Mark Zuckerberg announced last month that Meta Platforms plans to invest hundreds of billions of dollars in constructing several large AI data centers. This initiative intensifies his pursuit of superintelligence technology and fuels a competitive drive for top engineering talent.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

These data center construction projects, including a $10 billion investment in Louisiana and an $800 million facility in Indiana, are significantly boosting demand for truckload carriers. The transportation of heavy, oversized, and fragile equipment like servers and cooling systems is crucial for these large-scale projects, which can have construction timelines ranging from 18 months to several years.

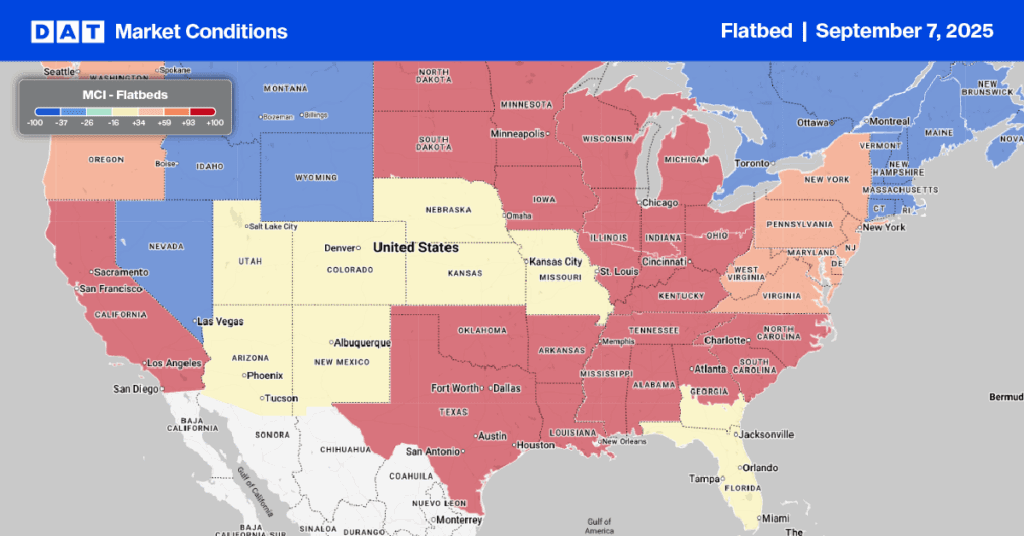

Given the high value and delicate nature of most components, specialized and flatbed carriers are essential for these operations. This increase in specific freight loads helps to offset declining demand in other sectors, such as agriculture, thereby creating more opportunities for transportation providers focused on this niche market. The influx of inbound freight from these projects also stimulates local market activity, leading to increased truck traffic and a need for infrastructure upgrades in surrounding areas.

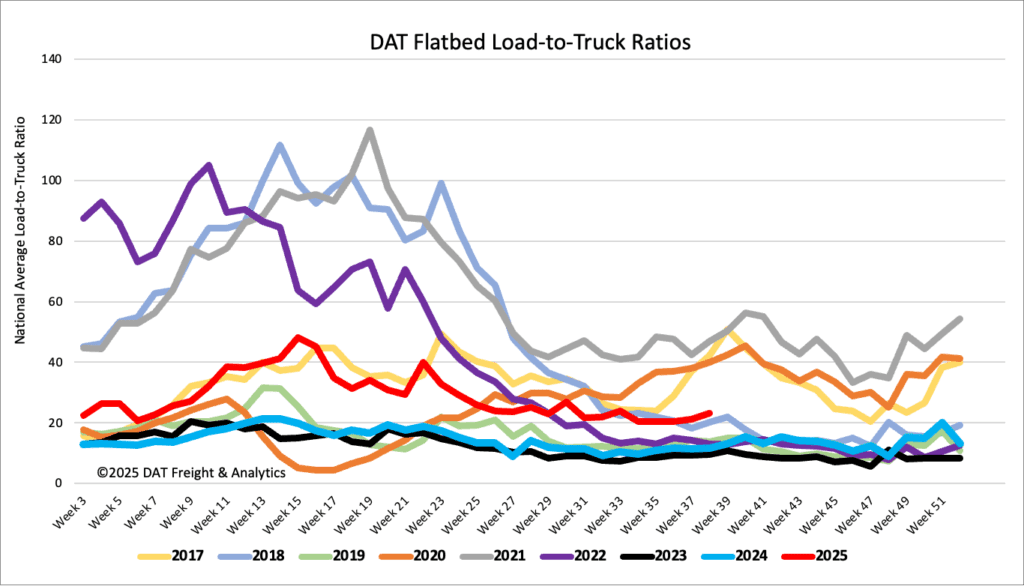

Load-to-Truck Ratio

Flatbed load post volumes held steady last week for the fifth straight week, up 23% year-over-year. This stability, coupled with a 16% decrease in carrier equipment posts after the short work week post-Labor Day, resulted in a 9% increase in the load-to-truck ratio, climbing to 23.14.

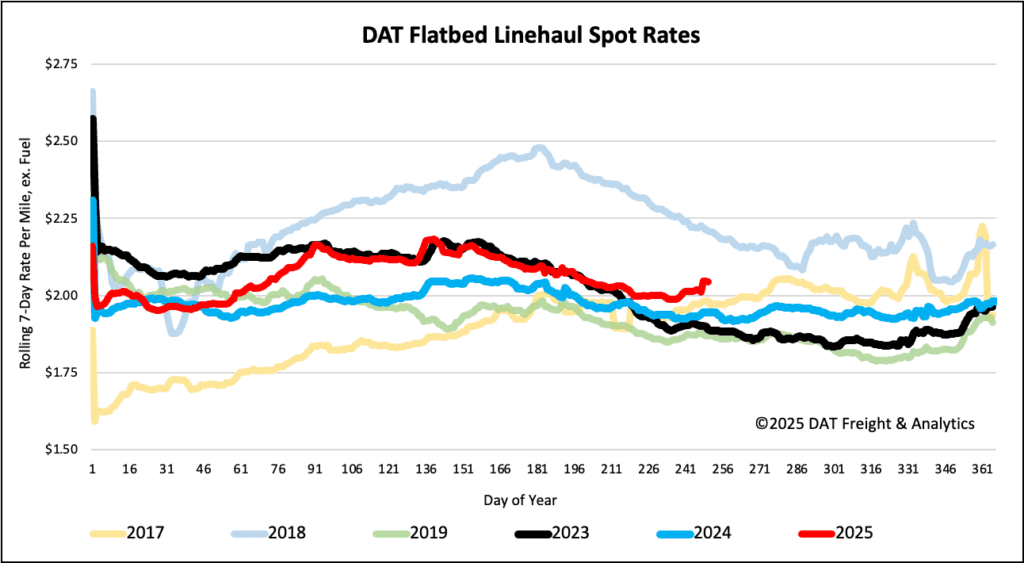

Spot rates

For the third consecutive week, the flatbed spot rate gap between this year and last continues to widen, now standing $0.10 per mile higher than last year. Last week, the national average flatbed spot rate, excluding fuel, increased by nearly $0.02 per mile, reaching just over $2.06 per mile for carriers.