December 2025 concluded the massive “pull-forward” wave, as U.S. containerized imports reached approximately 2.48 million TEUs (twenty-foot equivalent units), according to latest data from IHS Markit.

The West Coast remained the epicenter of this activity, with the Port of Los Angeles leading the nation at 419,562 TEUs (a 3.5% month-over-month increase), followed closely by Long Beach at 389,600 TEUs. While East Coast hubs like New York/New Jersey (331,730 TEUs) and Savannah (219,333 TEUs) saw slight seasonal dips compared to November, the overall top 10 ports—including Houston, Norfolk, Charleston, Oakland, and Tacoma—maintained historically high volumes. This geographical concentration toward the San Pedro Bay gateways has significantly tightened drayage capacity in the Inland Empire, as shippers prioritized the fastest trans-Pacific transit times to clear customs ahead of January trade policy shifts.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Historically, shippers aggressively front-load orders in December and early January to circumvent the traditional factory shutdowns across China, which typically last two weeks but disrupt production cycles for up to a month. The severity of this expected downturn is further amplified by the timing of the Lunar New Year, which falls on February 17, 2026. This year’s confluence of tariff hedging and Chinese New Year preparation has created an artificial peak that is likely to be followed by a sharp “volume vacuum” starting in late February. As Asian production centers go dark, the flow of inbound containers will dwindle, leaving west coast truckload carriers to navigate a significantly softer spot market in the weeks following the holiday.

The geopolitical tension surrounding Greenland has introduced a sudden “Atlantic Risk” into the 2026 logistics forecast. While the earlier “pull-forward” surge in 2025 was primarily a West Coast/China story, a trade war with the EU—triggered by renewed U.S. interests in Greenland—directly targets the East Coast gateways. We expect January data to show a sharp rebound in Atlantic TEUs as European shippers rush high-value machinery, chemicals, and luxury goods to the U.S. before retaliatory tariffs are enacted.

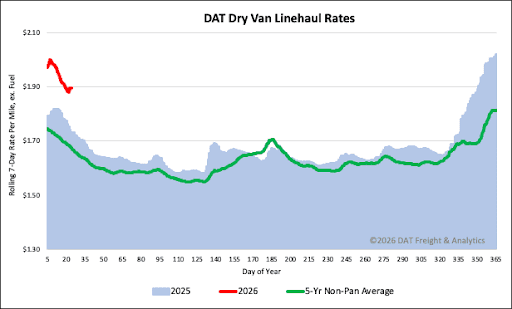

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted. The rate charts exclude 2021 and 2022, years influenced by the pandemic.

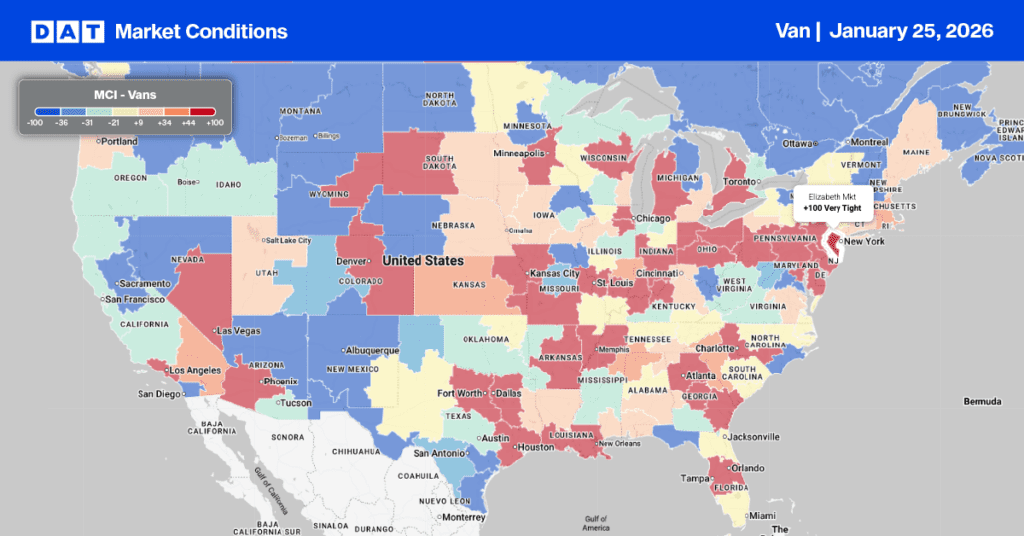

The national dry van market saw a continued decline in load post volumes last week, a trend expected to reverse as recovery efforts commence in the Southwest and Southeast following Winter Storm Fern. Load post volumes fell by 9% but remained nearly on par with the same period last year. This resulted in a 6% drop in the national load-to-truck ratio, which settled at 6.27.

Dry van linehaul spot rates averaged $1.90 per mile last week, marking a $0.15 drop over the first three weeks of 2026, including a $0.06 decrease just last week. Despite this recent decline, the current rate remains strong year-over-year, sitting $0.17 (10%) higher than the same week last year. Furthermore, it is $0.22 per mile (12%) above the 5-year average, excluding the pandemic years.

The average rate for DAT’s top 50 lanes by load volume decreased by another $0.11 per mile last week, averaging $2.18 per mile and $0.28 higher than the national 7-day rolling average spot rate.

In the 13 key Midwest states, which represent around 45% of national load volume and often indicate future national trends, spot rates decreased by another $0.11 per mile to $2.26 per mile, which was $0.36 above the national 7-day rolling average.