As the potato harvest season in over 30 states draws to a close, with Idaho, Washington, and Wisconsin leading in volume, it’s no surprise that potatoes are the highest commodity shipped nationally, outstripping onions and apples by almost two to one. According to the USDA, potato shipments typically peak in late November each year, generating significant demand for truckload carriers and freight brokers.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In the U.S., about half of all potatoes are processed into frozen products like french fries and other convenience foods. Approximately 24% are sold fresh for direct consumption. The remaining 26% are primarily used for dehydrated products, potato chips and snacks, and seed potatoes, with the latter accounting for roughly 6% of the total.

Early season shipments (September–October) can be overwhelming, with a spike in truck demand as brokers and buyers transport fresh-crop potatoes to processors, grocers, and markets. During these weeks, load-to-truck ratios rise sharply—there are often far more potato loads than available trucks, which pushes spot rates upward and draws truck capacity from other regional markets.

Reefer Market Conditions

There’s a distinct possibility that the ongoing government shutdown and the resulting suspension of Supplemental Nutrition Assistance Program (SNAP) benefits have already begun to affect the perishable produce freight market this week.

While SNAP’s legal and financial status remains uncertain due to the shutdown, several state agencies, including those in Florida and New York, had already announced that November allotments would be suspended effective November 1st due to a lack of federal funding. This will likely have impacted purchasing decisions last week and continue to do so throughout the coming week.

Usually, the reefer spot market experiences a 17% increase in load post volume at month-end around Halloween, as shippers typically empty their docks and handle last-minute perishable shipments. This year, however, load post volumes fell by just over 14%.

Midwest reefer markets, particularly in Missouri, are showing signs of tightness due to increased fresh turkey production as Thanksgiving approaches. Load post volumes in Missouri surged 10% last week and 33% over the past month, signaling the critical three-week period for fresh turkey shipments. Outbound Joplin reefer rates have risen to $2.36 per mile, up $0.02 last week and $0.05 in the last month, marking a $0.10 increase compared to last year.

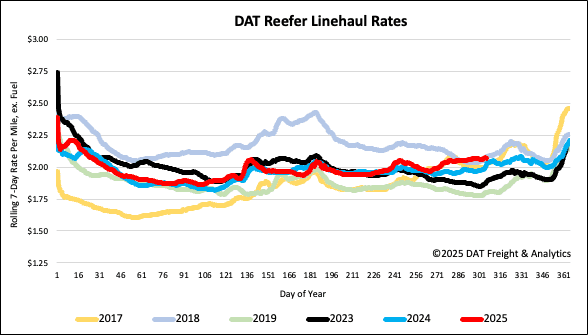

Reefer National Spot rates

The national 7-day rolling average for reefer carriers experienced a $0.02 decrease last week, settling at $2.08 per mile. This indicates a loss of momentum in the temperature-controlled market, contrary to the usual month-end tightening seen before Thanksgiving. The ongoing Federal Government shutdown is likely casting a shadow over the economy, impacting the market. Despite this, last week’s spot rate is slightly higher than last year’s by $0.04 (2%) and $0.18 above the 2023 average.