The Cass Shipments Index ended December with significant softness, reaching a new cycle low. Volumes were down 7.2% month over month (3.2% seasonally adjusted) and 7.5% year over year, worsening the full-year decline of 6.1%. This drop delivered a “cold reminder” that freight volumes are still decreasing. Winter storms in the Midwest severely disrupted highway networks, contributing to the December softness. Furthermore, holiday sales data suggests that retailers were actively destocking, as freight flows across modes remained below consumer spending trends.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Looking ahead, some of the December weakness appears transitory, with CASS noting pent‑up demand from weather that was still visible in the spot market into mid‑January and could lift January volumes above normal seasonality, which otherwise would imply about a 5% year‑over‑year decline in shipments. At the same time, the broader backdrop remains soft, with overcapacity and post‑tariff payback weighing on for‑hire volumes, even as tighter winter capacity and a prospective boost from the Supreme Court’s IEEPA tariff decision set the stage for a freight demand and pricing environment that may look firmer as 2026 begins.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted. The rate charts exclude 2021 and 2022, years influenced by the pandemic.

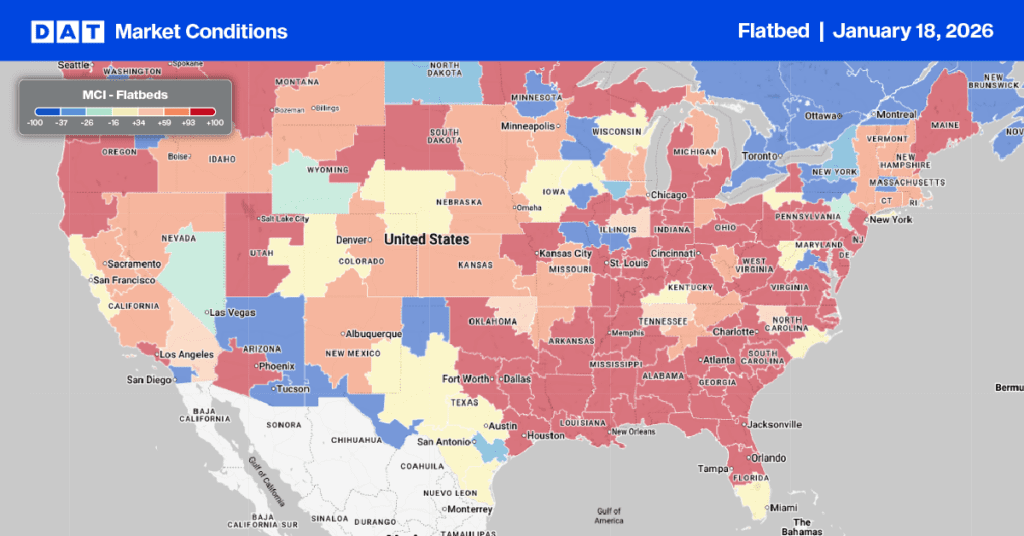

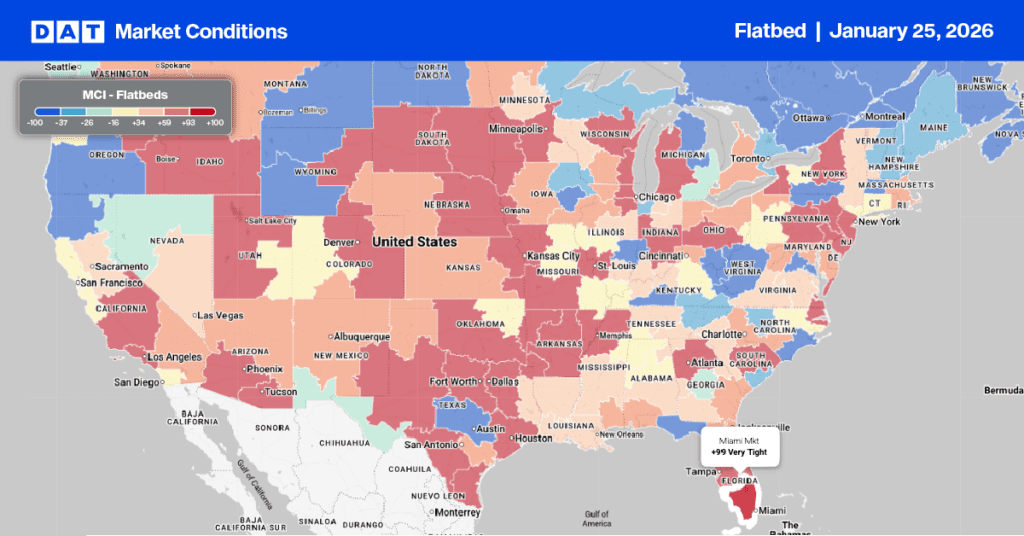

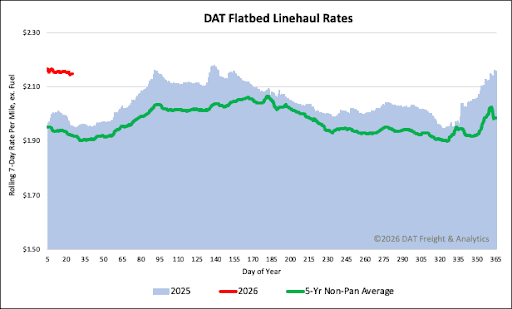

Despite a 3% decline in load post volumes for flatbeds last week, they remain nearly 70% above last year’s figures. Consequently, the load-to-truck ratio saw a slight drop, closing the week at 39.27.

The national average spot rate for flatbed carriers currently stands at just over $2.15 per mile, following a $0.02 decrease last week. This brings the total rate drop since the beginning of the year to $0.04 per mile. Despite this recent decline, the current rate remains notably higher than previous years. It is $0.19 per mile (approximately 10%) above the rate for the same period last year, $0.06 per mile higher than 2018 levels, and exceeds the 5-year average (excluding pandemic years) by $0.22, also a 10% increase.