AI data centers are quietly creating a powerful new freight story: a surge in heavy diesel and natural‑gas generator production at Caterpillar, GE Vernova, and Cummins that translates directly into more high-value truckload demand. As grids struggle to keep up with power-hungry AI workloads, data center developers are ordering hundreds of large backup units per campus, each one a multi-truck move from engine plant to final site. For truckload carriers, that shift turns the digital AI boom into very physical, industrial freight running through traditional manufacturing and construction regions.

Caterpillar’s power and energy unit has become the company’s fastest-growing segment, with generator and engine sales up roughly 28% year over year through the first three quarters of 2025, after a 22% gain in 2024. The Wall Street Journal describes a Utah AI data center project that will buy more than 700 natural-gas generators from Caterpillar alone, enough load to power about a quarter of the state’s current electricity demand. Each of those units travels as oversized, dense industrial freight, creating recurring truckload demand between engine plants like Lafayette, Indiana—where Caterpillar is investing about $725 million to expand capacity—and data center construction sites across the U.S.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Cummins and GE are riding the same wave, turning power-generation equipment into a growth counterweight to softer core engine markets and adding more generator freight into the network. As AI data center construction spreads into secondary and rural markets where grid constraints are tight, truckload carriers should expect more project freight—engines, housings, fuel systems, switchgear—moving in heavy, specialized loads that keep flatbeds, step-decks, and heavy-haul trailers busy even if traditional construction and manufacturing cycles cool.

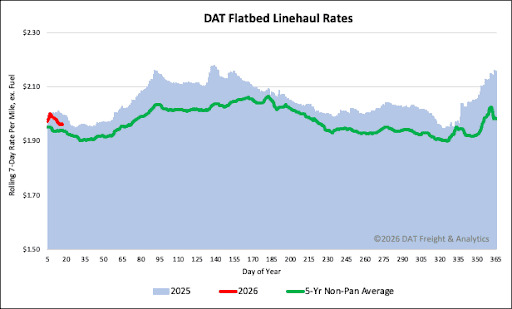

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted. The rate charts exclude 2021 and 2022, years influenced by the pandemic.

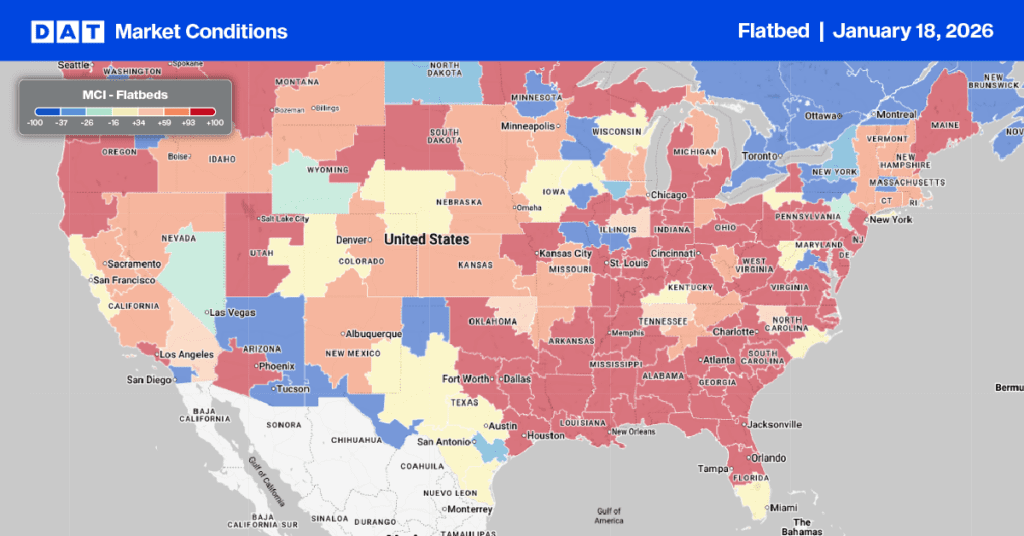

Flatbed capacity tightened last week in several markets, including Pennsylvania, Tennessee, the Northeast, and along I-95 corridors in New York and New Jersey, largely due to freezing cold weather. Load post volumes for flatbeds rose by almost 3% last week, marking an increase of nearly 40% compared to the previous year. This resulted in a minor uptick in the load-to-truck ratio, which finished the week at 42.99.

In Tennessee, where slick highway conditions on Interstate 40 near Cookeville, triggered a chain-reaction crash involving at least 11 vehicles, load post volumes jumped by 11% last week, while outbound spot rates increased by $0.10 per mile or 4%

The national average spot rate for flatbed carriers settled at just over $2.17 per mile last week, down a penny per mile. This current national average rate maintains a significant year-over-year increase, sitting $0.16 per mile (about 8%) higher than the rate recorded during the same period last year. Furthermore, it exceeds the 5-year average (excluding pandemic-influenced years) by $0.22, an increase of 10%.