mile. Looking back to 2016 and excluding the pandemic-influenced freight markets, last week’s 7-day rolling average reefer rate was $0.07/mile higher than the long-term Week 6 average of $1.92/mile.