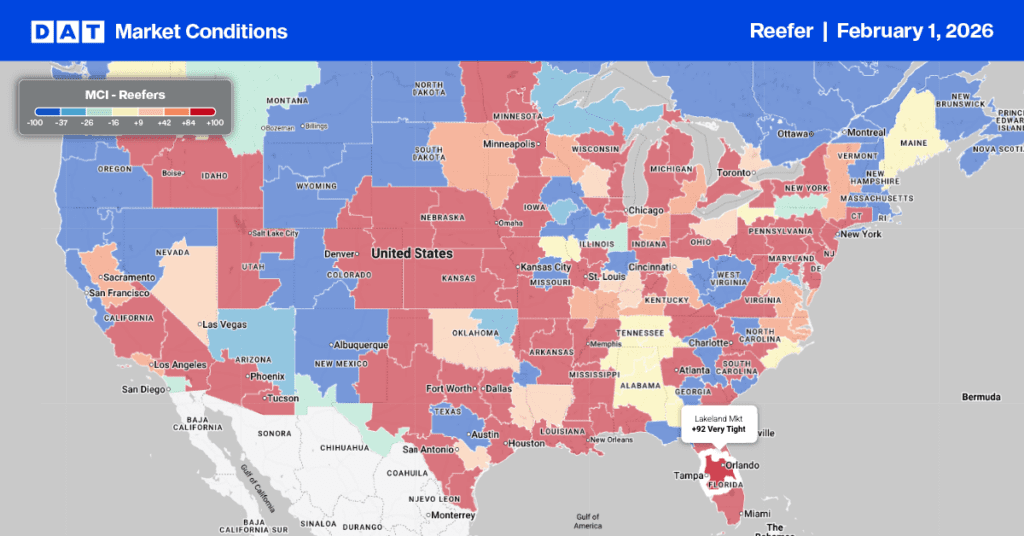

The end of the farmer and trucker protests on the Mexican side of the southern U.S. border at Thanksgiving is already reshaping this winter’s produce season, especially for import-heavy lanes out of Nogales, South Texas, and Baja. With blockades lifted after roughly two days of near-total disruption at key ports of entry, shippers are racing to clear backed-up loads of tomatoes, peppers, cucumbers, squash, and berries that were stalled in Mexico during the demonstrations. For U.S. retailers and wholesalers, the immediate impact is a short, sharp catch-up surge in cross-border volumes as delayed freight moves in a compressed window, stressing cold chain capacity and appointment scheduling even as normal operations resume.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

For carriers and brokers operating near the southern border, the coming weeks are expected to feel more like a swift “second start” to the winter produce season than a gradual buildup. Exporters are rushing to fulfill contracts and rebuild trust with U.S. buyers, which will lead to a surge in tender volumes and tighter loading windows for many fleets that were previously idled or rerouted due to protests.

Reefer spot rates in Pharr, TX, the largest commercial crossing zone for produce, saw a $0.05 per mile increase last week, reaching $2.25 per mile. However, the westbound lane to Los Angeles is experiencing a greater impact from recent ICE enforcement in California targeting non-domiciled CDL holders. Although reefer spot rates on this lane are easing from their November 7th peak, they remain $0.30 per mile higher than they were last year.

