The latest data from the American Trucking Associations (ATA) confirms what many in our industry are feeling: the freight market remains exceptionally difficult. The October For-Hire Truck Tonnage Index registered a significant monthly decline, marking the most substantial drop in nearly two years. Truck freight tonnage fell by 2.1% in October, which pushed the seasonally adjusted level down to the lowest since January. This was the largest single-month decline seen since January 2024, according to ATA Chief Economist Bob Costello, reinforcing the persistent challenge in the sector. The tonnage also experienced its largest year-over-year decline in 2025, dropping 1.8% compared to the same month last year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

While trucking is often seen as a barometer for the overall U.S. economy—representing nearly three-quarters of all domestic freight tonnage —these figures underscore the current capacity surplus and soft demand environment. The fact that year-to-date tonnage is unchanged compared to 2024 highlights how difficult a year this has been for growth.

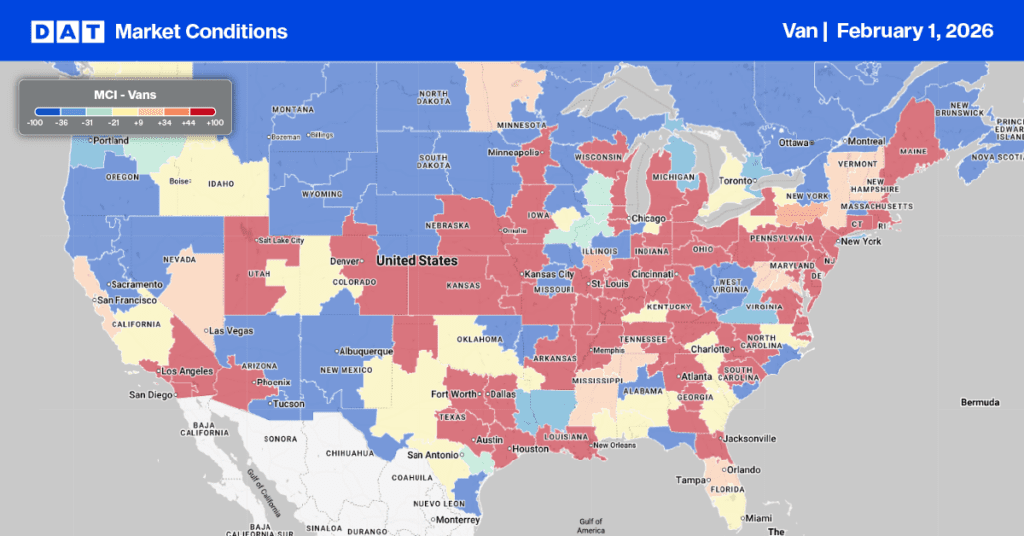

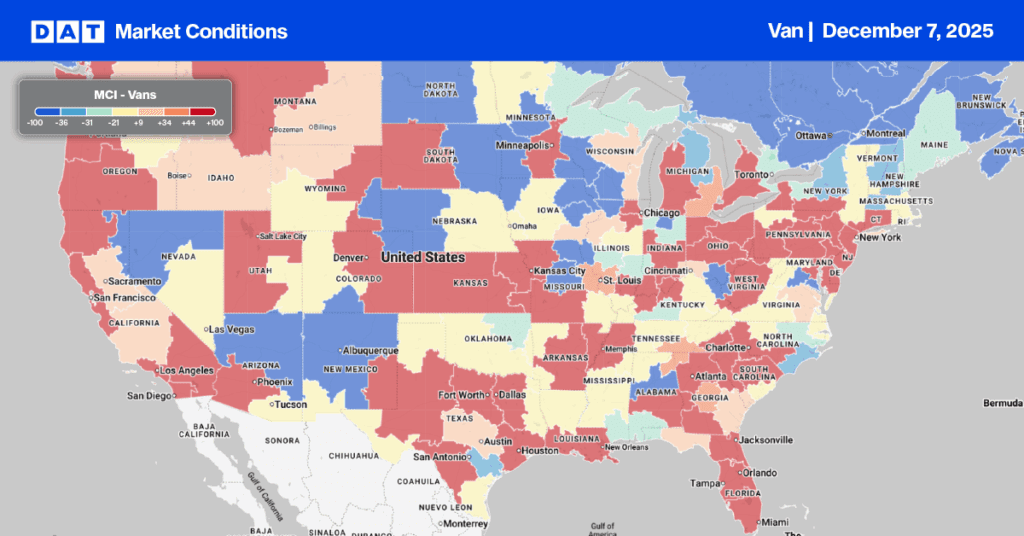

Dry Van Market Conditions Index

Following the Thanksgiving holiday, the dry van spot market experienced a surge in activity as dry van load post volumes more than doubled. This increase in carrier engagement resulted in the load-to-truck ratio jumping to 10.48 last week.

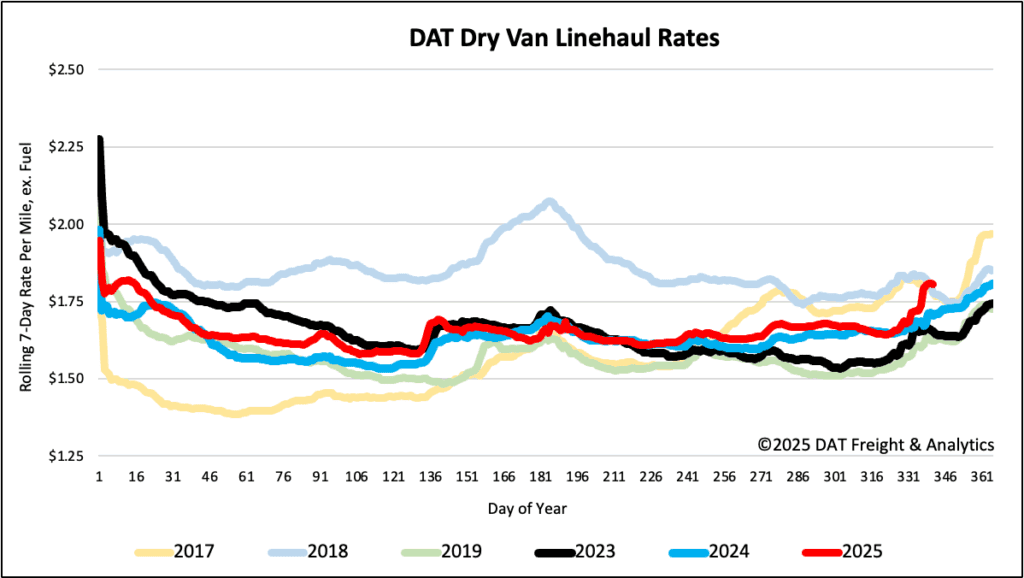

National dry van linehaul spot rates

Spot dry van linehaul rates jumped by another $0.07 per mile last week, settling at an average of $1.81 per mile. This rate is $0.06 higher than the same week last year or slightly less than 6%.

The average rate for DAT’s top 50 lanes by load volume increased by $0.05 per mile last week, averaging $2.13 per mile and $0.32 higher than the national 7-day rolling average spot rate.

In the 13 key Midwest states, which represent 45% of national load volume and often indicate future national trends, spot rates increased by $0.13 per mile to $2.10 per mile, which was $0.29 above the national 7-day rolling average.