The American Trucking Association’s advanced, seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.7% in January following the 1% m/m gain last December. Compared with January 2022, the SA index increased by 1.5%, the seventeenth year-over-year gain almost identical to early 2020 levels just before the pandemic took hold. ATA’s For-Hire Truck Tonnage Index is dominated by contract freight instead of spot market freight. It serves as a barometer of the U.S. economy, representing 72.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

ATA’s Chief Economist says, “Tonnage has increased nicely in the last couple of months. I suspect some gains are attributable to capacity coming out of the network, especially those carriers that primarily operate in the spot market and/or bought expensive used equipment in the last few years. This would push more freight to contract carriers, which dominate this index. It could also be that freight bottomed and is coming up a little too. So, the gain is likely a little higher demand and a little less supply. Despite the increases in December and January, tonnage is still off 1.4% from its recent high in September.

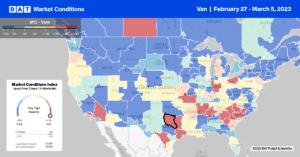

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

The effects of last week’s severe weather on the West Coast and across the Prairies were evident in dry van spot rates increasing by $0.05/mile in regions hardest hit. Idaho, Wyoming, and Montana dry van rates increased by $0.14/mile last week as blizzard conditions slowed down or closed interstate highways. In California, spot rates increased by $0.05/mile last week to a state outbound average of $1.91/mile, driven by gains in the Los Angeles and Ontario markets, where outbound rates were up by $0.04/mile to $1.68/mile following a 31% w/w increase in load posts. On the long-haul intermodal lane from Los Angeles to Chicago, spot rates improved last week, increasing by $0.04/mile to $1.31/mile after recording the lowest rate in 12 months the prior week. Loads north to Stockton were up $0.09/mile to $2.60/mile, while loads east to Phoenix headed south, recording the lowest in 12 months at $2.14/mile last week.

In the Southeast, capacity tightened slightly in Atlanta, where outbound rates averaged $1.71/mile, up $0.03/mile from the previous week. Loads south to Orlando were paying $2.69/mile, roughly the same as the prior week but still around the lowest in 12 months, while loads north to Elizabeth, NJ, were also flat at around $1.60/mile. After dropping for most of February, outbound spot rates in Elizabeth increased by a penny-per-mile last week to a market average of $1.59/mile, following a 3% w/w increase in load posts. Elizabeth to Atlanta loads paid $1.42/mile, the lowest in 12 months, with a similar trend reported for loads to Chicago at $1.22/mile. In the combined Joliet/Chicago markets, capacity was flat at $2.15/mile last week after increasing for three weeks on similar volumes to the preceding week.

Load-to-Truck Ratio (LTR)

Dry van load posts surged last week as the final shipping week of the month pushed more volume into the market. Volumes increased by 19% w/w – the most significant w/w gain this year, although loads posts are still around half of what they were the previous year. Capacity tightened slightly following a 4% w/w decrease in carrier equipment posts to around the same level as last year. With a surge in volume and drop in carrier posts last week, the dry van load-to-truck ratio (LTR) bounced back to 2.83, representing an increase of 24% w/w.

Linehaul Spot Rates

At $1.75/mile, dry van linehaul rates have increased by $0.03/mile in the last month, following another penny-per-mile increase last week. Spot rates are just under $0.90/mile lower than the previous year but show signs of bottoming out after three weeks of slight upward movement in the 7-day rolling average linehaul rate. Based on the volume of loads moved, the average rate for the top 50 dry van lanes was $0.23/mile higher, which averaged $1.98/mile last week.