The National Restaurant Association’s December Restaurant Performance Index dropped to 99.3, marking six consecutive months in contraction territory and the lowest reading since March. The decline was driven by weakening same-store sales and customer traffic, with 60% of operators reporting lower traffic compared to the prior year—the 11th straight month of net traffic declines. Only 37% of restaurant operators saw year-over-year sales increases in December, down from 47% in November, while 53% reported declining sales. This sustained weakness in consumer dining activity creates a ripple effect through foodservice supply chains, translating directly to reduced ordering volumes from distributors and suppliers who rely on truckload and less-than-truckload carriers to move product.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

From a freight demand perspective, this persistent softness in restaurant traffic should continue pressuring reefer volumes in the first quarter, particularly for carriers and brokers serving broadline foodservice distributors and protein suppliers. With only 34% of operators expecting higher sales in the next six months and 30% anticipating worsening economic conditions, the forward outlook remains cautious. However, there’s a modest bright spot: 53% of operators plan capital expenditures in the coming months, which could support spot demand for flatbed and dry van capacity related to restaurant equipment and remodeling projects. Carriers and brokers should plan for continued headwinds in temperature-controlled lanes serving the foodservice sector while monitoring whether capital spending activity generates offsetting opportunities in equipment transportation.

Reefer Market Conditions

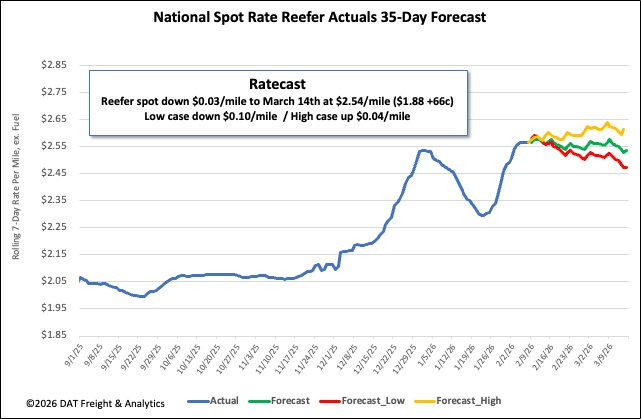

National reefer load post volumes saw a 10% decline last week, though they remain more than double the volume from the previous year. Meanwhile, equipment posts increased slightly (up 3% week over week). As a result of these changes, the reefer load-to-truck ratio decreased by 13%, settling at 23.16.

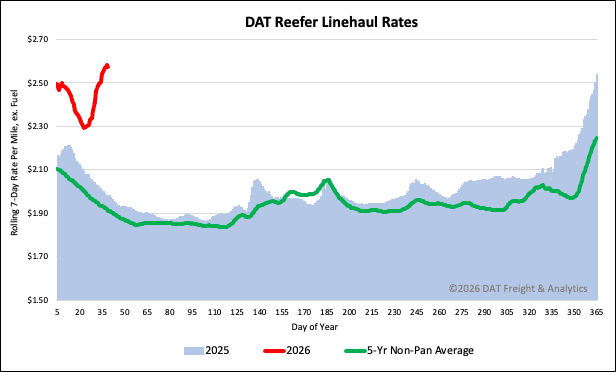

National reefer linehaul spot rates

From a trucking perspective, last week’s cold snap behaved less like “winter as usual” and more like a stress test for the entire freight network. Sub-zero temperatures across the Midwest, Plains, and into the Southeast slowed highway speeds, closed secondary roads, and stretched transit times just enough to scramble tightly scheduled freight. For truckers, it meant more hours burned idling for warmth, higher diesel consumption, and a spike in mechanical issues—gelled fuel, dead batteries, frozen air lines—the unglamorous physics of cold asserting itself.

The national 7-day rolling average spot rate for temperature-controlled loads rose to $2.57 per mile, primarily driven by an $0.08 per mile increase attributed to the ongoing freeze-risk pricing premium.

This rate remains $0.59 per mile (30%) higher than the same period last year. It is also substantially elevated when compared to historical data, exceeding the 5-year average (excluding pandemic-influenced years) by $0.65 per mile, or 25%.

Produce Wrap

Strawberry and Tomato Shippers Face Truck Shortages as Rates Surge

The latest USDA Specialty Crops National Truck Rate Report reveals significant capacity constraints across major agricultural shipping corridors for the fourth consecutive week, with California, Florida, and South Texas experiencing ongoing truck shortages. These tightening conditions are pushing spot rates higher and signal a potential shift in the freight market after an extended downturn.

California’s produce-rich regions are facing widespread capacity challenges. The Imperial and Coachella Valleys, along with Mexico crossings through Calexico and San Luis, are reporting shortages for leafy greens and vegetables, with truckload rates to East Coast markets like Baltimore and Philadelphia holding steady in the $8,300-$9,000 range. The Kern District, Oxnard, and Santa Maria regions are similarly constrained, particularly for specialty items like strawberries, celery, and grapes. These shortages reflect the agricultural sector’s peak shipping season coinciding with reduced truck availability across the West.

Florida’s shortage conditions are even more dramatic. Central and South Florida moved from adequate capacity last week to shortage and slight shortage conditions this week, with rates spiking significantly. Loads to Atlanta jumped 83% to $2,100-$2,300, while rates to Chicago surged 60% to $3,100-$3,300. The region’s diverse produce mix, including tomatoes, peppers, sweet corn, and strawberries, is competing for limited truck capacity as winter vegetable production hits its stride. These sharp rate increases suggest shippers are scrambling to secure equipment in a suddenly tight market.

South Texas crossings from Mexico are experiencing the most severe capacity constraints, with shortage conditions reported across all major destination markets. Rates have declined week-over-week as the market adjusts from even tighter conditions, but they remain elevated with loads to Dallas running $2,000-$2,600 and Chicago routes at $4,400-$5,200. The region’s extensive produce flows, including peppers, tomatoes, cucumbers, citrus, and tropical fruits, are facing persistent truck availability challenges that align with broader industry signals of accelerating capacity attrition.