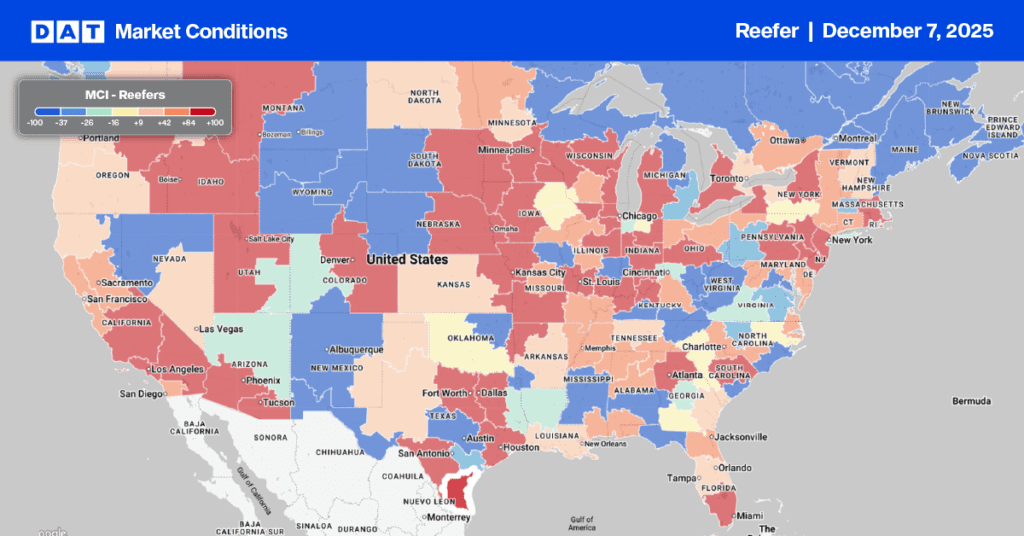

Reefer Market Conditions

Load post volumes surged last week, more than doubling as the market caught up from the short week prior to Thanksgiving. Reefer carriers returned to the network slowly resulting in the load-to-truck ratio increasing to 18.14.

The start of the Winter Salad Bowl has triggered a rise in reefer spot rates in Yuma, AZ. Located in the far southwest corner of Arizona, bordering California and Mexico on the Colorado River, Yuma is responsible for about 90% of the nation’s winter leafy greens from November through March, creating significant demand for refrigerated transport.

Last week, reefer spot rates saw an increase of $0.05 per mile, reaching an average of $2.33, which is 4% higher than the previous year. According to the USDA, capacity was particularly tight on high-volume lanes to Los Angeles, with a shortage of trucks driving spot rates up by $0.22 per mile last week for loads of winter vegetables.

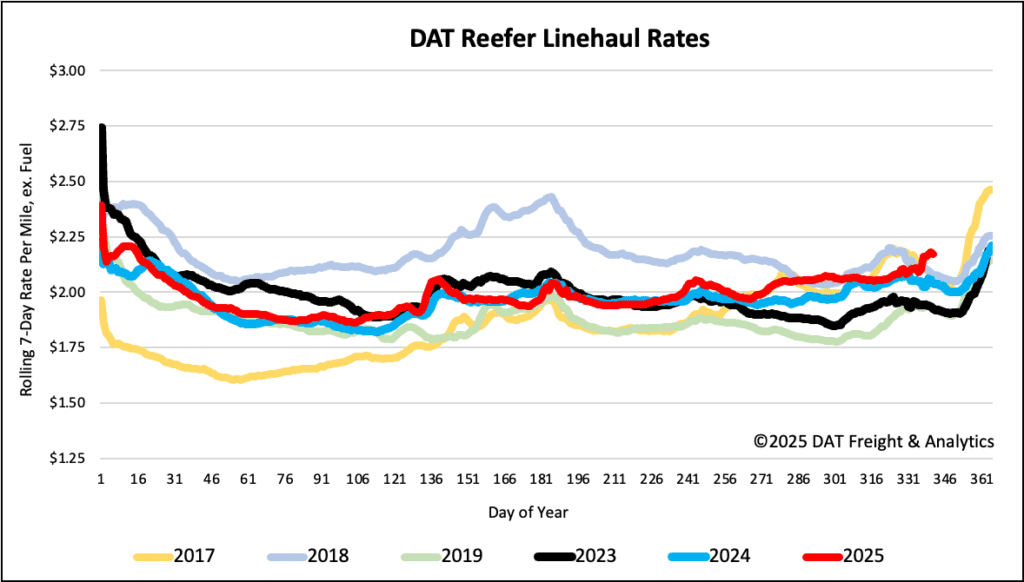

Reefer National Spot rates

The national 7-day rolling average rate jumped to $2.18 per mile last week, increasing by $0.05 per mile. This is approximately $0.13/mile, or 6%, higher than reefer spot rates recorded during the same period last year.