By Christina Ellington

The American Trucking Associations’ (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 2% in April after rising 1.8% in March. Compared with April 2021, the SA index rose 1.8%, the eighth straight year-over-year gain. In 2022, year-to-date, and compared with the same period in 2021, tonnage was up 2.3%.

“After eight straight gains totaling 6.9%, for-hire tonnage finally slid back in April. Despite being the largest sequential drop since August 2020, the index was still above where it started in 2022 and a year earlier,” said ATA Chief Economist Bob Costello. “It is important to note that ATA’s for-hire tonnage data is dominated by contract freight with minimal amounts of spot market loads. The spot market has softened more than for-hire contract freight, as the market transitions back to pre-pandemic shares of contract versus spot market,” Costello said.

However, the shippers are paying more for freight even though the spot market has declined. The Bureau of Labor Statistics’ latest long-distance truckload producer price index (PPI) rose 5.1 percent in April from March and was up 7 percent from February. “Contract rates have been going up, even as spot has declined,” said Tal Dickstein, a senior economist at S&P Global. Dickstein said the BLS data reflects the strength of contract pricing as shippers shift freight away from the spot market. Based on pricing inputs from thousands of companies, the BLS truckload PPI has been rising steadily since last June and was up 39.6 percent year over year in April, reflecting spot and contract gains.

From a truckload demand perspective, the for-hire trucking ton-mile index (TTMI) produced by Yemisi Bolumole, PhD and Jason Miller at Michigan State University (MSU) reported a 3.5% m/m increase in March, a record-high reading for the index. According to Prof. Miller, the increase in demand, “was driven by gangbuster sales, even when inflation is removed, in parts of wholesaling, including furniture, metals, and paper, and strong manufacturing output”.

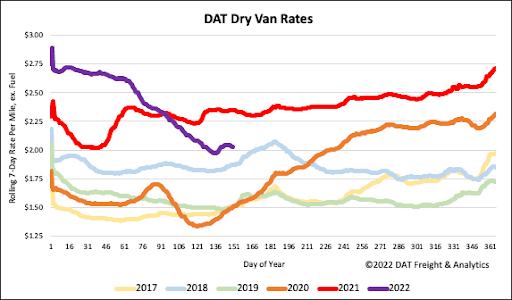

All rates cited below exclude fuel surcharges unless otherwise noted.

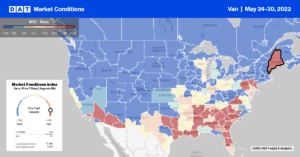

Even though the volume of dry van loads moving on DAT’s freight network dropped 4% last week, volume and spot rates were still up on around half of the top 100 lanes. In California, capacity tightened for the third week following last week’s $0.05/mile increase in spot rates. The state average linehaul spot rate is currently $2.18/mile, the same as the Los Angeles market this week. Loads north to Seattle increased slightly last week after dropping steadily since the start of the year. The Los Angeles to Seattle 7-day average is currently at $2.89/mile, while rates for loads east to Chicago continue to decrease, averaging $1.66/mile this week – around half what loads were paying last December.

In the Midwest markets, including Chicago and Joliet, linehaul rates also increased for the third week in succession, up $0.02/mile to an average of $2.28/mile. Outbound rates in Elizabeth, NJ, followed a similar trend although much lower at an average of $1.73/mile and even lower at $1.48/mile for loads west to Chicago and $1.43/mile to Atlanta. In the country’s logistics hub in Memphis, capacity tightened following last week’s $0.05/mile increase to an outbound average of $2.40/mile. In DAT’s most prominent spot market, dry van capacity remains tight in Houston, where spot rates increased $0.05/mile last week to an outbound average of $2.17/mile.

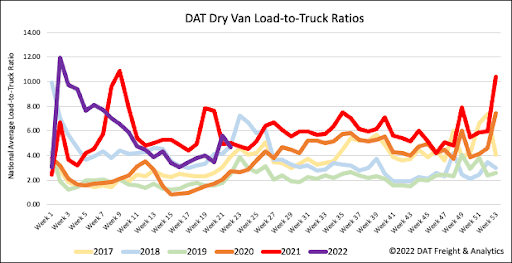

After dropping 16% during International Roadcheck Week, carriers returned to the market following last week’s 11% w/w increase in equipment posts. Load post volumes predictably increased ahead of the short Memorial Day work week, increasing by 8% w/w. As a result, the dry van load-to-truck ratio decreased 17% w/w from 5.59 to 4.64.

Dry van linehaul spot rates (excluding fuel) held onto gains from the prior week and increased slightly to a national average of $2.05/mile last week. This isn’t unusual following Roadcheck Week and leading into the shorter workweek for shippers following Memorial Day. It remains to be seen if the longer-term slide in spot rates has been halted and the seasonal trend of increasing rates from now until Independence Day takes effect. The national average dry van linehaul is $0.32/mile lower than the previous year and $0.16/mile higher than the same week in 2018.