Industrial supply companies are reporting continued growth with their latest 2nd quarter results, suggesting that there isn’t a downward shift in demand yet. The industrial sector is a crucial industry for truckload tonnage. Fastenal Company, a leader in the wholesale distribution of industrial and construction supplies, reported net sales increased by $270.8, or 18.0%, in the second quarter of 2022 compared to the second quarter of 2021. The report also mentions that “the second quarter of 2022 continued to experience strong, economically-driven growth in underlying demand for manufacturing and construction equipment and supplies. From an end market standpoint, daily sales to our manufacturing customers increased 23.1% in the second quarter of 2022 from the second quarter of 2021. Daily sales to our non-residential construction customers increased 10.8% in the second quarter of 2022 from the second quarter of 2021.”

MSC Industrial, a leading North American distributor of a broad range of metalworking and maintenance, repair, and operations products and services, reported a 10.7% increase in sales in the 2nd quarter of 2022. Erik Gershwind, President and Chief Executive Officer, said, “Our fiscal third quarter is another proof point of the building momentum inside our Company. We achieved double-digit average daily sales growth, roughly 500 basis points above the Industrial Production index.” The Company expects double-digit average daily sales growth to continue into the next quarter.

Enerpac Tool Group Corp. also reported a profitable quarter. Net sales were $152 million, representing a 10% year-over-year increase in core sales. “Our solid third-quarter sales and profit were the result of continued broad-based demand and strong execution by our team across our global footprint,” said Paul Sternlieb, Enerpac Tool Group’s President & CEO.

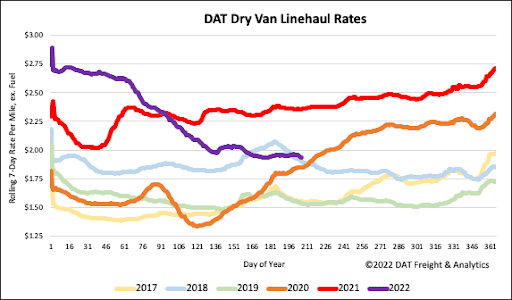

All rates cited below exclude fuel surcharges unless otherwise noted.

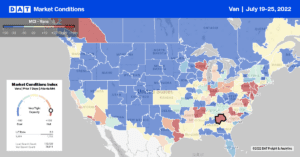

Available capacity in Brooklyn, NY, the market tightened for the fourth week in a row following lost week’s $0.10/mile increase to an average outbound rate of $2.16/mile. Brooklyn load post volumes are now up 46% in the last month following last week’s 10% increase. Loads 1,400 miles west to Hutchinson, KS, are up $0.15/mile in the previous three weeks to an average of $1.55/mile, which is just $0.03/mile lower than the same time last year. In the Massachusetts manufacturing hub in Springfield, dry van capacity was tight after spot rates jumped $0.28/mile to an average outbound rate of $2.03/mile. Short-haul loads to Harrisburg, PA, averaged $2.34/mile last week or around $0.30/mile lower than the previous year.

On the West Coast in Los Angeles and Ontario markets, capacity tightened slightly with rates moving up $0.01/mile to an average of $2.29/mile, while in Chicago, spot rates were up by the same amount to $2.23/mile. In Atlanta, spot rates dropped for the third week in a row following last week’s $0.07/mile decrease to $2.04/mile.

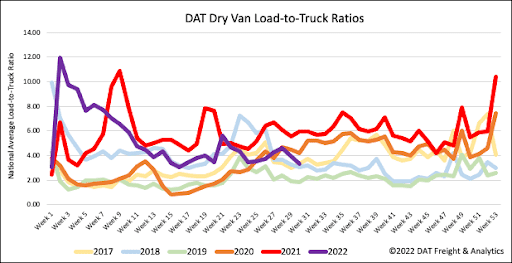

Dry van load post volumes dropped below 2020 levels for the first time last week following a 15% w/w decrease. In contrast, equipment posts remained at their highest level recorded in July and around 8% higher than 2019 levels. As a result, last week’s dry van load-to-truck ratio decreased for the fourth week in a row to 3.31.

Dry van linehaul rates decreased again by less than a penny-per-mile last week to a national average of $1.96/mile. Spot rates are $0.42/mile lower than the previous year but are still $0.33/mile higher than the average of pre-pandemic years and $0.04/mile higher than this time in 2018.