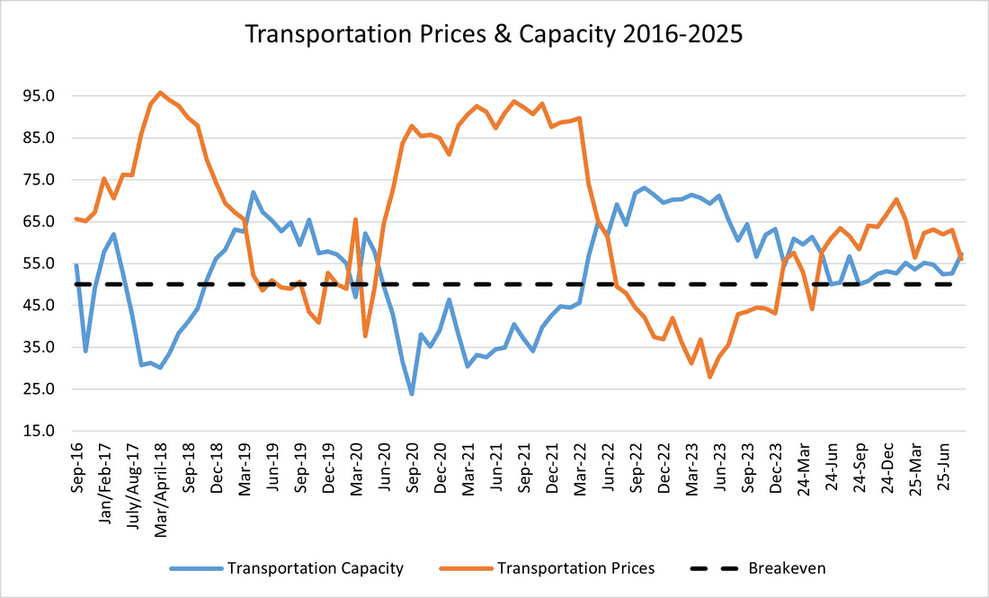

The August Logistics Manager’s Index (LMI) saw a slight increase of 0.1 points from July, reaching 59.3. This minor change resulted from opposing trends within its sub-components, with inventory and warehousing metrics rising while transportation metrics fell. Notably, Transportation Capacity is now expanding faster than Transportation Prices, signaling a mild negative freight inversion (see chart below), which historically indicates potential slowdowns in the transportation market (2019 & 2022). However, this August inversion is relatively mild and represents only a single data point.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Traditionally, a three-month trend would indicate a freight recession, but this shift reflects ongoing trends since January, when Transportation Prices were significantly higher than Transportation Capacity. Although freight metrics had been on an upward trajectory suggesting robust growth, the August shift at the beginning of peak season reduces the likelihood of a booming market in the near future.

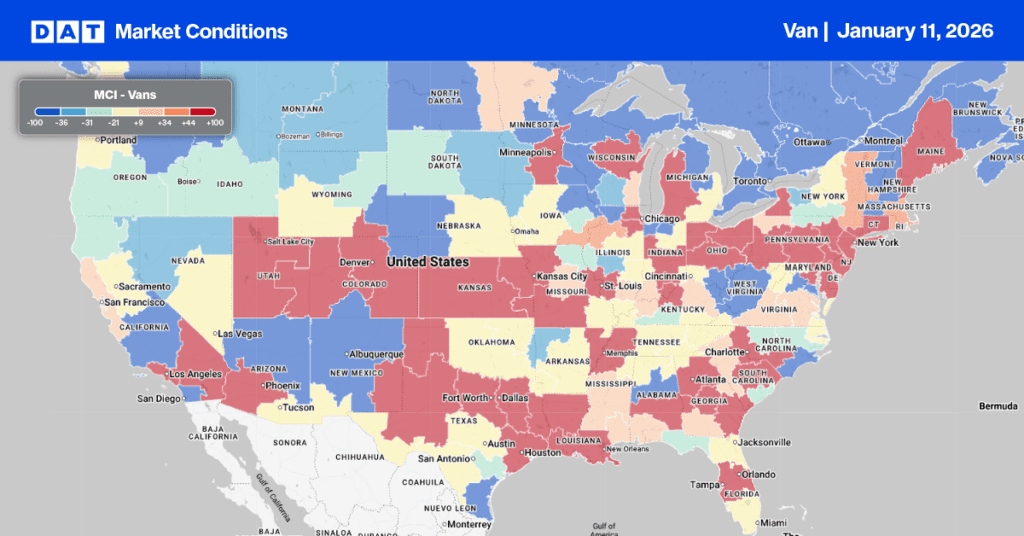

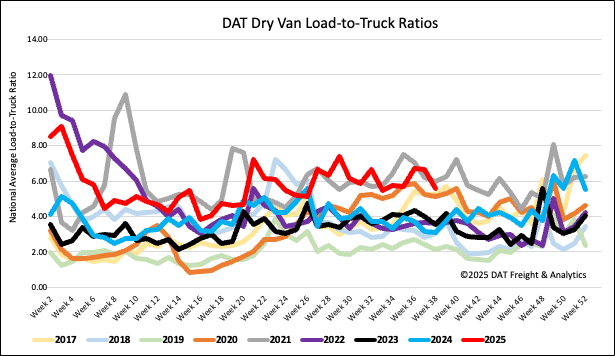

Load-to-Truck Ratio

During the first full shipping week after the Labor Day long weekend, dry van load posts saw a 5% increase week over week. This rise coincided with a 13% increase in equipment posts, indicating a return of truckload capacity to the network. As a result, the dry van load-to-truck ratio decreased to 5.66 last week.

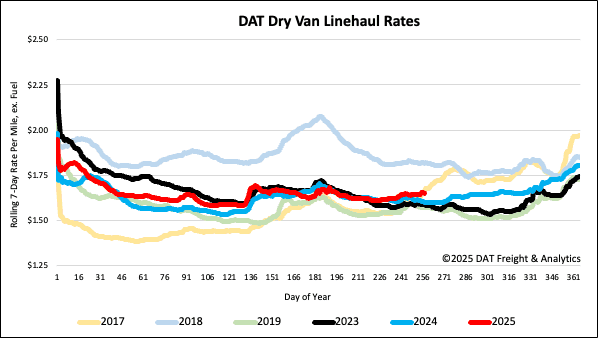

Linehaul spot rates

Dry van linehaul spot rates dropped by just over $0.03 per mile last week, averaging $1.66 per mile, $0.03 higher than the same time last year.

The average rate for DAT’s top 50 lanes by load volume remained decreased by $0.02 per mile last week, averaging $2.01 per mile and $0.35 higher than the national 7-day rolling average spot rate.

In the 13 key Midwest states, which represent 46% of national load volume and often indicate future national trends, spot rates were down $0.01. Carriers in these states earned an average of $1.91 per mile, which remained $0.25 above the national 7-day rolling average.