U.S. farm tractor sales in June 2025 declined by 4.4% compared to the same month in 2024, with combine sales dropping significantly by 43.7% year-over-year. Year-to-date, tractor sales are down 10.9%, and combine sales are off 43.4%. The largest declines were seen in higher horsepower and four-wheel drive (4WD) segments, while small tractor sales (under 100 horsepower) experienced only modest declines of 1-2%, indicating some stability.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The significant drop in large tractor and combine sales is attributed to global trade instability, high interest rates, and increasing input costs, leading to farmer hesitancy towards high-cost investments. Although June showed slight improvement over May’s deeper declines, the overall sales trend for 2025 remains negative. Market uncertainties and economic pressures are expected to keep sales subdued in the near term.

Load-to-Truck Ratio

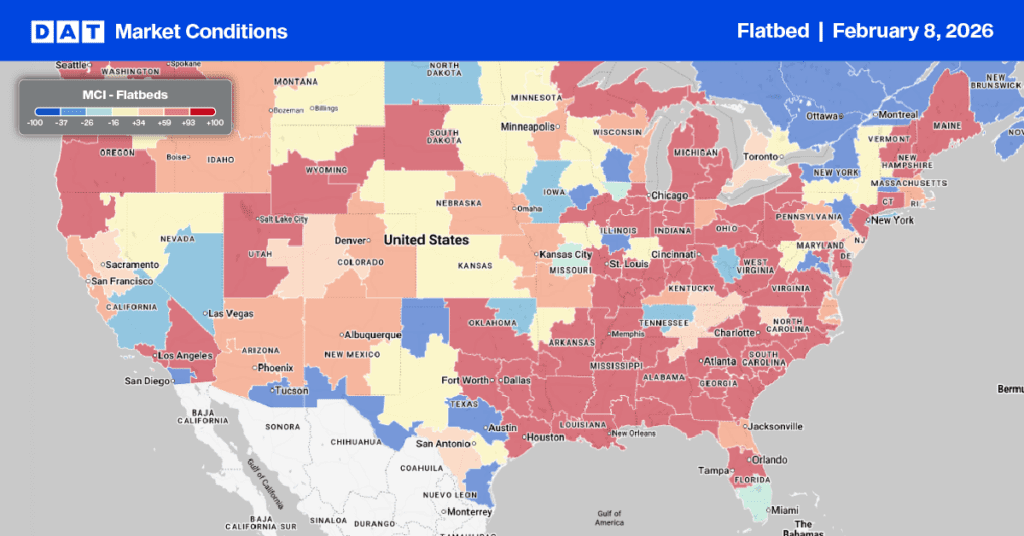

The flatbed load-to-truck ratio saw a 13% decline last week, settling at 21.03. This shift was driven by an 11% drop in load posts and a 2% rise in carrier equipment posts.

Spot rates

The national average flatbed spot rate, excluding fuel, saw a nearly $0.04 per mile decrease to $2.03 per mile after two weeks of remaining flat. This rate currently stands $0.07 per mile higher than in the same week of 2024 and $0.08 per mile higher than in 2023.