Valentine’s Day 2026 is shaping up to be another record flower season through Miami, and that’s bullish for reefer demand and spot rates in South Florida and beyond. With more than 90,000 tons of flowers or the equivalent of 4,500 truckloads projected to move through Miami around the holiday, reefer capacity will be tight, cycles will be compressed, and outbound reefer rates from Miami should see a meaningful seasonal bump this year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Miami International Airport (MIA) handles about 90–91% of U.S. fresh‑cut flower air imports, with roughly 1,500 tons of flowers arriving daily in the runup to Valentine’s Day. Flowers land in Miami on wide‑body freighters and belly cargo from Colombia and Ecuador, then move almost immediately into temperature‑controlled warehouses for inspection and cross‑dock before cascading out into via reefers to grocery distribution centers, flower stores, and wholesalers across the Southeast, Northeast, and Midwest on extremely tight delivery windows.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted. The rate charts exclude 2021 and 2022, years influenced by the pandemic.

Refrigerated truckload supply eased last week in the major produce regions according to the USDA, but still reported a slight shortage in most regions including all five regions in California for the second week. Even though truckload volumes dropped just over 2% last week in Florida, the ongoing shortage of trucks continued for winter vegetables to major east coast cities. According to DATs RateView, carriers were paid an average of $2,780 per load between Lakeland and Brooklyn, NY last week, 6% higher than a year ago, while loads to Boston were paying around 11% more over the same timeframe.

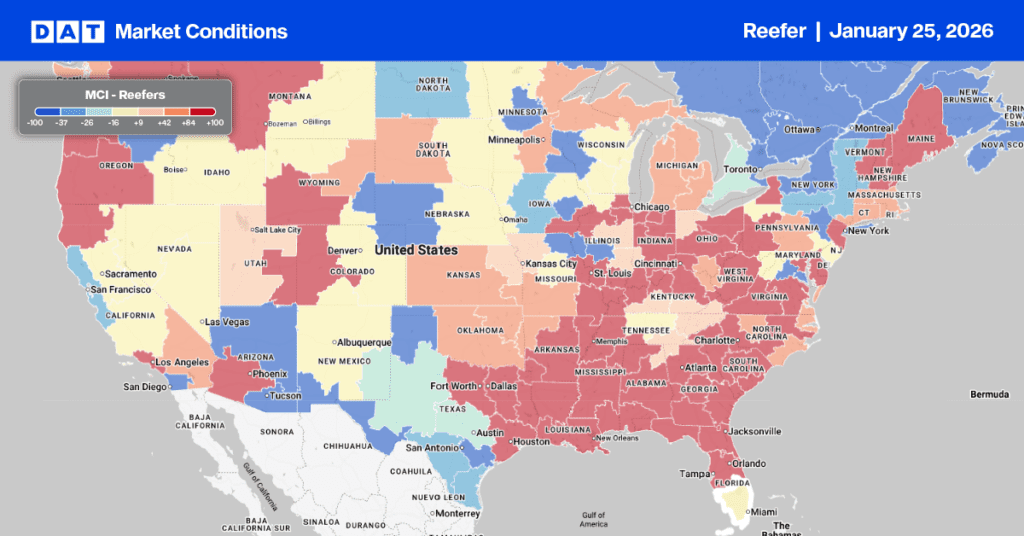

Reefer load post volumes saw a 4% week-over-week increase, driven primarily by colder weather. This surge was due to shippers posting more “Protect from Freeze” loads, which require reefer trailers. Despite the higher volume, there was sufficient capacity to cover less expensive dry freight, resulting in a decrease in the national average spot rates. The reefer load-to-truck ratio increased by 13% from the previous week, settling at 14.55.

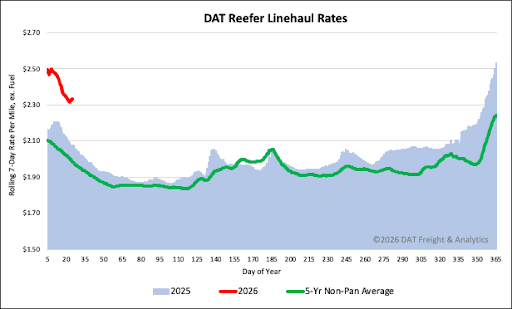

The spot market for temperature-controlled reefers is experiencing a continued cooldown, with the national 7-day rolling average spot rate settling at $2.34 per mile last week. Since the beginning of the year, the rate has plummeted by nearly $0.20 per mile, including an $0.08 drop last week alone. This decline has erased almost 50% of the significant gains made during the previous December.

This rate remains $0.26 per mile (12%) higher than the same period last year. It is also substantially elevated when compared to historical data, exceeding the 5-year average (excluding pandemic-influenced years) by $0.34 per mile, or 15%.