As 2025 wound down, the Association of Equipment Manufacturers (AEM) reported that U.S. retail sales for agricultural tractors and combines finished the year on a softer note. In December 2025, total farm tractor sales in the U.S. declined 14.8% compared to December 2024, with all major categories—from compact sub-40 hp units to larger 100+ hp and four-wheel-drive machines—posting lower monthly volumes. Self-propelled combine sales also edged down 4.3% year-over-year for the month. Year-to-date figures through December showed U.S. farm tractor sales at 195,857 units, nearly 10% below the 2024 total, while combine sales were down more than 35% from the prior year, underscoring weaker demand throughout 2025. Inventories at the start of December reflected this trend, with roughly 89,700 tractors and 845 combines on hand, suggesting dealer stocks remained significant as farmers continued to delay big-ticket purchases.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

AEM’s commentary alongside the data highlighted that December’s reductions likely mirror broader economic pressures that have weighed on farmers—rising input costs, tighter credit conditions, and cautious capital spending patterns. Despite the near-term contraction, industry leaders expressed confidence in the sector’s long-term resilience and commitment to meeting producer needs as conditions evolve into 2026. The December report, drawn from proprietary member data and retail sales estimates, provides a detailed snapshot of how agricultural equipment markets closed out a challenging year.

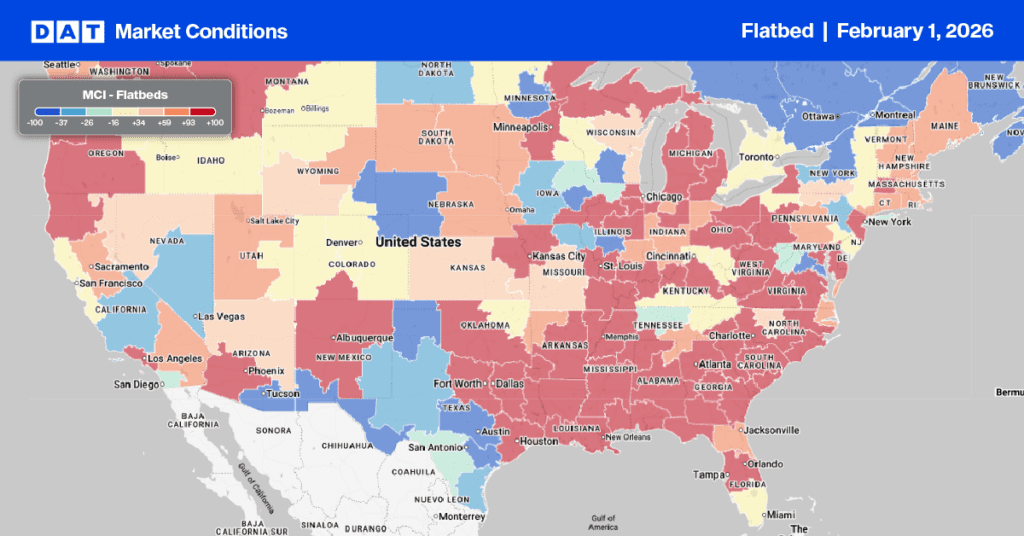

Flatbed Market Conditions

The flatbed segment saw a significant 27% increase in the load-to-truck ratio last week, reaching 48.30. This rise was driven by a 5% increase in load posts and an almost 18% decrease in truck posts.

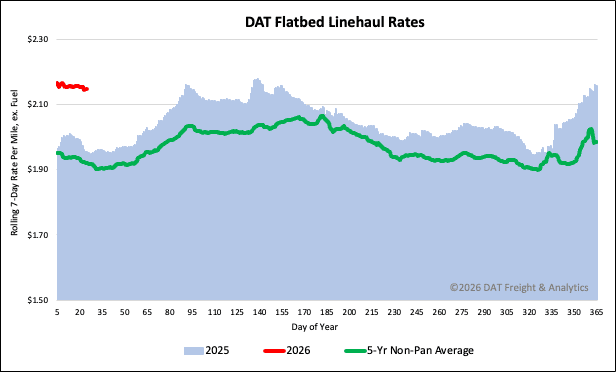

National flatbed spot rates

The national average spot rate for flatbed carriers currently stands at just over $2.16 per mile, following a penny per mile increase last week. The current rate remains notably higher than previous years. It is $0.19 per mile (approximately 10%) above the rate for the same period last year, $0.21 per mile higher than 2018 levels, and exceeds the 5-year average (excluding pandemic years) by $0.25, also a 12% increase.