For reefer carriers and brokers, the 2026 Florida Strawberry Festival (February 26 – March 8) isn’t just a celebration of shortcake; it’s the definitive peak of the Florida strawberry season. Plant City, the “Winter Strawberry Capital of the World,” is currently ramping up for a harvest expected to move upwards of 70 to 100 truckloads per day during this window. With the 2026 crop reported in excellent shape following a manageable winter, the “Still Growing” theme of this year’s festival translates directly into high-volume outbound reefer demand. Carriers can expect a significant capacity crunch in the Lakeland freight market, as growers race to move nearly 40 million flats of highly perishable berries to grocery shelves across the Northeast and Midwest.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The timing of this festival creates a perfect storm for refrigerated spot rates. We are seeing a “double peak” effect: a sharp spike in demand leading up to Valentine’s Day, followed by sustained pressure through the end of the festival in early March. As local capacity is absorbed by high-priority berry shipments, outbound tender rejection rates in Central Florida are projected to climb, forcing brokers to look toward the spot market to cover non-agricultural loads. For carriers, this is the time to position equipment in the Southeast to capitalize on 15–20% rate premiums on outbound lanes.

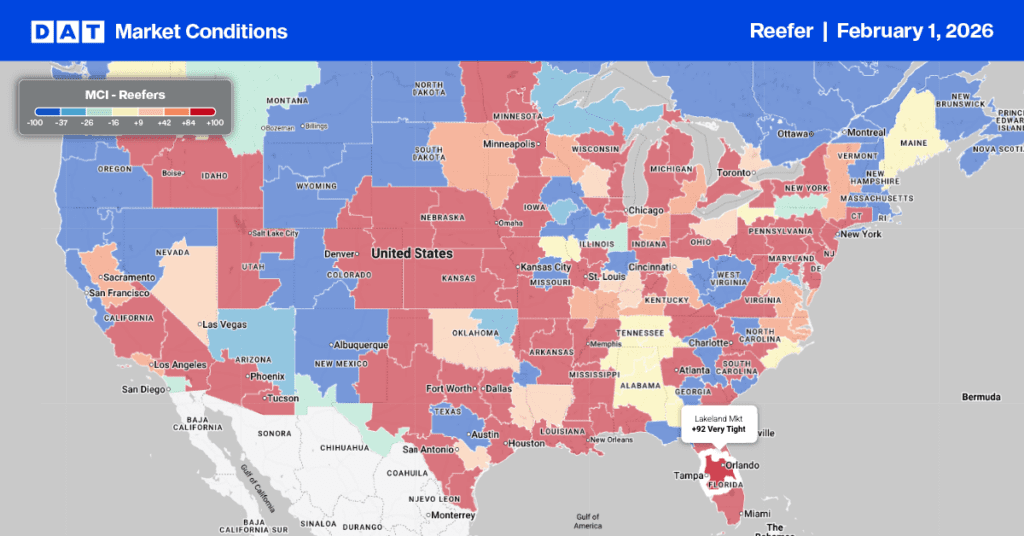

Reefer Market Conditions

Winter Storm Fern brought significantly colder weather, causing reefer load post volumes to surge by 72% week-over-week. This jump was primarily due to shippers posting more loads requiring “Protect from Freeze” service, which necessitates a reefer trailer. As a result, the reefer load-to-truck ratio nearly doubled compared to the previous week, reaching 27.54.

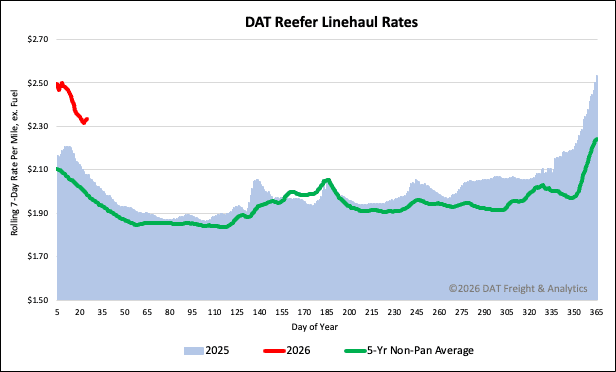

National reefer linehaul spot rates

The extremely cold temperatures brought by Winter Storm Fern significantly reduced the availability of refrigerated capacity, as drivers were forced off the road. This scarcity was exacerbated by dry freight shippers competing for insulated refrigerated vans to move dry loads at risk of freezing in standard dry vans. The freeze-risk pricing premium sent spot rates for temperature-controlled loads soaring last week, with the national 7-day rolling average spot rate increasing by $0.15/mile to $2.49 per mile.

This rate remains $0.46 per mile (23%) higher than the same period last year. It is also substantially elevated when compared to historical data, exceeding the 5-year average (excluding pandemic-influenced years) by $0.54 per mile, or 22%.

Produce wrap

Truckload capacity is tightening along the southern border due to the active Mexico produce season, leading to elevated produce volumes, especially in Nogales, AZ, and Southern Texas. Specifically in Nogales, AZ, the USDA reported a slight shortage of trucks for all major destinations last week. The shortage was more pronounced for loads of winter vegetables destined for Chicago, where reefer spot rates hit a 13-month high. Carriers on this long-haul lane averaged $5,317 per load, which is over $400 more than rates paid a year ago.

In Southern Texas, the USDA reports a continued truck shortage, impacting shipments to all major East Coast capital cities. Meanwhile, reefer rates on the West Coast lane to Los Angeles have climbed for the fifth consecutive month. This 82% increase since September—when immigration enforcement began along the southern border—has pushed the average carrier payment per load to $4,200 this week. This is significantly higher than the $2,500 recorded in 2024 and the $2,300 rate at the start of last September.

Trucking capacity remains tight in major agricultural regions. California is experiencing a slight truck shortage across all five of its winter vegetable, grape, and strawberry growing regions for the third consecutive week. Similarly, Florida is reporting a slight shortage for winter vegetable and strawberry shipments heading to key East Coast cities.

This scarcity is driving up rates. Carriers hauling from Lakeland, FL, to New York are currently earning an average of $3,500 per load, a significant increase of approximately $900 from rates a year ago. Ratescast forecasts this rate to climb an additional $500 per load leading up to Valentine’s Day.