Truckload carriers have been experiencing considerable growth in freight volumes in the Southeast and Southwest since the pandemic began in early 2020, and it is likely being sustained based on recent data from the U.S. Census Bureau. The Northeast, traditionally a GDP powerhouse, now contributes less to the national GDP than six fast-growing states in the South — Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas. The population migration during the pandemic helped steer about $100 billion in new income to the Southeast in 2020 and 2021 alone, while the Northeast lost about $60 billion, based on an analysis of recently published Internal Revenue Service data. The Southeast has accounted for more than two-thirds of all job growth in the U.S. since early 2020, almost doubling its pre-pandemic share.

The Census Bureau said in May that nine of the nation’s 15 fastest-growing cities were in the South, with six being in Texas alone. Topping the list was Ft. Worth, followed by Phoenix, two markets that have experienced massive freight growth in the last three years. The volume of dry van loads moved by truckload carriers in the DAT freight network into the Ft. Worth market since the start of 2019 has increased by 81%, while outbound loads to all destinations have increased by 67%. Inbound and outbound loads from all origins and to all destinations in Phoenix have increased by 60% over the same timeframe. The Census Bureau estimates 2.2 million people have moved to the Southeast and Southwest in the last two years, and that population shift is both permanent and impactful from a freight perspective.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

At $2.19/mile, outbound average Georgia spot rates are identical to 2019 following last week’s penny per mile increase. In Atlanta, capacity tightened for the third week following last week’s $0.05/mile increase to $1.88/mile. On the high-volume lane from Atlanta to Orlando, loads paid carriers $2.63/mile, the highest since February – but $0.40/mile lower than the previous year. Northbound loads to Elizabeth, NJ, averaged $1.97/mile, the highest since last October.

Average spot rates in Illinois are identical to 2019 at $2.06/mile following last week’s $0.10/mile increase. Outbound loads from Chicago paid carriers $2.01/mile last week, up $0.09/mile compared to the previous week. In neighboring Joliet, spot rates increased by $0.08/mile to $2.03/mile.

In California, outbound linehaul rates from Los Angeles rose for the fourth week to $1.97/mile following last week’s $0.06/mile gain. Ontario linehaul rates followed a similar trend, increasing by $0.05/mile to $2.06/mile. At $2.17/mile, California’s average statewide rates are identical to 2017 and 2019.

In Texas, after dropping for the previous three weeks, outbound loads from Houston paid carriers $1.78/mile following last week’s $0.01/mile increase.

Load-to-Truck Ratio (LTR)

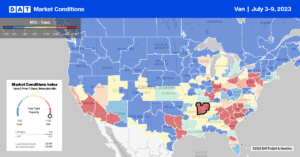

Spot market load posts followed seasonal trends after last week’s 39% w/w decrease in volume. According to data going back to 2016, in the week after the July 4 break, volumes typically drop by an average of 38% w/w. Last week’s spot market volumes were 58% lower than the previous year and 20% lower than the average spanning pre-pandemic years. Carrier equipment posts dropped by 19% w/w, resulting in the dry van load-to-truck ratio (LTR) dropping from 3.46 to 2.63.

Linehaul Spot Rates

Dry van linehaul rates were mainly flat last week, and at a national average of $1.72/mile, spot rates are $0.26/mile lower than the previous year. Produce season typically impacts dry van rates as capacity shifts to higher-paying refrigerated produce loads, and in a typical year, dry van linehaul rates would increase by $0.19/mile from mid-April to the long July 4 weekend. This year, the increase was just $0.11/mile. Compared to DAT’s Top 50 lanes, which averaged $2.07/mile last week, the national average was $0.35/mile lower.